Question: please help breakdown the math Nicholas Ram Corporation have a $1,600,000 bond issue dated March 1, 2016 due in 15 years with an annual interest

please help breakdown the math

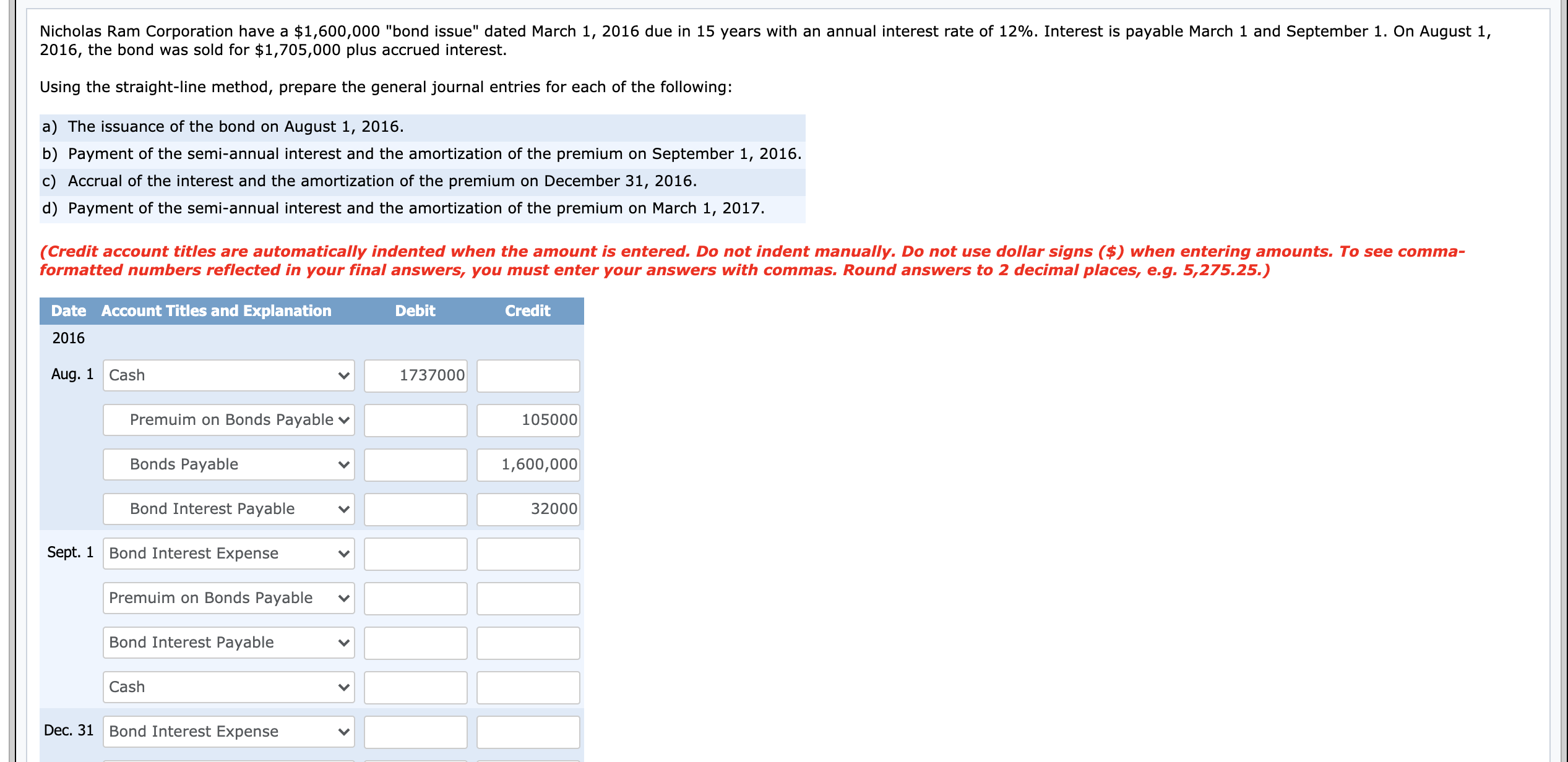

Nicholas Ram Corporation have a $1,600,000 "bond issue" dated March 1, 2016 due in 15 years with an annual interest rate of 12%. Interest is payable March 1 and September 1. On August 1, 2016, the bond was sold for $1,705,000 plus accrued interest. Using the straight-line method, prepare the general journal entries for each of the following: a) The Issuance of the bond on August 1, 2016. b) Payment of the semi-annual Interest and the amortization of the premium on September 1, 2016. c) Accrual of the Interest and the amortization of the premium on December 31, 2016. d) Payment of the semi-annual Interest and the amortization of the premium on March 1, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs (3) when entering amounts. To see comma- formatted numbers reected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) Date Account Titles and Explanation Debit 2016 Aug. 1 Cash v 1737000 Premuim on Bonds Payable v 105000 Bonds Payable v 1,600,000 Bond Interest Payable v 32000 Sept. 1 Bond Interest Expense v Premuim on Bonds Payable v Bond Interest Payable v Cash v Dec. 31 Bond Interest Expense v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts