Question: PLEASE HELP BY THE PRO FORMA A TEMPLATE An Owner just purchased a 62,000 square foot office building for $15,768,000 with 65% LTV with a

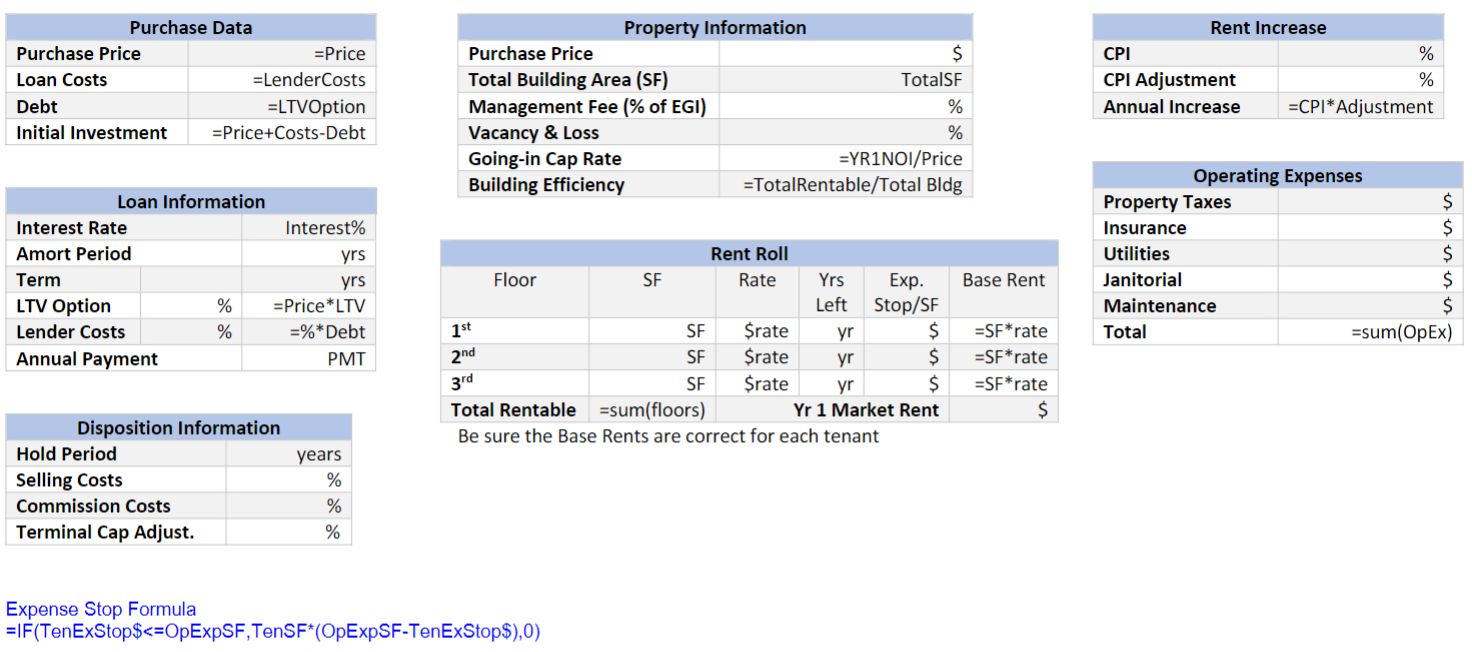

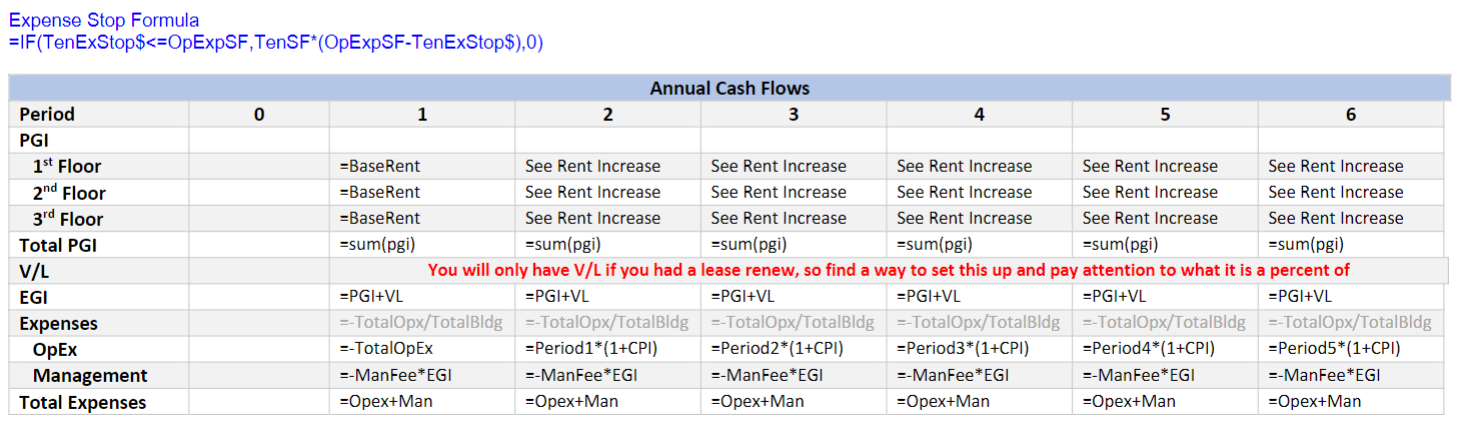

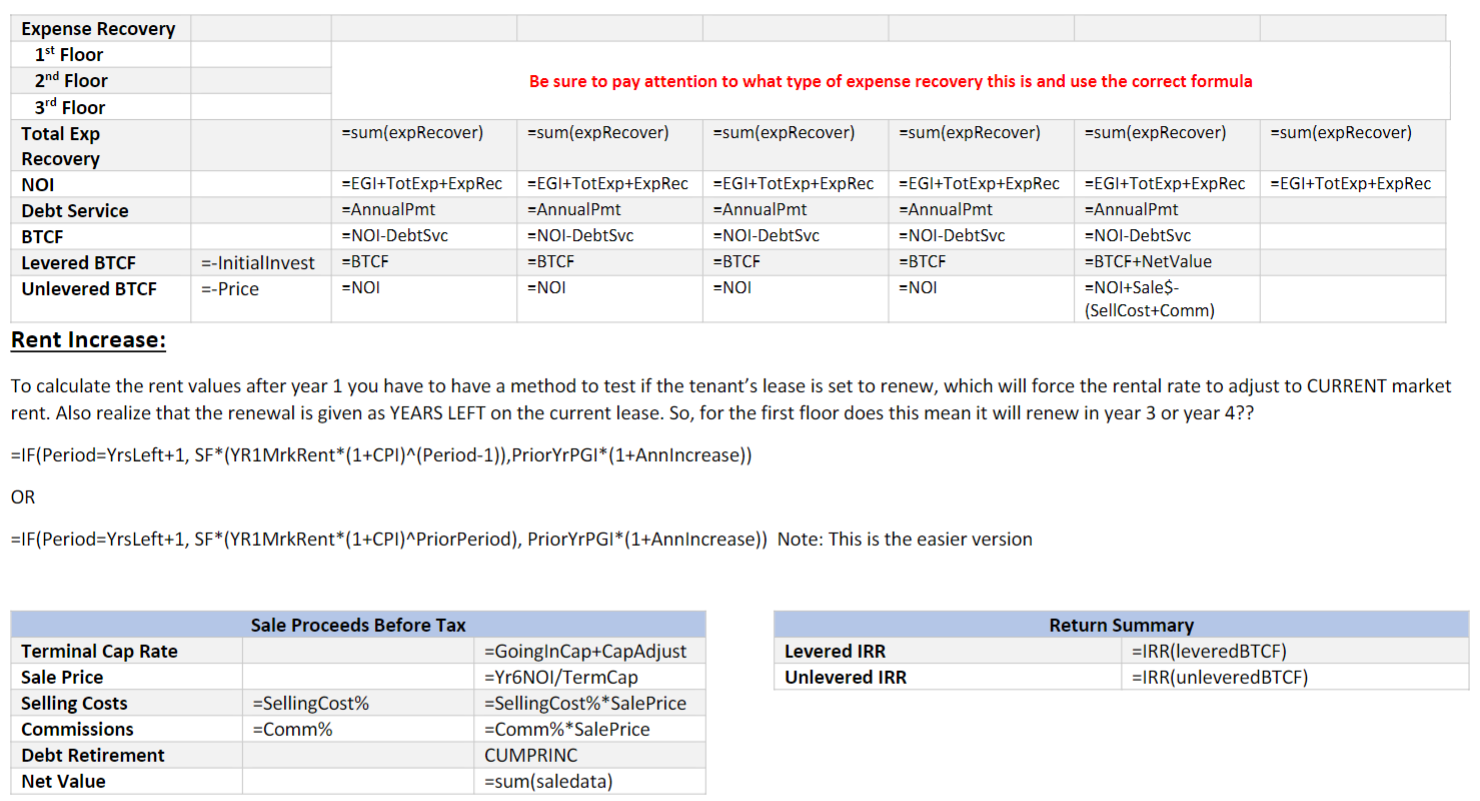

PLEASE HELP BY THE PRO FORMA A TEMPLATE An Owner just purchased a 62,000 square foot office building for $15,768,000 with 65% LTV with a loan of 6.25%, 20-year fully amortizing loan. The owner intends to hold the building for five years. The building has three floors of rentable space with a single tenant on each floor. The first floor has 20,000 square feet of rentable space and is currently renting for $19.45 per square foot. One year remains on the lease. The lease has an expense stop at $5.85 per square foot. The second floor has 20,750 square feet of rentable space and is leasing for $19.23 per square foot and has three years remaining on the lease. This lease has an expense has an expense stop at $6.00 per square foot. The third floor has 20,750 square feet of leasable space and a lease just signed for the next four years at a rental rate of $22.80 per square foot, which is the current market rate. The expense stop is at $6.10 per square foot, which is what expenses per square foot are estimated to be during the first year of the hold period (excluding management). Each lease also has a CPI adjustment that provides for the base rent to increase at 50% of the increase in the CPI. The CPI is projected to increase 3.25 percent per year. (Please note that CPI and a rent adjustment are not the same thing. A rent adjustment is just that, a change in rent, and can be based on CPI but it is not CPI.) The market rental rate at which leases are expected to be renewed is also projected to increase 3.25 percent per year. To account for any time that may be necessary to find new tenants after current leases expire and new leases are made, vacancy is estimated to be 8 percent of total PGI for the years in which a lease renews (aka when the new lease takes effect). Management expenses are expected to be at 3 percent of effective gross income and are not included in the expense stop. Estimated operating expenses for the first year of ownership includes the following: Property taxes $ 130,560 Insurance 65,450 Utilities 84,165 Janitorial 51,841 Maintenance 45,980 All expenses are projected to increase 3.0 percent per year. At the time of sale, you are assuming the going out cap rate is .35% more than the going in cap rate. And that there will be 5.00% selling costs and need to pay 4.0% in commissions Place the answers to the following questions in a highlighted Question and Answer box in the spreadsheet: Project the net operating income (NOI) for the next five years. What is the building efficiency? How much does the NOI increase (average compound rate) over the five years? What is the BTCF each year? What is the overall capitalization rate ("going-in" rate)? What is the sale price at the end of year five? What is the reversion value after sale? What is the levered IRR? What is the unlevered IRR? With a 12% discount rate is this a worthwhile investment?

be sure tne base kents are correct ror eacn tenant Expense Stop Formula Expense Stop Formula =IF(TenExStop$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts