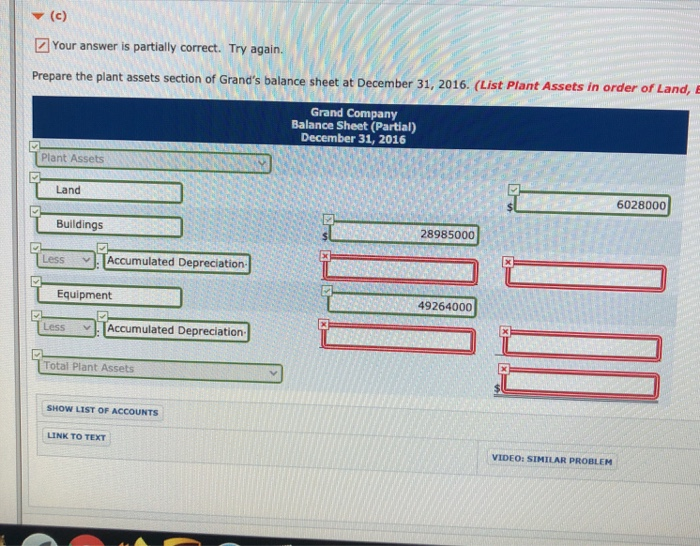

Question: Please help. (c) Your answer is partially correct. Try again. Prepare the plant assets section of Grand's balance sheet at December 31, 2016. (List Plant

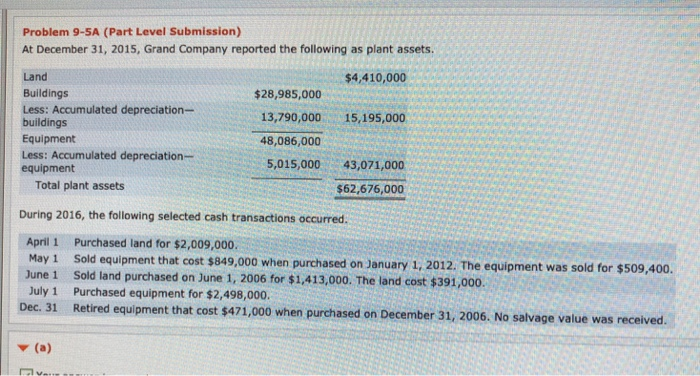

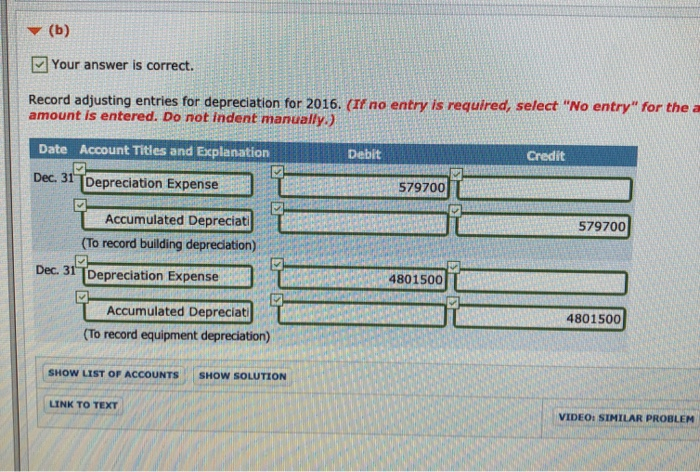

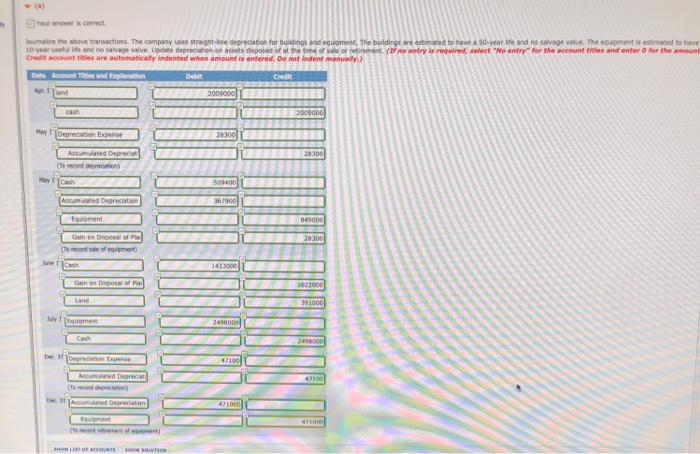

(c) Your answer is partially correct. Try again. Prepare the plant assets section of Grand's balance sheet at December 31, 2016. (List Plant Assets in order of Land, E Grand Company Balance Sheet (Partial) December 31, 2016 Plant Assets Land 6028000 Buildings 28985000 Less Accumulated Depreciation Equipment 49264000 > Less Accumulated Depreciation . Total Plant Assets SHOW LIST OF ACCOUNTS LINK TO TEXT VIDEO: SIMILAR PROBLEM Problem 9-5A (Part Level Submission) At December 31, 2015, Grand Company reported the following as plant assets. Land $4,410,000 Buildings $28,985,000 Less: Accumulated depreciation- 13,790,000 15,195,000 buildings Equipment 48,086,000 Less: Accumulated depreciation- equipment 5,015,000 43,071,000 Total plant assets $62,676,000 During 2016, the following selected cash transactions occurred. April 1 Purchased land for $2,009,000. May 1 Sold equipment that cost $849,000 when purchased on January 1, 2012. The equipment was sold for $509,400. June 1 Sold land purchased on June 1, 2006 for $1,413,000. The land cost $391,000. July 1 Purchased equipment for $2,498,000. Dec. 31 Retired equipment that cost $471,000 when purchased on December 31, 2006. No salvage value was received. (a) Dan (b) Your answer is correct. Record adjusting entries for depreciation for 2016. (If no entry is required, select "No entry" for the a amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Depreciation Expense 579700 Accumulated Depreciati (To record building depreciation) 579700 Dec. 31 Depreciation Expense 4801500 Accumulated Depreciati (To record equipment depreciation) 4801500 SHOW LIST OF ACCOUNTS SHOW SOLUTION LINK TO TEXT VIDEO: SIMILAR PROBLEM Your awwer is correct Jumle the above transactions. The company uses straight-line depreciation for buildings and equioment. The buildings are estimated to have a 50-year life and no salvage value. The equipment is estimated to have 10-year wall and no salvage value Update depreciation on assets disposed of at the time of sale or retirement (no entry is required, select "No entry for the accountitles and enter for the amount Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Crede Act 2000000 2009000 May Depreciation Expense 28300 28300 Accumulated Deprecat (to recordation May 509400 Accumulated Depreciation 367900 Equipment 349000 28300 Gainos Disposal of to record sale of equipment Sun Cash 1413000 Gainen polo DECORCOTECTE 1022000 Land 391000 2498000 2013000 Depreciation pense 47100 Accued Deprecat 47100 Dermed Depreciation 471000 471000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts