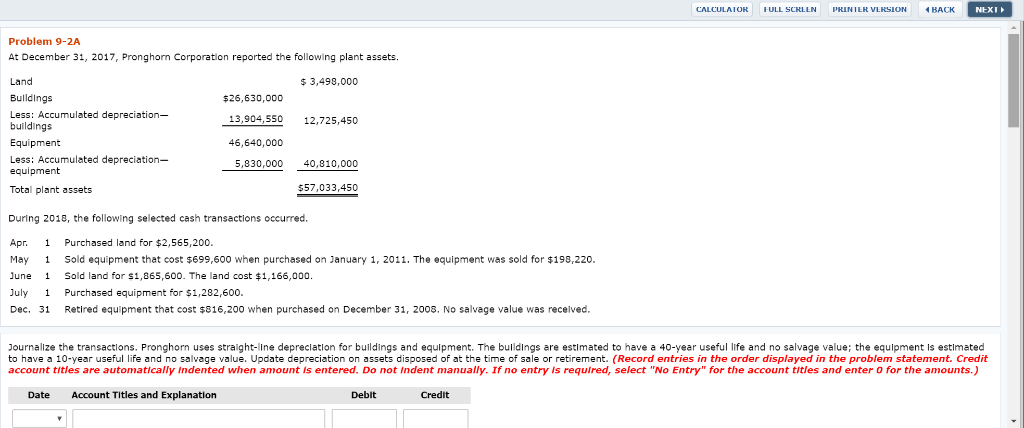

Question: Please help! CALCULAIOR FULL SCREEN PRINILR VERSION 4 NEXI Problem 9-2A At December 31, 2017, Pronghorn Corporation reported the following plant assets. Land 3,498,000 Bulldings

Please help!

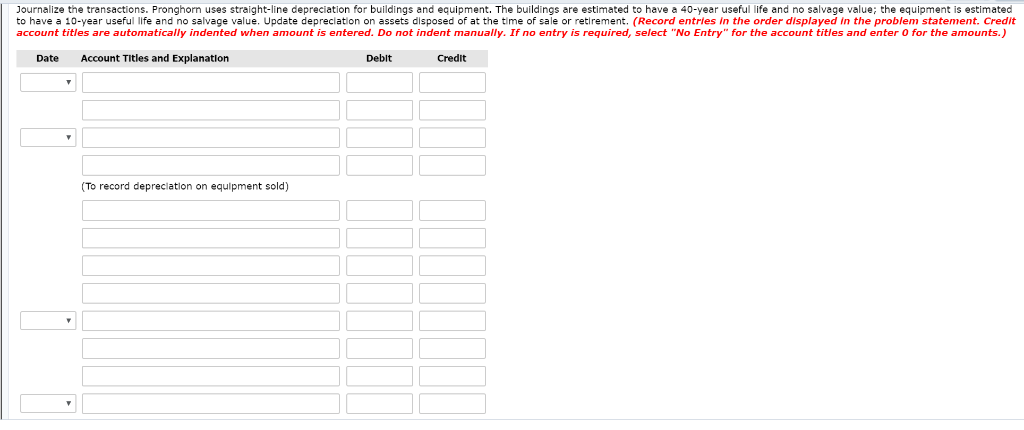

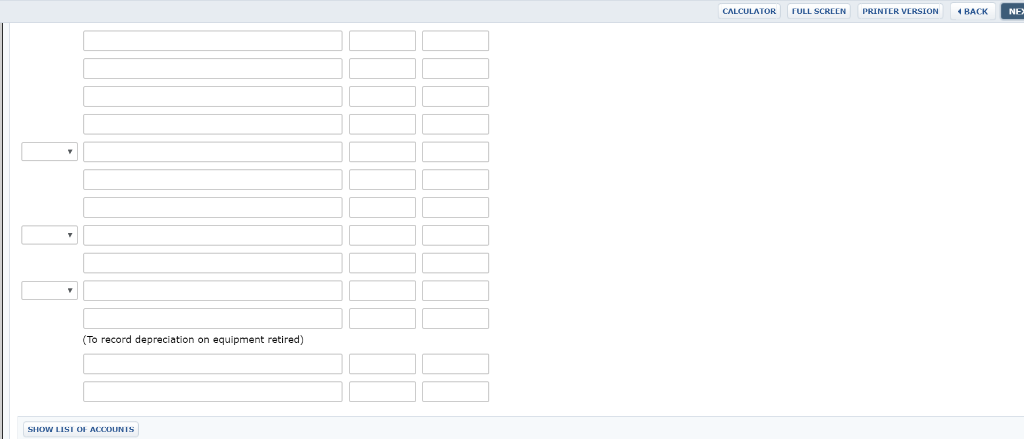

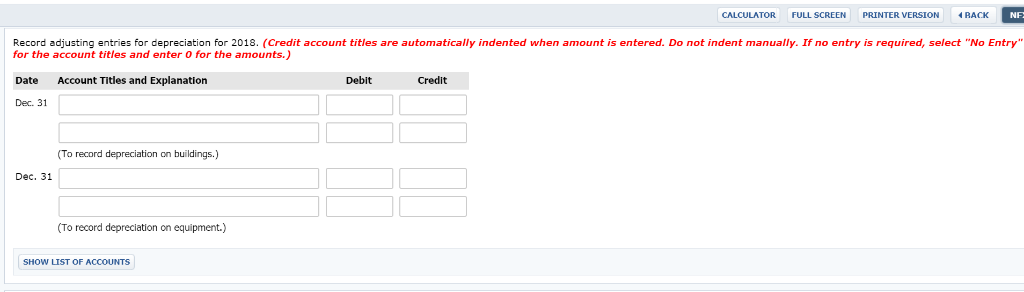

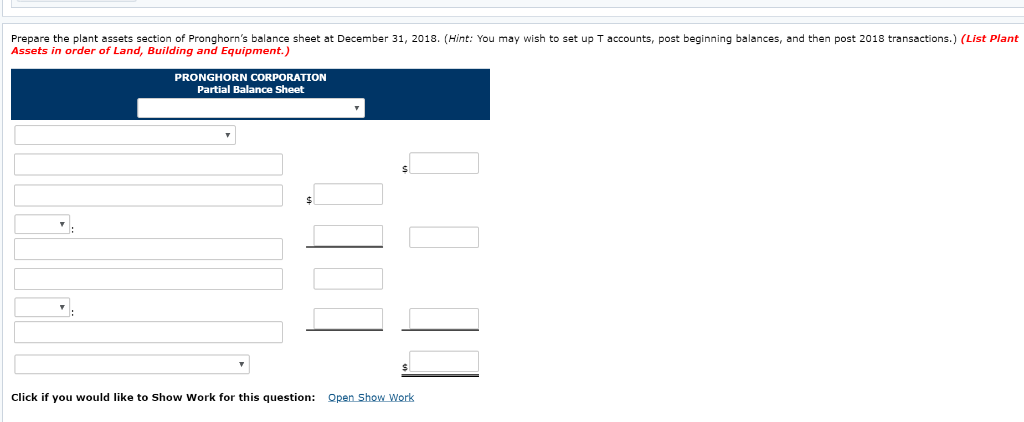

CALCULAIOR FULL SCREEN PRINILR VERSION 4 NEXI Problem 9-2A At December 31, 2017, Pronghorn Corporation reported the following plant assets. Land 3,498,000 Bulldings $26,630,000 ulated depreciation- 13,904,550 ul 12,725,450 Ings 46,640,000 Equipment Less: Accumulated depreciation- equipment 40,810,000 5.830.000 Total plant assets $57,033,450 During 2018, the following selected cash transactions occurred. Ap. 1 Purchased land for $2,565,200. Sold equipment that cost $699,600 when purchased on January 1, 2011. The equipment was sold for $198,220. May 1 Sold land for $1,865,600. The land cost $1,166,000 June 1 July 1 Purchased equipment for $1,282,600. Dec. 31 Retired equipment that cost s816,200 when purchased on December 31, 2008. No salvage value was received. Journalize the transactions. Pronahorn uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-vear useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation account titles are automatically Indented when amount the order displayed in the problem statement. Credit entered. Do not Indent manually. If no entry Is required, select "No Entry" for the account titles and enter 0 for the amounts.) assets disposed of at the time of sale or retirement. (Record entries Date Account Titles and Explanation Debit Credit Journalize the transactions. Pronghorn uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation o account titles are automatically indented when amount is entered. assets disposed of at the time of sale or retirement. (Record entries in the order displayed in the problem statement. Credit not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account TItles and Explanation Credit Debit Date (To record depreclation on equipment sold) CALCULATOR FULL SCREEN PRINTER VERSION BACK NE (To record depreciation on equipment retired) SHOW LISIO ACCOUNIS CALCULATOR FULL SCREEN PRINTER VERSION BACK NE Record adjusting entries for depreciation for 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry for the account titles and enter s required, select "No Entry for the amounts.) Account Titles and Explanation Debit Credit Date Dec. 31 (To record depreciation on buildings.) Dec. 31 (To record depreciation on equipment.) SHOW LIST OF ACCOUNTS Prepare the plant assets section of Pronghorn's balance sheet at December 31, 2018. (Hint: You may wish to set up T accounts, post beginning balances, and then post 2018 transactions.) (List Plant Assets in order of Land, Building and Equipment. PRONGHORN CORPORATION Partial Balance Sheet Open Show Work click if you would like to Show Work for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts