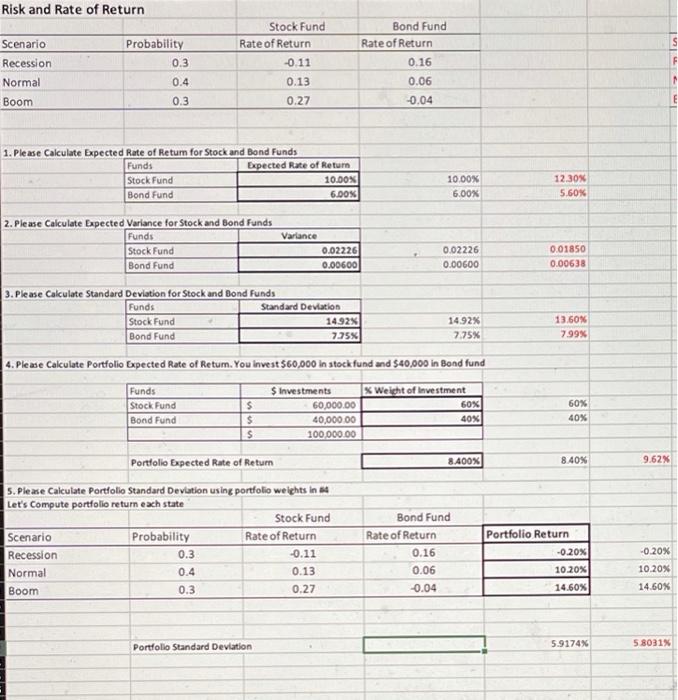

Question: Please help calculate formula through Excel for Portfolio Standard Deviation (#5 only)! Risk and Rate of Return Probability 0.3 Scenario Recession Normal Boom Stock Fund

Risk and Rate of Return Probability 0.3 Scenario Recession Normal Boom Stock Fund Rate of Return -0.11 0.13 0.27 Bond Fund Rate of Return 0.16 0.06 -0.04 0.4 0.3 E 1. Please Calculate Expected Rate of Retum for Stock and Bond Funds Funds Expected Rate of Return Stock Fund 10.DON Bond Fund 6.DOS 10.00% 6.00% 12.30% 5.60% 2. Please Calculate Expected Variance for Stock and Bond Funds Funds Stock Fund Bond Fund Variance 0.02226 0.00600 0.02226 0.00600 0.01850 0.00638 3. Please Calculate Standard Deviation for Stock and Bond Funds Funds Standard Deviation Stock Fund 14.92 Bond Fund 7.75% 14.92% 7.75% 13.60% 7.99% 4. Please Calculate Portfolio Expected Rate of Return. You invest $60,000 in stock fund and $40,000 in Bond fund Funds Stock Fund Bond Fund $ $ s $ Investments 60,000.00 40,000.00 100,000.00 * Welcht of investment 60% 40% 60% 40% Portfolio Expected Rate of Return 8.400% 8.40% 9.62% 5. Please Calculate Portfolio Standard Deviation using portfolio weights in #4 Let's Compute portfolio return each state Stock Fund Scenario Probability Rate of Return Recession 0.3 -0.11 Normal 0.4 0.13 Boom 0.3 0.27 Bond Fund Rate of Return 0.16 0.06 -0.04 Portfolio Return -0.20% 10.20% -0.20% 10.20% 14.60% 14,60% Portfolio Standard Deviation 5.9174% 58031%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts