Question: please help calculating ratios below BALANCE SHEET Current Liabilities Notes and loans payable 39 Current portion of long-torm debt 12 Accounts payable 1,479 Accrued income

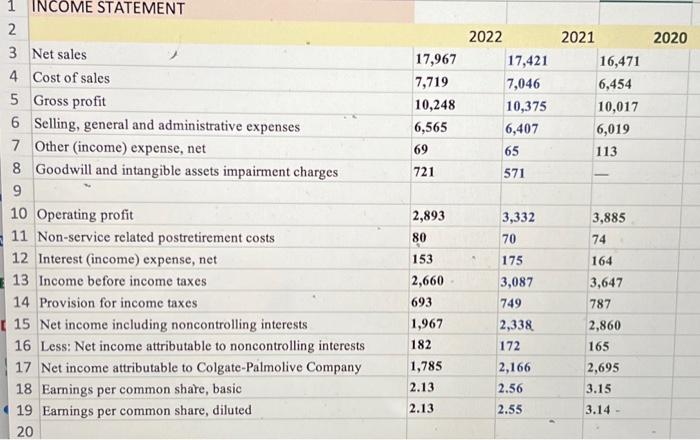

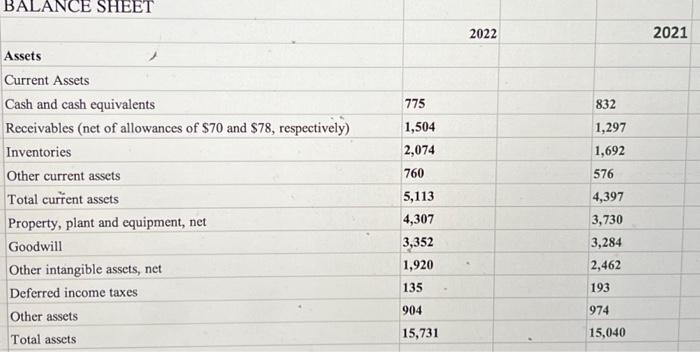

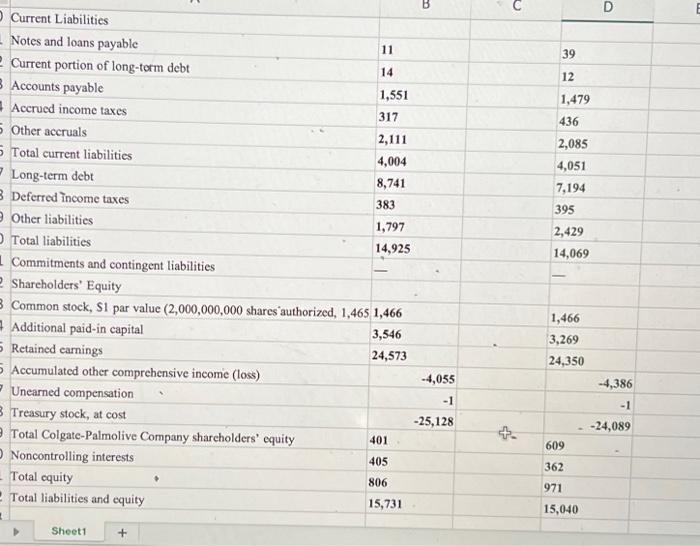

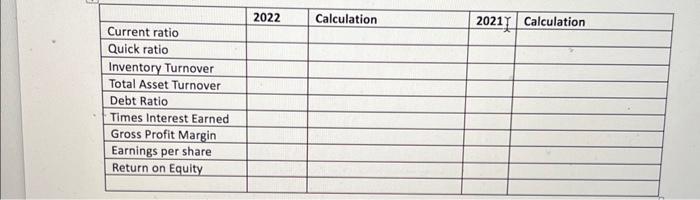

BALANCE SHEET Current Liabilities Notes and loans payable 39 Current portion of long-torm debt 12 Accounts payable 1,479 Accrued income taxes 436 Other accruals 2,085 Total current liabilities 4,051 Long-term debt Deferred income taxes 7,194 395 Other liabilities 2,429 Total liabilities 14,069 Commitments and contingent liabilities Shareholders' Equity Common stock, S1 par value (2,000,000,000 shares authorized, 1,465 1,466 Additional paid-in capital Retained earnings \begin{tabular}{|l|l|} \hline 3,546 & 3,466 \\ \hline 24,573 & 24,350 \\ \hline \end{tabular} Accumulated other comprehensive income (loss) Unearned compensation Treasury stock, at cost 4,055 -1 25,128 4,386 Total Colgate-Palmolive Company sharcholders' equity Noncontrolling interests Total equity Total liabilities and equity 15,731 Sheet1 + \begin{tabular}{|l|l|l|l|l|} \hline & 2022 & Calculation & 2021 & Calculation \\ \hline Current ratio & & & & \\ \hline Quick ratio & & & & \\ \hline Inventory Turnover & & & & \\ \hline Total Asset Turnover & & & & \\ \hline Debt Ratio & & & & \\ \hline Times Interest Earned & & & & \\ \hline Gross Profit Margin & & & & \\ \hline Earnings per share & & & & \\ \hline Return on Equity & & & & \\ \hline & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts