Question: please help calculating these for year 1 and year 2 Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the

please help calculating these for year 1 and year 2

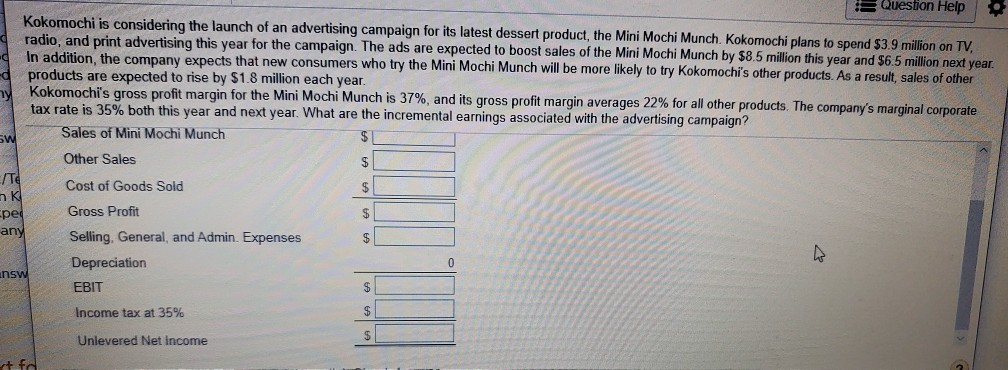

Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $3.9 million on TV radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.5 million this year and $6.5 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other d products are expected to rise by $1.8 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 37%, and its gross profit margin averages 22% for all other products. The company's marginal corporate tax rate is 35% both this year and next year. What are the incremental earnings associated with the advertising campaign? Sales of Mini Mochi Munch $ 5W Other Sales $ TO Cost of Goods Sold Gross Profit any Selling. General, and Admin. Expenses Depreciation EBIT ak Income tax at 35% Unlevered Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts