Question: please help. Can someone please explain which numbers are supposed to go where and how you found them? Required: Use the following information to complete

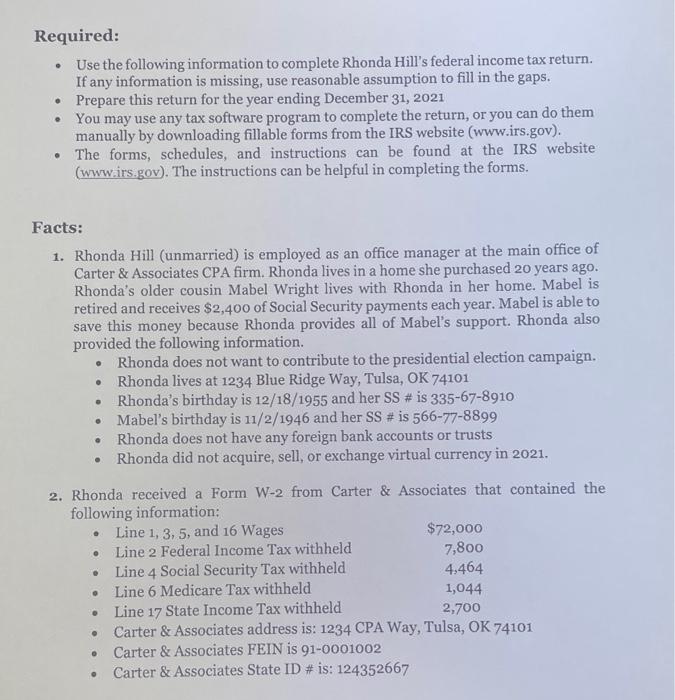

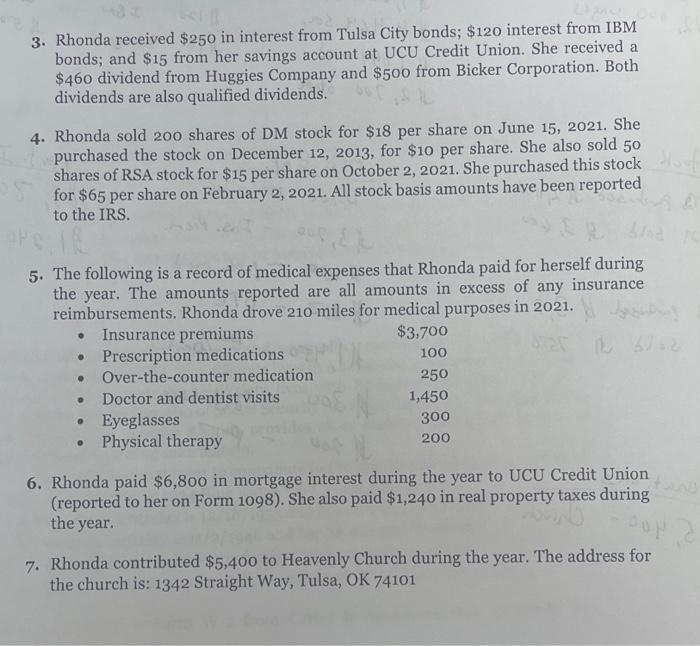

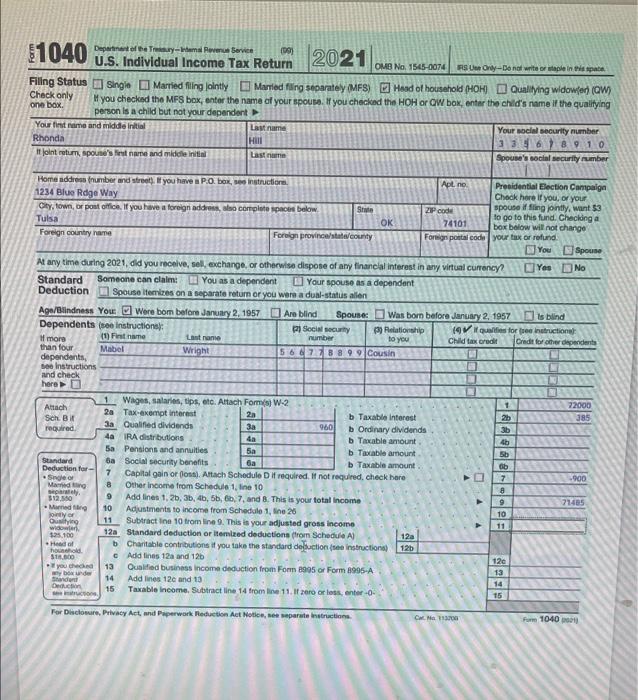

Required: Use the following information to complete Rhonda Hill's federal income tax return. If any information is missing, use reasonable assumption to fill in the gaps. Prepare this return for the year ending December 31, 2021 You may use any tax software program to complete the return, or you can do them manually by downloading fillable forms from the IRS website (www.irs.gov). . The forms, schedules, and instructions can be found at the IRS website (www.irs.gov). The instructions can be helpful in completing the forms. Facts: 1. Rhonda Hill (unmarried) is employed as an office manager at the main office of Carter & Associates CPA firm. Rhonda lives in a home she purchased 20 years ago. Rhonda's older cousin Mabel Wright lives with Rhonda in her home. Mabel is retired and receives $2,400 of Social Security payments each year. Mabel is able to save this money because Rhonda provides all of Mabel's support. Rhonda also provided the following information. 0 Rhonda does not want to contribute to the presidential election campaign. Rhonda lives at 1234 Blue Ridge Way, Tulsa, OK 74101 Rhonda's birthday is 12/18/1955 and her SS # is 335-67-8910 Mabel's birthday is 11/2/1946 and her SS # is 566-77-8899 @ Rhonda does not have any foreign bank accounts or trusts Rhonda did not acquire, sell, or exchange virtual currency in 2021. 2. Rhonda received a Form W-2 from Carter & Associates that contained the following information: .. Line 1, 3, 5, and 16 Wages $72,000 7,800 Line 2 Federal Income Tax withheld . 4,464 Line 4 Social Security Tax withheld . Line 6 Medicare Tax withheld 1,044 Line 17 State Income Tax withheld 2,700 Carter & Associates address is: 1234 CPA Way, Tulsa, OK 74101 Carter & Associates FEIN is 91-0001002 0 Carter & Associates State ID # is: 124352667 . K 200 3. Rhonda received $250 in interest from Tulsa City bonds; $120 interest from IBM bonds; and $15 from her savings account at UCU Credit Union. She received a $460 dividend from Huggies Company and $500 from Bicker Corporation. Both dividends are also qualified dividends. 4. Rhonda sold 200 shares of DM stock for $18 per share on June 15, 2021. She purchased the stock on December 12, 2013, for $10 per share. She also sold 50 shares of RSA stock for $15 per share on October 2, 2021. She purchased this stock for $65 per share on February 2, 2021. All stock basis amounts have been reported to the IRS. $.10 5. The following is a record of medical expenses that Rhonda paid for herself during the year. The amounts reported are all amounts in excess of any insurance reimbursements. Rhonda drove 210 miles for medical purposes in 2021. Insurance premiums $3,700 12 3762 Prescription medications 100 Over-the-counter medication 250 0 Doctor and dentist visits 1,450 .. Eyeglasses 300 Physical therapy 200 6. Rhonda paid $6,800 in mortgage interest during the year to UCU Credit Union. (reported to her on Form 1098). She also paid $1,240 in real property taxes during the year. 7. Rhonda contributed $5,400 to Heavenly Church during the year. The address for the church is: 1342 Straight Way, Tulsa, OK 74101 Department of the Treasury-Intemal Revenue Service (19) 1040 2021 U.S. Individual Income Tax Return OMB No. 1545-0074 RS Use Only-Do not write or staple in this spate Filling Status Single Married filing jointly Married filing separately (MFS) Check only one box. Head of household (HOH) Qualifying widower) (QW) If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent Your fint name and middle initial Last name Hill Rhonda Your social security number 33 910 Spouse's social security number It joint return, spouse's first name and middle initial Last name Home address (number and street). If you have a P.O. box, see instructions. Apt no 1234 Blue Rdge Way Presidential Election Campaign Check here if you, or your spouse if fling jointly, want $3 to go to this fund. Checking a box below will not change City, town, or post office. If you have a foreign address, also complete spaces below. Tulsa State OK Foreign country name Foreign province/state/county You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No You as a dependent Standard Someone can claim: Deduction Your spouse as a dependent Spouse itemizes on a separate return or you were a dual-status allen Are blind Spouse: Age/Blindness You Were bom before January 2, 1957 Dependents (see instructions): Social security number Was born before January 2, 1957 Is blind (3) Relationship (4)It qualities for (see instructional to you Child tax credit Credit for other dependents Cousin (1) First name If more than four dependents, Last name Wright Mabel 566778899 see Instructions and check NOUVEME here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 22000 385 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. Bif 3a Qualified dividends 3a 960 required b Ordinary dividends 3b 4a IRA distributions 4a b Taxable amount. 5a Pensions and annuities 5a b Taxable amount. 6a Social security benefits 6a b Taxable amount. 7 -900 Capital gain or (oss). Attach Schedule D if required. If not required, check here Other income from Schedule 1, line 10 8 9 71485 Standard Deduction for- Single or Married ing separately. $12.550 -Marned ting jointly or Qualifying widowlan $25,100 Head of household $18,000 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income Adjustments to income from Schedule 1, line 26 10 11 12a Subtract Ine 10 from line 9. This is your adjusted gross income Standard deduction or itemized deductions (from Schedule A) Charitable contributions if you take the standard deduction (see instructions) 128 b 12b c Add lines 12a and 12b 13 you checked any box under Standert Deduction structions Qualified business income deduction from Form 8995 or Form 8995-A Add lines 120 and 13 14 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-0- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. ZIP code 74101 Foreign postal code your tax or refund. Cat No 113700 D A 4b 5b ob 7 8 9 10 12c 13 14 15 Form 1040 21) Required: Use the following information to complete Rhonda Hill's federal income tax return. If any information is missing, use reasonable assumption to fill in the gaps. Prepare this return for the year ending December 31, 2021 You may use any tax software program to complete the return, or you can do them manually by downloading fillable forms from the IRS website (www.irs.gov). . The forms, schedules, and instructions can be found at the IRS website (www.irs.gov). The instructions can be helpful in completing the forms. Facts: 1. Rhonda Hill (unmarried) is employed as an office manager at the main office of Carter & Associates CPA firm. Rhonda lives in a home she purchased 20 years ago. Rhonda's older cousin Mabel Wright lives with Rhonda in her home. Mabel is retired and receives $2,400 of Social Security payments each year. Mabel is able to save this money because Rhonda provides all of Mabel's support. Rhonda also provided the following information. 0 Rhonda does not want to contribute to the presidential election campaign. Rhonda lives at 1234 Blue Ridge Way, Tulsa, OK 74101 Rhonda's birthday is 12/18/1955 and her SS # is 335-67-8910 Mabel's birthday is 11/2/1946 and her SS # is 566-77-8899 @ Rhonda does not have any foreign bank accounts or trusts Rhonda did not acquire, sell, or exchange virtual currency in 2021. 2. Rhonda received a Form W-2 from Carter & Associates that contained the following information: .. Line 1, 3, 5, and 16 Wages $72,000 7,800 Line 2 Federal Income Tax withheld . 4,464 Line 4 Social Security Tax withheld . Line 6 Medicare Tax withheld 1,044 Line 17 State Income Tax withheld 2,700 Carter & Associates address is: 1234 CPA Way, Tulsa, OK 74101 Carter & Associates FEIN is 91-0001002 0 Carter & Associates State ID # is: 124352667 . K 200 3. Rhonda received $250 in interest from Tulsa City bonds; $120 interest from IBM bonds; and $15 from her savings account at UCU Credit Union. She received a $460 dividend from Huggies Company and $500 from Bicker Corporation. Both dividends are also qualified dividends. 4. Rhonda sold 200 shares of DM stock for $18 per share on June 15, 2021. She purchased the stock on December 12, 2013, for $10 per share. She also sold 50 shares of RSA stock for $15 per share on October 2, 2021. She purchased this stock for $65 per share on February 2, 2021. All stock basis amounts have been reported to the IRS. $.10 5. The following is a record of medical expenses that Rhonda paid for herself during the year. The amounts reported are all amounts in excess of any insurance reimbursements. Rhonda drove 210 miles for medical purposes in 2021. Insurance premiums $3,700 12 3762 Prescription medications 100 Over-the-counter medication 250 0 Doctor and dentist visits 1,450 .. Eyeglasses 300 Physical therapy 200 6. Rhonda paid $6,800 in mortgage interest during the year to UCU Credit Union. (reported to her on Form 1098). She also paid $1,240 in real property taxes during the year. 7. Rhonda contributed $5,400 to Heavenly Church during the year. The address for the church is: 1342 Straight Way, Tulsa, OK 74101 Department of the Treasury-Intemal Revenue Service (19) 1040 2021 U.S. Individual Income Tax Return OMB No. 1545-0074 RS Use Only-Do not write or staple in this spate Filling Status Single Married filing jointly Married filing separately (MFS) Check only one box. Head of household (HOH) Qualifying widower) (QW) If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent Your fint name and middle initial Last name Hill Rhonda Your social security number 33 910 Spouse's social security number It joint return, spouse's first name and middle initial Last name Home address (number and street). If you have a P.O. box, see instructions. Apt no 1234 Blue Rdge Way Presidential Election Campaign Check here if you, or your spouse if fling jointly, want $3 to go to this fund. Checking a box below will not change City, town, or post office. If you have a foreign address, also complete spaces below. Tulsa State OK Foreign country name Foreign province/state/county You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No You as a dependent Standard Someone can claim: Deduction Your spouse as a dependent Spouse itemizes on a separate return or you were a dual-status allen Are blind Spouse: Age/Blindness You Were bom before January 2, 1957 Dependents (see instructions): Social security number Was born before January 2, 1957 Is blind (3) Relationship (4)It qualities for (see instructional to you Child tax credit Credit for other dependents Cousin (1) First name If more than four dependents, Last name Wright Mabel 566778899 see Instructions and check NOUVEME here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 22000 385 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. Bif 3a Qualified dividends 3a 960 required b Ordinary dividends 3b 4a IRA distributions 4a b Taxable amount. 5a Pensions and annuities 5a b Taxable amount. 6a Social security benefits 6a b Taxable amount. 7 -900 Capital gain or (oss). Attach Schedule D if required. If not required, check here Other income from Schedule 1, line 10 8 9 71485 Standard Deduction for- Single or Married ing separately. $12.550 -Marned ting jointly or Qualifying widowlan $25,100 Head of household $18,000 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income Adjustments to income from Schedule 1, line 26 10 11 12a Subtract Ine 10 from line 9. This is your adjusted gross income Standard deduction or itemized deductions (from Schedule A) Charitable contributions if you take the standard deduction (see instructions) 128 b 12b c Add lines 12a and 12b 13 you checked any box under Standert Deduction structions Qualified business income deduction from Form 8995 or Form 8995-A Add lines 120 and 13 14 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter-0- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. ZIP code 74101 Foreign postal code your tax or refund. Cat No 113700 D A 4b 5b ob 7 8 9 10 12c 13 14 15 Form 1040 21)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts