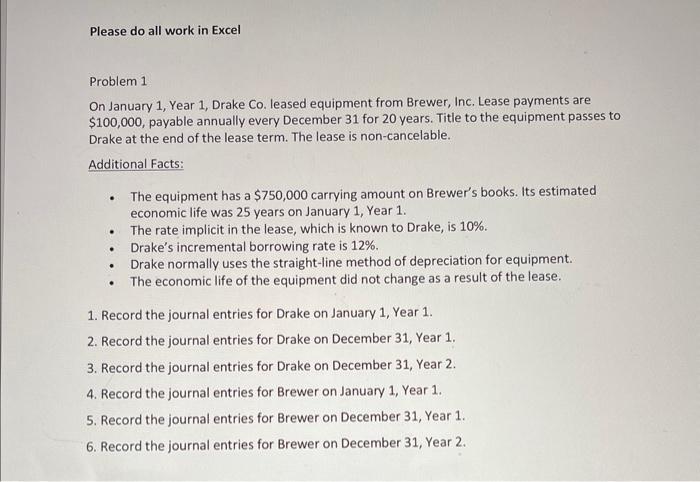

Question: please help!! Can you show your work? Problem 1 On January 1, Year 1, Drake Co. leased equipment from Brewer, Inc. Lease payments are $100,000,

Problem 1 On January 1, Year 1, Drake Co. leased equipment from Brewer, Inc. Lease payments are $100,000, payable annually every December 31 for 20 years. Title to the equipment passes to Drake at the end of the lease term. The lease is non-cancelable. Additional Facts: - The equipment has a $750,000 carrying amount on Brewer's books. Its estimated economic life was 25 years on January 1 , Year 1. - The rate implicit in the lease, which is known to Drake, is 10%. - Drake's incremental borrowing rate is 12%. - Drake normally uses the straight-line method of depreciation for equipment. - The economic life of the equipment did not change as a result of the lease. 1. Record the journal entries for Drake on January 1, Year 1. 2. Record the journal entries for Drake on December 31, Year 1. 3. Record the journal entries for Drake on December 31, Year 2. 4. Record the journal entries for Brewer on January 1 , Year 1. 5. Record the journal entries for Brewer on December 31 , Year 1. 6. Record the journal entries for Brewer on December 31, Year 2. Problem 1 On January 1, Year 1, Drake Co. leased equipment from Brewer, Inc. Lease payments are $100,000, payable annually every December 31 for 20 years. Title to the equipment passes to Drake at the end of the lease term. The lease is non-cancelable. Additional Facts: - The equipment has a $750,000 carrying amount on Brewer's books. Its estimated economic life was 25 years on January 1 , Year 1. - The rate implicit in the lease, which is known to Drake, is 10%. - Drake's incremental borrowing rate is 12%. - Drake normally uses the straight-line method of depreciation for equipment. - The economic life of the equipment did not change as a result of the lease. 1. Record the journal entries for Drake on January 1, Year 1. 2. Record the journal entries for Drake on December 31, Year 1. 3. Record the journal entries for Drake on December 31, Year 2. 4. Record the journal entries for Brewer on January 1 , Year 1. 5. Record the journal entries for Brewer on December 31 , Year 1. 6. Record the journal entries for Brewer on December 31, Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts