Question: Please help!! Cannot get the correct answers for these questions. Percentage WACC 8%. Please round 4 decimal places for only the final answer. Will upvote!

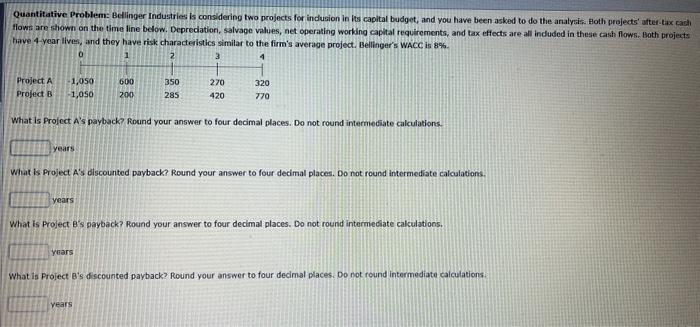

Quantitative Problem: Bellinger Industries is considering two projects for indusion in lts capital budget, and you have been asked to do the analysis Both projeds' after -tax cach Hows are chown on the time line below. Depredation, Salvage values, net operating working capital requirements, and tax effects are all induded in these cash flows. Both projects bave 4 -year lives, ind thev have risk charactedictira isimilar tn tha firon's average preject. Bellinger's Wacc is 8%. What is Profect A's payback? Round your answer to four decimal places. Do not round intemieciate calculations. What is project A's discounted payback? Round your answer to four decimal places. Do not round intermediate calculations. years What is Prolect B's payback? Round your answer to four decimal places, Do not round intermeciate calculations. years What is Project B's discounted payback? Round your answer to four decimal places. Do not round intermediate calculations: vears

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts