Question: Please Help CASE 7 DUNHAM COSMETICS FINANCIAL EVALUATION For the last 26 years, Dunham Cosmetics has obtained virtually all of its busi- ness loans from

Please Help

Please Help

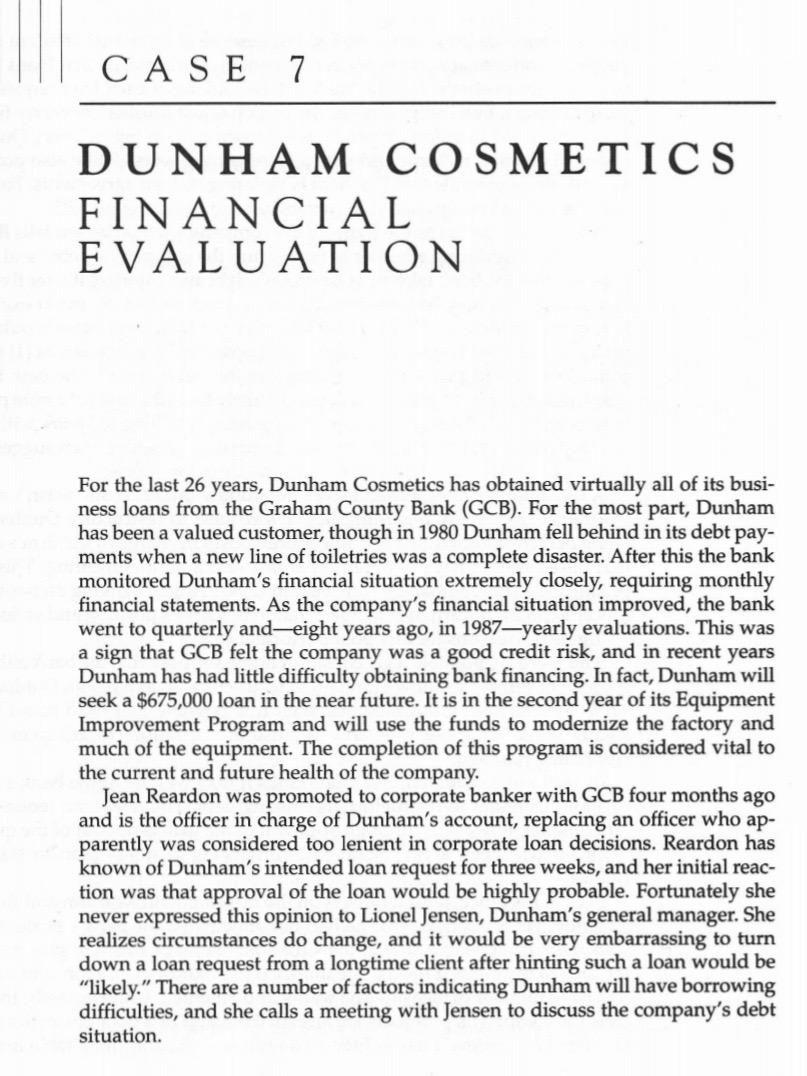

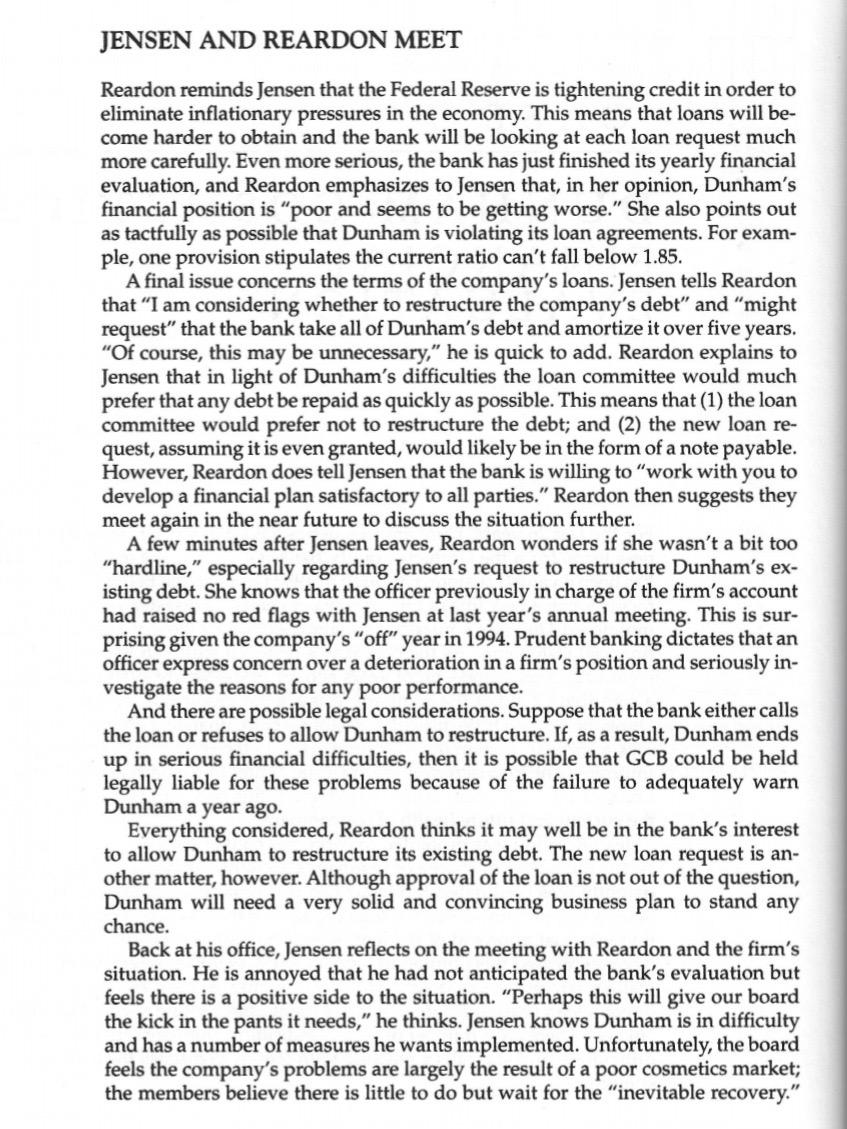

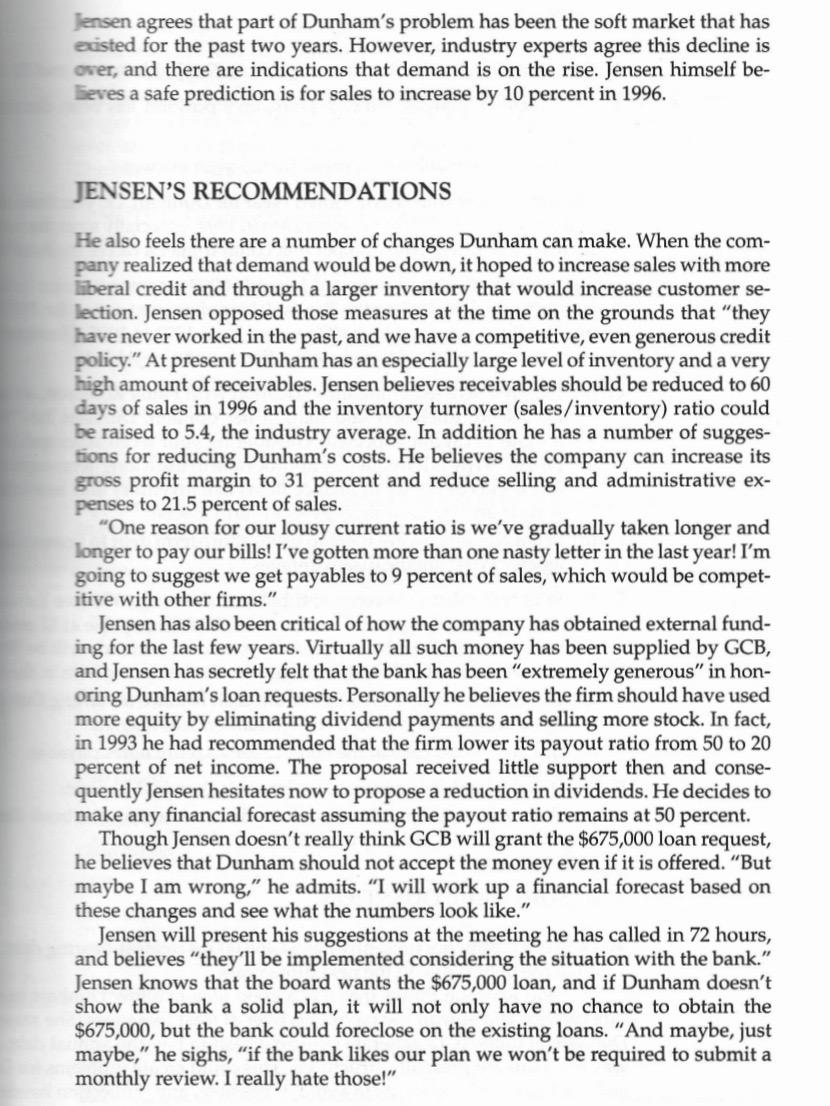

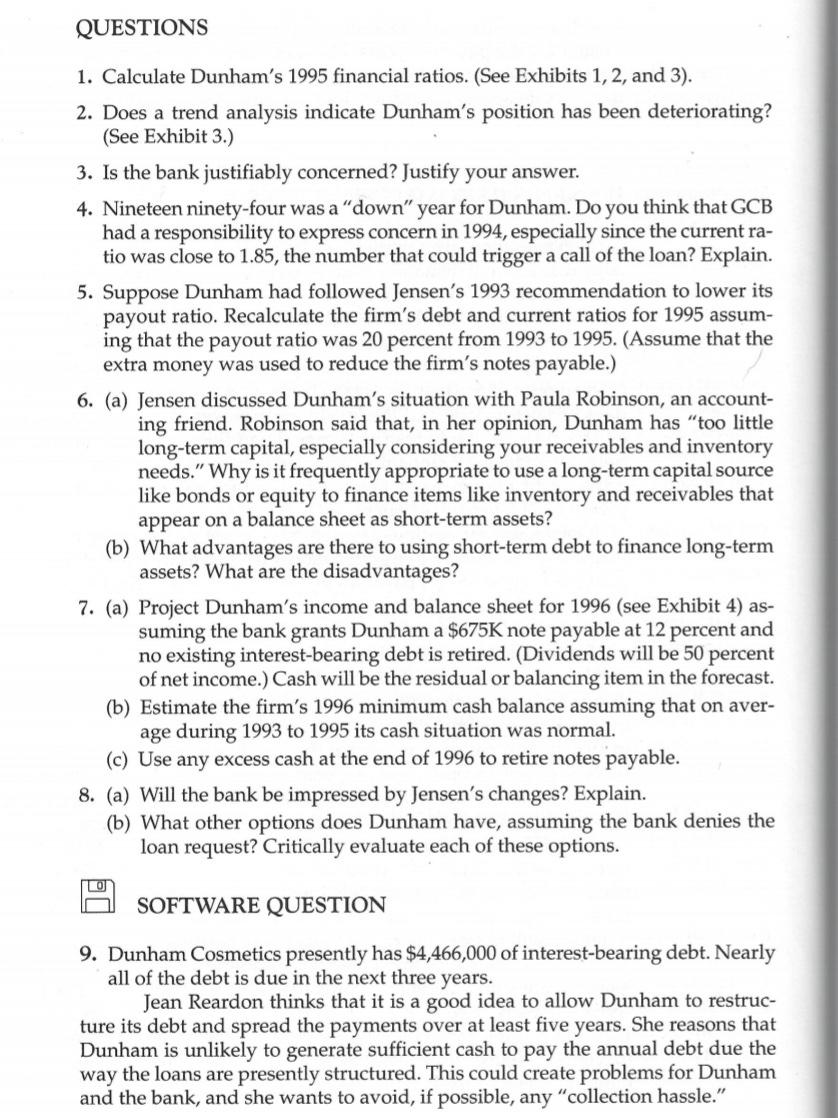

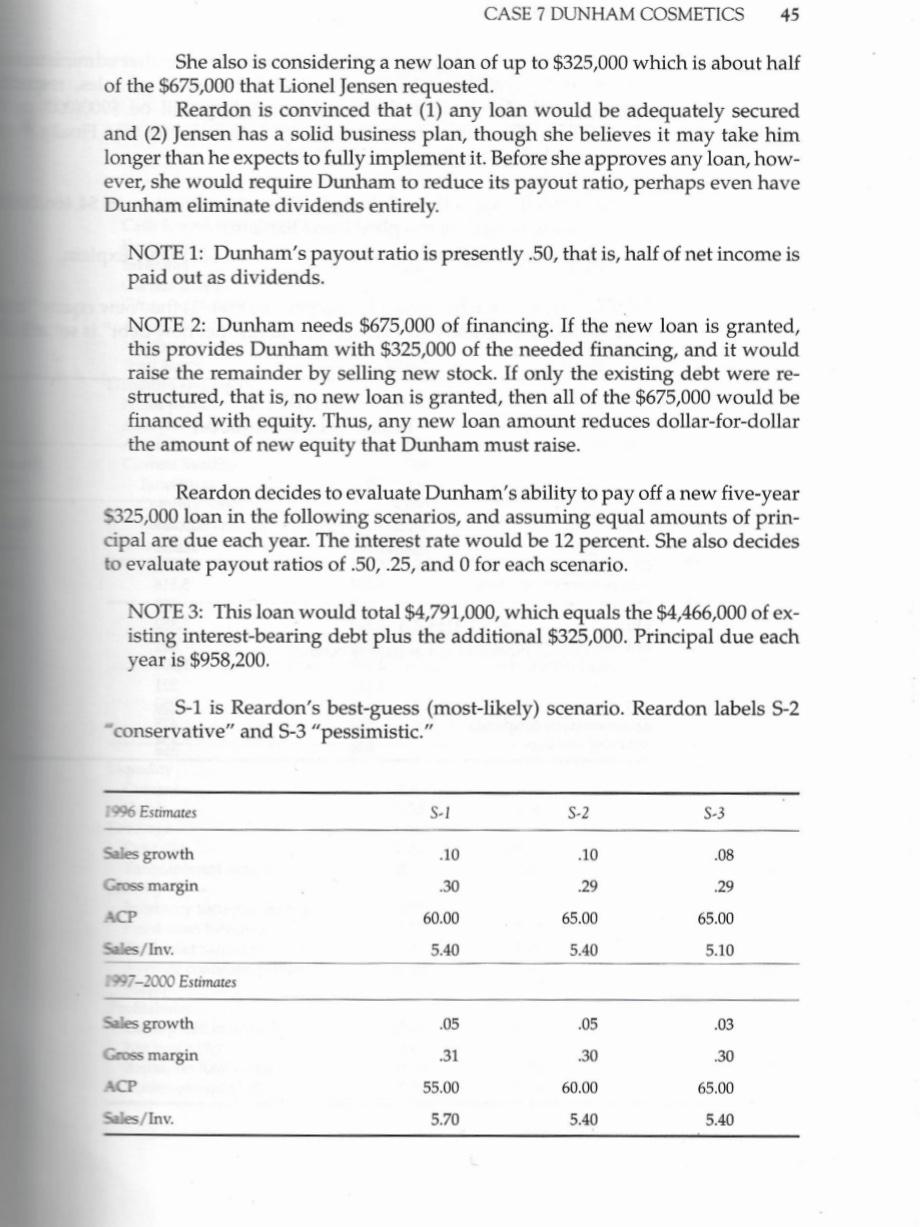

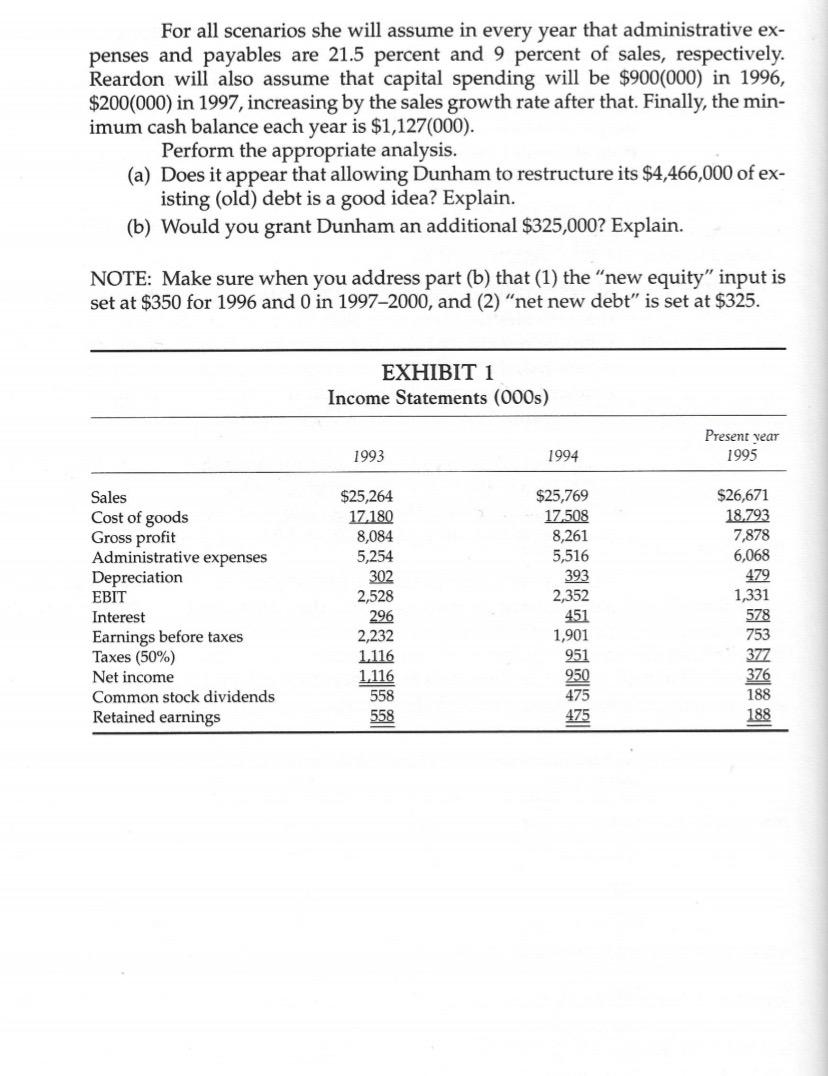

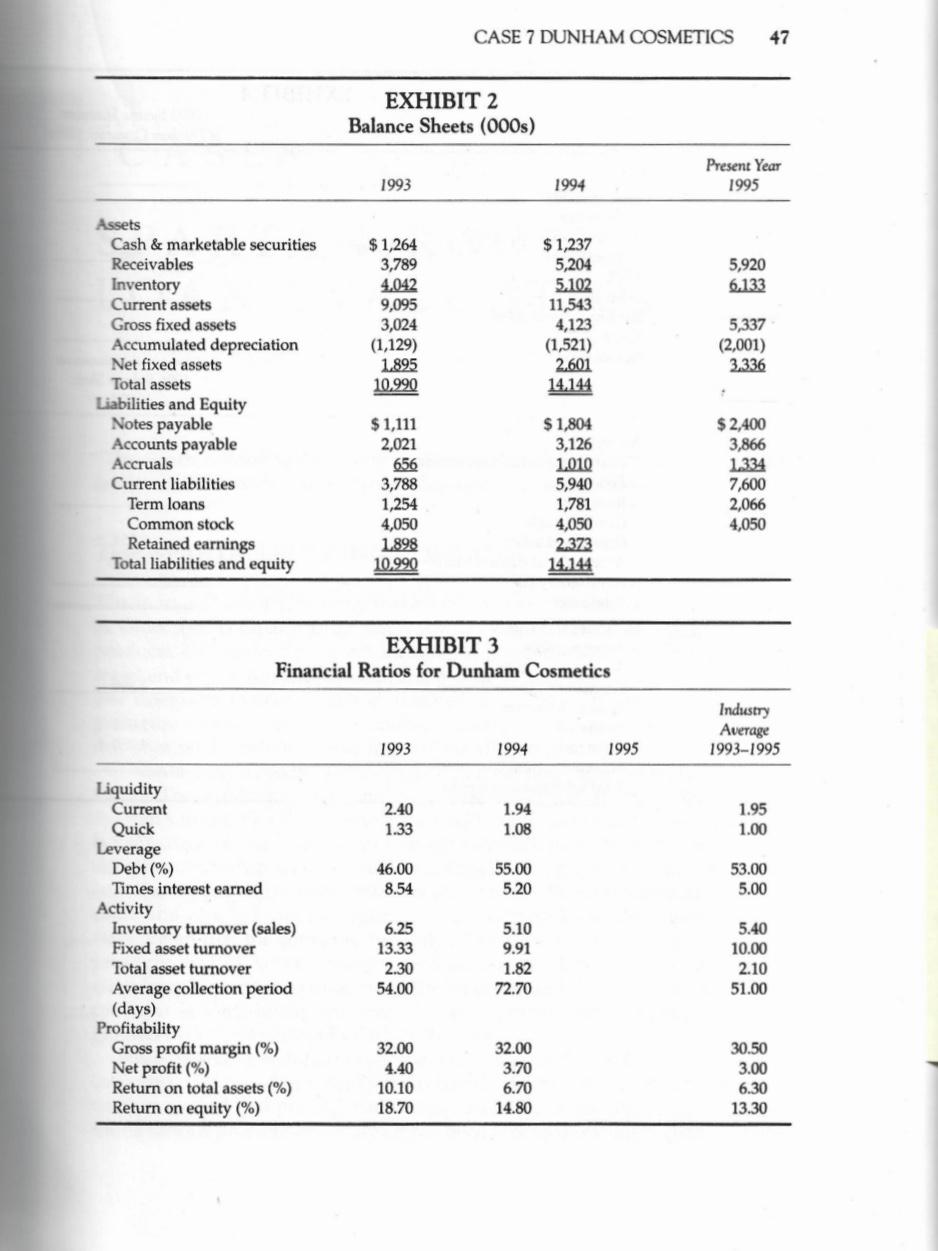

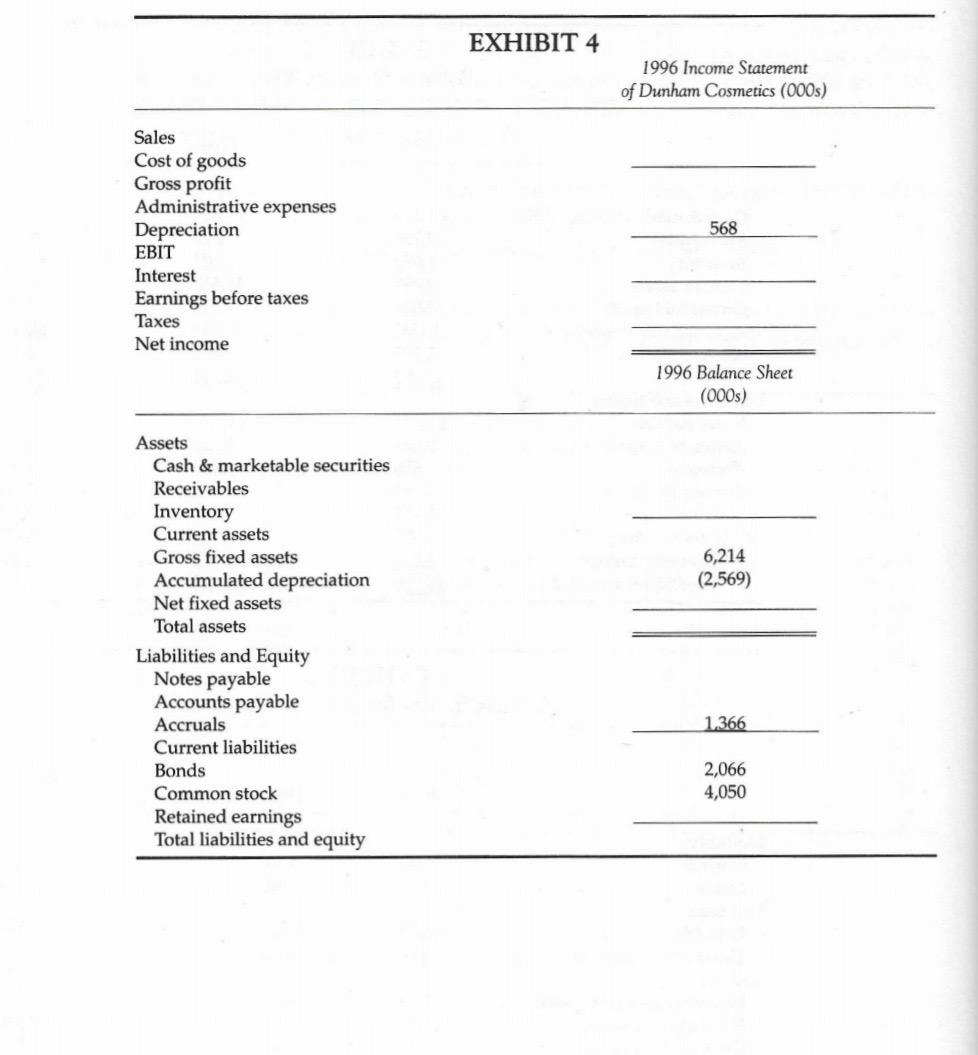

CASE 7 DUNHAM COSMETICS FINANCIAL EVALUATION For the last 26 years, Dunham Cosmetics has obtained virtually all of its busi- ness loans from the Graham County Bank (GCB). For the most part, Dunham has been a valued customer, though in 1980 Dunham fell behind in its debt pay- ments when a new line of toiletries was a complete disaster. After this the bank monitored Dunham's financial situation extremely closely, requiring monthly financial statements. As the company's financial situation improved, the bank went to quarterly and eight years ago, in 1987yearly evaluations. This was a sign that GCB felt the company was a good credit risk, and in recent years Dunham has had little difficulty obtaining bank financing. In fact, Dunham will seek a $675,000 loan in the near future. It is in the second year of its Equipment Improvement Program and will use the funds to modernize the factory and much of the equipment. The completion of this program is considered vital to the current and future health of the company, Jean Reardon was promoted to corporate banker with GCB four months ago and is the officer in charge of Dunham's account, replacing an officer who ap- parently was considered too lenient in corporate loan decisions. Reardon has known of Dunham's intended loan request for three weeks, and her initial reac- tion was that approval of the loan would be highly probable. Fortunately she never expressed this opinion to Lionel Jensen, Dunham's general manager. She realizes circumstances do change, and it would be very embarrassing to turn down a loan request from a longtime client after hinting such a loan would be "likely." There are a number of factors indicating Dunham will have borrowing difficulties, and she calls a meeting with Jensen to discuss the company's debt situation. JENSEN AND REARDON MEET Reardon reminds Jensen that the Federal Reserve is tightening credit in order to eliminate inflationary pressures in the economy. This means that loans will be come harder to obtain and the bank will be looking at each loan request much more carefully. Even more serious, the bank has just finished its yearly financial evaluation, and Reardon emphasizes to Jensen that, in her opinion, Dunham's financial position is poor and seems to be getting worse." She also points out as tactfully as possible that Dunham is violating its loan agreements. For exam- ple, one provision stipulates the current ratio can't fall below 1.85. A final issue concerns the terms of the company's loans. Jensen tells Reardon that I am considering whether to restructure the company's debt" and "might request" that the bank take all of Dunham's debt and amortize it over five years. "Of course, this may be unnecessary," he is quick to add. Reardon explains to Jensen that in light of Dunham's difficulties the loan committee would much prefer that any debt be repaid as quickly as possible. This means that (1) the loan committee would prefer not to restructure the debt; and (2) the new loan re- quest, assuming it is even granted, would likely be in the form of a note payable. However, Reardon does tell Jensen that the bank is willing to work with you to develop a financial plan satisfactory to all parties." Reardon then suggests they meet again in the near future to discuss the situation further. A few minutes after Jensen leaves, Reardon wonders if she wasn't a bit too "hardline," especially regarding Jensen's request to restructure Dunham's ex- isting debt. She knows that the officer previously in charge of the firm's account had raised no red flags with Jensen at last year's annual meeting. This is sur- prising given the company's "off" year in 1994. Prudent banking dictates that an officer express concern over a deterioration in a firm's position and seriously in- vestigate the reasons for any poor performance. And there are possible legal considerations. Suppose that the bank either calls the loan or refuses to allow Dunham to restructure. If, as a result, Dunham ends up in serious financial difficulties, then it is possible that GCB could be held legally liable for these problems because of the failure to adequately warn Dunham a year ago. Everything considered, Reardon thinks it may well be in the bank's interest to allow Dunham to restructure its existing debt. The new loan request is an- other matter, however. Although approval of the loan is not out of the question, Dunham will need a very solid and convincing business plan to stand any chance. Back at his office, Jensen reflects on the meeting with Reardon and the firm's situation. He is annoyed that he had not anticipated the bank's evaluation but feels there is a positive side to the situation. "Perhaps this will give our board the kick in the pants it needs," he thinks. Jensen knows Dunham is in difficulty and has a number of measures he wants implemented. Unfortunately, the board feels the company's problems are largely the result of a poor cosmetics market; the members believe there is little to do but wait for the "inevitable recovery." Jensen agrees that part of Dunham's problem has been the soft market that has existed for the past two years. However, industry experts agree this decline is over, and there are indications that demand is on the rise. Jensen himself be- seves a safe prediction is for sales to increase by 10 percent in 1996. JENSEN'S RECOMMENDATIONS He also feels there are a number of changes Dunham can make. When the com- pany realized that demand would be down, it hoped to increase sales with more liberal credit and through a larger inventory that would increase customer se- lection. Jensen opposed those measures at the time on the grounds that "they have never worked in the past, and we have a competitive, even generous credit policy." At present Dunham has an especially large level of inventory and a very high amount of receivables. Jensen believes receivables should be reduced to 60 days of sales in 1996 and the inventory turnover (sales/inventory) ratio could be raised to 5.4, the industry average. In addition he has a number of sugges- tions for reducing Dunham's costs. He believes the company can increase its gross profit margin to 31 percent and reduce selling and administrative ex- penses to 21.5 percent of sales. One reason for our lousy current ratio is we've gradually taken longer and longer to pay our bills! I've gotten more than one nasty letter in the last year! I'm going to suggest we get payables to 9 percent of sales, which would be compet- itive with other firms." Jensen has also been critical of how the company has obtained external fund- ing for the last few years. Virtually all such money has been supplied by GCB, and Jensen has secretly felt that the bank has been "extremely generous" in hon- oring Dunham's loan requests. Personally he believes the firm should have used more equity by eliminating dividend payments and selling more stock. In fact, in 1993 he had recommended that the firm lower its payout ratio from 50 to 20 percent of net income. The proposal received little support then and conse- quently Jensen hesitates now to propose a reduction in dividends. He decides to make any financial forecast assuming the payout ratio remains at 50 percent. Though Jensen doesn't really think GCB will grant the $675,000 loan request, he believes that Dunham should not accept the money even if it is offered. "But maybe I am wrong," he admits. "I will work up a financial forecast based on these changes and see what the numbers look like." Jensen will present his suggestions at the meeting he has called in 72 hours, and believes "they'll be implemented considering the situation with the bank." Jensen knows that the board wants the $675,000 loan, and if Dunham doesn't show the bank a solid plan, it will not only have no chance to obtain the $675,000, but the bank could foreclose on the existing loans. "And maybe, just maybe," he sighs, "if the bank likes our plan we won't be required to submit a monthly review. I really hate those!" QUESTIONS 1. Calculate Dunham's 1995 financial ratios. (See Exhibits 1, 2, and 3). 2. Does a trend analysis indicate Dunham's position has been deteriorating? (See Exhibit 3.) 3. Is the bank justifiably concerned? Justify your answer. 4. Nineteen ninety-four was a "down" year for Dunham. Do you think that GCB had a responsibility to express concern in 1994, especially since the current ra- tio was close to 1.85, the number that could trigger a call of the loan? Explain. 5. Suppose Dunham had followed Jensen's 1993 recommendation to lower its payout ratio. Recalculate the firm's debt and current ratios for 1995 assum- ing that the payout ratio was 20 percent from 1993 to 1995. (Assume that the extra money was used to reduce the firm's notes payable.) 6. (a) Jensen discussed Dunham's situation with Paula Robinson, an account- ing friend. Robinson said that, in her opinion, Dunham has "too little long-term capital, especially considering your receivables and inventory needs." Why is it frequently appropriate to use a long-term capital source like bonds or equity to finance items like inventory and receivables that appear on a balance sheet as short-term assets? (b) What advantages are there to using short-term debt to finance long-term assets? What are the disadvantages? 7. (a) Project Dunham's income and balance sheet for 1996 (see Exhibit 4) as- suming the bank grants Dunham a $675K note payable at 12 percent and no existing interest-bearing debt is retired. (Dividends will be 50 percent of net income.) Cash will be the residual or balancing item in the forecast. (b) Estimate the firm's 1996 minimum cash balance assuming that on aver- age during 1993 to 1995 its cash situation was normal. (c) Use any excess cash at the end of 1996 to retire notes payable. 8. (a) Will the bank be impressed by Jensen's changes? Explain. (b) What other options does Dunham have, assuming the bank denies the loan request? Critically evaluate each of these options. 0 SOFTWARE QUESTION 9. Dunham Cosmetics presently has $4,466,000 of interest-bearing debt. Nearly all of the debt is due in the next three years. Jean Reardon thinks that it is a good idea to allow Dunham to restruc- ture its debt and spread the payments over at least five years. She reasons that Dunham is unlikely to generate sufficient cash to pay the annual debt due the way the loans are presently structured. This could create problems for Dunham and the bank, and she wants to avoid, if possible, any collection hassle." CASE 7 DUNHAM COSMETICS 45 She also is considering a new loan of up to $325,000 which is about half of the $675,000 that Lionel Jensen requested. Reardon is convinced that (1) any loan would be adequately secured and (2) Jensen has a solid business plan, though she believes it may take him longer than he expects to fully implement it. Before she approves any loan, how- ever, she would require Dunham to reduce its payout ratio, perhaps even have Dunham eliminate dividends entirely. NOTE 1: Dunham's payout ratio is presently .50, that is, half of net income is paid out as dividends. NOTE 2: Dunham needs $675,000 of financing. If the new loan is granted, this provides Dunham with $325,000 of the needed financing, and it would raise the remainder by selling new stock. If only the existing debt were re- structured, that is, no new loan is granted, then all of the $675,000 would be financed with equity. Thus, any new loan amount reduces dollar-for-dollar the amount of new equity that Dunham must raise. Reardon decides to evaluate Dunham's ability to pay off a new five-year $325,000 loan in the following scenarios, and assuming equal amounts of prin- cipal are due each year. The interest rate would be 12 percent. She also decides to evaluate payout ratios of .50, 25, and 0 for each scenario. NOTE 3: This loan would total $4,791,000, which equals the $4,466,000 of ex- isting interest-bearing debt plus the additional $325,000. Principal due each year is $958,200. S-1 is Reardon's best-guess (most-likely) scenario. Reardon labels S-2 "conservative" and S-3 pessimistic." 1996 Estimates S-1 S-2 S-3 .10 .10 .08 Sales growth Gross margin ACP .30 .29 .29 60.00 65.00 65.00 Sales/Inv. 5.40 5.40 5.10 1997-2000 Estimates .05 .05 .03 Sales growth Gross margin .31 .30 .30 55.00 60.00 65.00 Sales/Inv. 5.70 5.40 5.40 For all scenarios she will assume in every year that administrative ex- penses and payables are 21.5 percent and 9 percent of sales, respectively. Reardon will also assume that capital spending will be $900(000) in 1996, $200(000) in 1997, increasing by the sales growth rate after that. Finally, the min- imum cash balance each year is $1,127(000). Perform the appropriate analysis. (a) Does it appear that allowing Dunham to restructure its $4,466,000 of ex- isting (old) debt is a good idea? Explain. (b) Would you grant Dunham an additional $325,000? Explain. NOTE: Make sure when you address part (b) that (1) the "new equity" input is set at $350 for 1996 and 0 in 1997-2000, and (2) "net new debt" is set at $325. EXHIBIT 1 Income Statements (000s) Present year 1995 1993 1994 Sales Cost of goods Gross profit Administrative expenses Depreciation EBIT Interest Earnings before taxes Taxes (50%) Net income Common stock dividends Retained earnings $25,264 17.180 8,084 5,254 302 2,528 296 2,232 1.116 1.116 558 558 $25,769 17.508 8,261 5,516 393 2,352 451 1,901 951 950 475 475 $26,671 18.793 7,878 6,068 479 1,331 578 753 377 376 188 188 CASE 7 DUNHAM COSMETICS 47 EXHIBIT 2 Balance Sheets (000s) Present Year 1995 1993 1994 5,920 6.133 $ 1,264 3,789 4,042 9,095 3,024 (1,129) 1.895 10.990 $ 1,237 5,204 5.102 11,543 4,123 (1,521) 2.601 14.144 5,337 (2,001) 3.336 Assets Cash & marketable securities Receivables Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Notes payable Accounts payable Accruals Current liabilities Term loans Common stock Retained earnings Total liabilities and equity $ 1,111 2,021 656 3,788 1,254 4,050 1.898 10.990 $ 1,804 3,126 1.010 5,940 1,781 4,050 2.373 14.144 $ 2,400 3,866 1.334 7,600 2,066 4,050 EXHIBIT 3 Financial Ratios for Dunham Cosmetics Industry Average 1993-1995 1993 1994 1995 2.40 1.95 1.94 1.08 1.33 1.00 46.00 55.00 5.20 53.00 5.00 8.54 Liquidity Current Quick Leverage Debt (%) Times interest earned Activity Inventory turnover (sales) Fixed asset turnover Total asset turnover Average collection period (days) Profitability Gross profit margin (%) Net profit (%) Return on total assets (%) Return on equity (%) 6.25 13.33 2.30 54.00 5.10 9.91 1.82 72.70 5.40 10.00 2.10 51.00 32.00 4.40 10.10 18.70 32.00 3.70 6.70 14.80 30.50 3.00 6.30 13.30 EXHIBIT 4 1996 Income Statement of Dunham Cosmetics (000s) 568 Sales Cost of goods Gross profit Administrative expenses Depreciation EBIT Interest Earnings before taxes Taxes Net income 1996 Balance Sheet (000s) 6,214 (2,569) Assets Cash & marketable securities Receivables Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Notes payable Accounts payable Accruals Current liabilities Bonds Common stock Retained earnings Total liabilities and equity 1.366 2,066 4,050 CASE 7 DUNHAM COSMETICS FINANCIAL EVALUATION For the last 26 years, Dunham Cosmetics has obtained virtually all of its busi- ness loans from the Graham County Bank (GCB). For the most part, Dunham has been a valued customer, though in 1980 Dunham fell behind in its debt pay- ments when a new line of toiletries was a complete disaster. After this the bank monitored Dunham's financial situation extremely closely, requiring monthly financial statements. As the company's financial situation improved, the bank went to quarterly and eight years ago, in 1987yearly evaluations. This was a sign that GCB felt the company was a good credit risk, and in recent years Dunham has had little difficulty obtaining bank financing. In fact, Dunham will seek a $675,000 loan in the near future. It is in the second year of its Equipment Improvement Program and will use the funds to modernize the factory and much of the equipment. The completion of this program is considered vital to the current and future health of the company, Jean Reardon was promoted to corporate banker with GCB four months ago and is the officer in charge of Dunham's account, replacing an officer who ap- parently was considered too lenient in corporate loan decisions. Reardon has known of Dunham's intended loan request for three weeks, and her initial reac- tion was that approval of the loan would be highly probable. Fortunately she never expressed this opinion to Lionel Jensen, Dunham's general manager. She realizes circumstances do change, and it would be very embarrassing to turn down a loan request from a longtime client after hinting such a loan would be "likely." There are a number of factors indicating Dunham will have borrowing difficulties, and she calls a meeting with Jensen to discuss the company's debt situation. JENSEN AND REARDON MEET Reardon reminds Jensen that the Federal Reserve is tightening credit in order to eliminate inflationary pressures in the economy. This means that loans will be come harder to obtain and the bank will be looking at each loan request much more carefully. Even more serious, the bank has just finished its yearly financial evaluation, and Reardon emphasizes to Jensen that, in her opinion, Dunham's financial position is poor and seems to be getting worse." She also points out as tactfully as possible that Dunham is violating its loan agreements. For exam- ple, one provision stipulates the current ratio can't fall below 1.85. A final issue concerns the terms of the company's loans. Jensen tells Reardon that I am considering whether to restructure the company's debt" and "might request" that the bank take all of Dunham's debt and amortize it over five years. "Of course, this may be unnecessary," he is quick to add. Reardon explains to Jensen that in light of Dunham's difficulties the loan committee would much prefer that any debt be repaid as quickly as possible. This means that (1) the loan committee would prefer not to restructure the debt; and (2) the new loan re- quest, assuming it is even granted, would likely be in the form of a note payable. However, Reardon does tell Jensen that the bank is willing to work with you to develop a financial plan satisfactory to all parties." Reardon then suggests they meet again in the near future to discuss the situation further. A few minutes after Jensen leaves, Reardon wonders if she wasn't a bit too "hardline," especially regarding Jensen's request to restructure Dunham's ex- isting debt. She knows that the officer previously in charge of the firm's account had raised no red flags with Jensen at last year's annual meeting. This is sur- prising given the company's "off" year in 1994. Prudent banking dictates that an officer express concern over a deterioration in a firm's position and seriously in- vestigate the reasons for any poor performance. And there are possible legal considerations. Suppose that the bank either calls the loan or refuses to allow Dunham to restructure. If, as a result, Dunham ends up in serious financial difficulties, then it is possible that GCB could be held legally liable for these problems because of the failure to adequately warn Dunham a year ago. Everything considered, Reardon thinks it may well be in the bank's interest to allow Dunham to restructure its existing debt. The new loan request is an- other matter, however. Although approval of the loan is not out of the question, Dunham will need a very solid and convincing business plan to stand any chance. Back at his office, Jensen reflects on the meeting with Reardon and the firm's situation. He is annoyed that he had not anticipated the bank's evaluation but feels there is a positive side to the situation. "Perhaps this will give our board the kick in the pants it needs," he thinks. Jensen knows Dunham is in difficulty and has a number of measures he wants implemented. Unfortunately, the board feels the company's problems are largely the result of a poor cosmetics market; the members believe there is little to do but wait for the "inevitable recovery." Jensen agrees that part of Dunham's problem has been the soft market that has existed for the past two years. However, industry experts agree this decline is over, and there are indications that demand is on the rise. Jensen himself be- seves a safe prediction is for sales to increase by 10 percent in 1996. JENSEN'S RECOMMENDATIONS He also feels there are a number of changes Dunham can make. When the com- pany realized that demand would be down, it hoped to increase sales with more liberal credit and through a larger inventory that would increase customer se- lection. Jensen opposed those measures at the time on the grounds that "they have never worked in the past, and we have a competitive, even generous credit policy." At present Dunham has an especially large level of inventory and a very high amount of receivables. Jensen believes receivables should be reduced to 60 days of sales in 1996 and the inventory turnover (sales/inventory) ratio could be raised to 5.4, the industry average. In addition he has a number of sugges- tions for reducing Dunham's costs. He believes the company can increase its gross profit margin to 31 percent and reduce selling and administrative ex- penses to 21.5 percent of sales. One reason for our lousy current ratio is we've gradually taken longer and longer to pay our bills! I've gotten more than one nasty letter in the last year! I'm going to suggest we get payables to 9 percent of sales, which would be compet- itive with other firms." Jensen has also been critical of how the company has obtained external fund- ing for the last few years. Virtually all such money has been supplied by GCB, and Jensen has secretly felt that the bank has been "extremely generous" in hon- oring Dunham's loan requests. Personally he believes the firm should have used more equity by eliminating dividend payments and selling more stock. In fact, in 1993 he had recommended that the firm lower its payout ratio from 50 to 20 percent of net income. The proposal received little support then and conse- quently Jensen hesitates now to propose a reduction in dividends. He decides to make any financial forecast assuming the payout ratio remains at 50 percent. Though Jensen doesn't really think GCB will grant the $675,000 loan request, he believes that Dunham should not accept the money even if it is offered. "But maybe I am wrong," he admits. "I will work up a financial forecast based on these changes and see what the numbers look like." Jensen will present his suggestions at the meeting he has called in 72 hours, and believes "they'll be implemented considering the situation with the bank." Jensen knows that the board wants the $675,000 loan, and if Dunham doesn't show the bank a solid plan, it will not only have no chance to obtain the $675,000, but the bank could foreclose on the existing loans. "And maybe, just maybe," he sighs, "if the bank likes our plan we won't be required to submit a monthly review. I really hate those!" QUESTIONS 1. Calculate Dunham's 1995 financial ratios. (See Exhibits 1, 2, and 3). 2. Does a trend analysis indicate Dunham's position has been deteriorating? (See Exhibit 3.) 3. Is the bank justifiably concerned? Justify your answer. 4. Nineteen ninety-four was a "down" year for Dunham. Do you think that GCB had a responsibility to express concern in 1994, especially since the current ra- tio was close to 1.85, the number that could trigger a call of the loan? Explain. 5. Suppose Dunham had followed Jensen's 1993 recommendation to lower its payout ratio. Recalculate the firm's debt and current ratios for 1995 assum- ing that the payout ratio was 20 percent from 1993 to 1995. (Assume that the extra money was used to reduce the firm's notes payable.) 6. (a) Jensen discussed Dunham's situation with Paula Robinson, an account- ing friend. Robinson said that, in her opinion, Dunham has "too little long-term capital, especially considering your receivables and inventory needs." Why is it frequently appropriate to use a long-term capital source like bonds or equity to finance items like inventory and receivables that appear on a balance sheet as short-term assets? (b) What advantages are there to using short-term debt to finance long-term assets? What are the disadvantages? 7. (a) Project Dunham's income and balance sheet for 1996 (see Exhibit 4) as- suming the bank grants Dunham a $675K note payable at 12 percent and no existing interest-bearing debt is retired. (Dividends will be 50 percent of net income.) Cash will be the residual or balancing item in the forecast. (b) Estimate the firm's 1996 minimum cash balance assuming that on aver- age during 1993 to 1995 its cash situation was normal. (c) Use any excess cash at the end of 1996 to retire notes payable. 8. (a) Will the bank be impressed by Jensen's changes? Explain. (b) What other options does Dunham have, assuming the bank denies the loan request? Critically evaluate each of these options. 0 SOFTWARE QUESTION 9. Dunham Cosmetics presently has $4,466,000 of interest-bearing debt. Nearly all of the debt is due in the next three years. Jean Reardon thinks that it is a good idea to allow Dunham to restruc- ture its debt and spread the payments over at least five years. She reasons that Dunham is unlikely to generate sufficient cash to pay the annual debt due the way the loans are presently structured. This could create problems for Dunham and the bank, and she wants to avoid, if possible, any collection hassle." CASE 7 DUNHAM COSMETICS 45 She also is considering a new loan of up to $325,000 which is about half of the $675,000 that Lionel Jensen requested. Reardon is convinced that (1) any loan would be adequately secured and (2) Jensen has a solid business plan, though she believes it may take him longer than he expects to fully implement it. Before she approves any loan, how- ever, she would require Dunham to reduce its payout ratio, perhaps even have Dunham eliminate dividends entirely. NOTE 1: Dunham's payout ratio is presently .50, that is, half of net income is paid out as dividends. NOTE 2: Dunham needs $675,000 of financing. If the new loan is granted, this provides Dunham with $325,000 of the needed financing, and it would raise the remainder by selling new stock. If only the existing debt were re- structured, that is, no new loan is granted, then all of the $675,000 would be financed with equity. Thus, any new loan amount reduces dollar-for-dollar the amount of new equity that Dunham must raise. Reardon decides to evaluate Dunham's ability to pay off a new five-year $325,000 loan in the following scenarios, and assuming equal amounts of prin- cipal are due each year. The interest rate would be 12 percent. She also decides to evaluate payout ratios of .50, 25, and 0 for each scenario. NOTE 3: This loan would total $4,791,000, which equals the $4,466,000 of ex- isting interest-bearing debt plus the additional $325,000. Principal due each year is $958,200. S-1 is Reardon's best-guess (most-likely) scenario. Reardon labels S-2 "conservative" and S-3 pessimistic." 1996 Estimates S-1 S-2 S-3 .10 .10 .08 Sales growth Gross margin ACP .30 .29 .29 60.00 65.00 65.00 Sales/Inv. 5.40 5.40 5.10 1997-2000 Estimates .05 .05 .03 Sales growth Gross margin .31 .30 .30 55.00 60.00 65.00 Sales/Inv. 5.70 5.40 5.40 For all scenarios she will assume in every year that administrative ex- penses and payables are 21.5 percent and 9 percent of sales, respectively. Reardon will also assume that capital spending will be $900(000) in 1996, $200(000) in 1997, increasing by the sales growth rate after that. Finally, the min- imum cash balance each year is $1,127(000). Perform the appropriate analysis. (a) Does it appear that allowing Dunham to restructure its $4,466,000 of ex- isting (old) debt is a good idea? Explain. (b) Would you grant Dunham an additional $325,000? Explain. NOTE: Make sure when you address part (b) that (1) the "new equity" input is set at $350 for 1996 and 0 in 1997-2000, and (2) "net new debt" is set at $325. EXHIBIT 1 Income Statements (000s) Present year 1995 1993 1994 Sales Cost of goods Gross profit Administrative expenses Depreciation EBIT Interest Earnings before taxes Taxes (50%) Net income Common stock dividends Retained earnings $25,264 17.180 8,084 5,254 302 2,528 296 2,232 1.116 1.116 558 558 $25,769 17.508 8,261 5,516 393 2,352 451 1,901 951 950 475 475 $26,671 18.793 7,878 6,068 479 1,331 578 753 377 376 188 188 CASE 7 DUNHAM COSMETICS 47 EXHIBIT 2 Balance Sheets (000s) Present Year 1995 1993 1994 5,920 6.133 $ 1,264 3,789 4,042 9,095 3,024 (1,129) 1.895 10.990 $ 1,237 5,204 5.102 11,543 4,123 (1,521) 2.601 14.144 5,337 (2,001) 3.336 Assets Cash & marketable securities Receivables Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Notes payable Accounts payable Accruals Current liabilities Term loans Common stock Retained earnings Total liabilities and equity $ 1,111 2,021 656 3,788 1,254 4,050 1.898 10.990 $ 1,804 3,126 1.010 5,940 1,781 4,050 2.373 14.144 $ 2,400 3,866 1.334 7,600 2,066 4,050 EXHIBIT 3 Financial Ratios for Dunham Cosmetics Industry Average 1993-1995 1993 1994 1995 2.40 1.95 1.94 1.08 1.33 1.00 46.00 55.00 5.20 53.00 5.00 8.54 Liquidity Current Quick Leverage Debt (%) Times interest earned Activity Inventory turnover (sales) Fixed asset turnover Total asset turnover Average collection period (days) Profitability Gross profit margin (%) Net profit (%) Return on total assets (%) Return on equity (%) 6.25 13.33 2.30 54.00 5.10 9.91 1.82 72.70 5.40 10.00 2.10 51.00 32.00 4.40 10.10 18.70 32.00 3.70 6.70 14.80 30.50 3.00 6.30 13.30 EXHIBIT 4 1996 Income Statement of Dunham Cosmetics (000s) 568 Sales Cost of goods Gross profit Administrative expenses Depreciation EBIT Interest Earnings before taxes Taxes Net income 1996 Balance Sheet (000s) 6,214 (2,569) Assets Cash & marketable securities Receivables Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Notes payable Accounts payable Accruals Current liabilities Bonds Common stock Retained earnings Total liabilities and equity 1.366 2,066 4,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts