Question: please help cember 31, 2021, when she turned age 40, individual K withdrew $50,000 from her Roth 5401(k). I had a $200,000 balance immediately before

please help

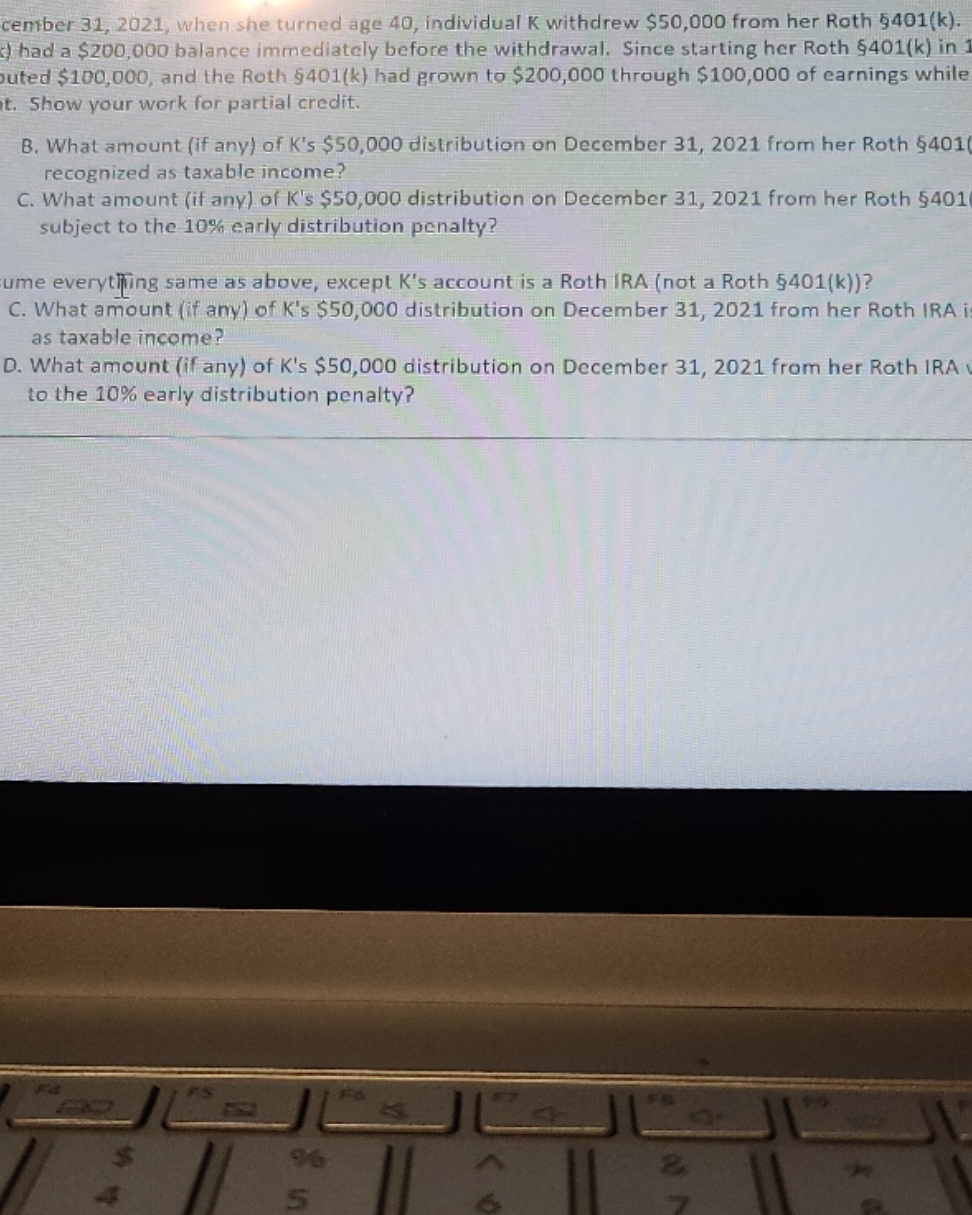

cember 31, 2021, when she turned age 40, individual K withdrew $50,000 from her Roth 5401(k). I had a $200,000 balance immediately before the withdrawal. Since starting her Roth $401(k) in uted $100,000, and the Roth $401(k) had grown to $200,000 through $100,000 of earnings while t. Show your work for partial credit. B. What amount (if any) of K's $50,000 distribution on December 31, 2021 from her Roth $401 recognized as taxable income? C. What amount (if any) of K's $50,000 distribution on December 31, 2021 from her Roth $401 subject to the 10% early distribution penalty? ume everything same as above, except K's account is a Roth IRA (not a Roth $401(k))? C. What amount (if any) of K's $50,000 distribution on December 31, 2021 from her Roth IRA i as taxable income? D. What amount (if any) of K's $50,000 distribution on December 31, 2021 from her Roth IRA to the 10% early distribution penalty? 2 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts