Question: please help Chapter 2 Question 5 Billy Dugan is single and has $189,000 in taxable income. Using the rates from Table 2.3, calculate his income

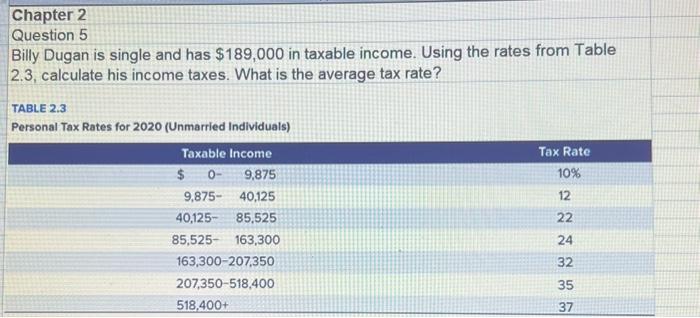

Chapter 2 Question 5 Billy Dugan is single and has $189,000 in taxable income. Using the rates from Table 2.3, calculate his income taxes. What is the average tax rate? TABLE 2.3 Personal Tax Rates for 2020 (Unmarried Individuals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts