Question: please help Chapter 3 Adjusting Accounts for Financial Statements ance. The adjusted trial balance for Chiara Company as of December 31, 2017, follows. lance or

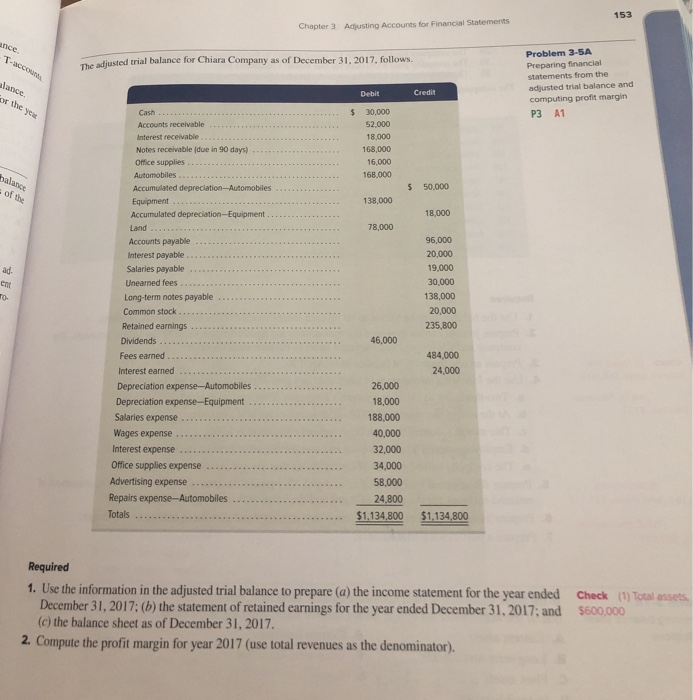

Chapter 3 Adjusting Accounts for Financial Statements ance. The adjusted trial balance for Chiara Company as of December 31, 2017, follows. lance or the year Problem 3-5A Preparing financial statements from the adjusted trial balance and computing profit margin P3 A1 Debit Credit $ 30,000 52.000 18,000 168,000 16,000 168,000 balance of the $ 50,000 138,000 18.000 78,000 Cash... Accounts receivable .... Interest receivable Notes receivable (due in 90 days) ... Office supplies.. Automobiles Accumulated depreciation-Automobiles Equipment Accumulated depreciation-Equipment Land ... Accounts payable ... Interest payable Salaries payable ... Unearned fees Long-term notes payable ... Common stock Retained earnings. Dividends ..... Fees earned Interest earned Depreciation expense-Automobiles ... Depreciation expense-Equipment .. Salaries expense ... Wages expense.... Interest expense Office supplies expense ..... Advertising expense ... Repairs expense--Automobiles. Totals ......... 96,000 20,000 19.000 30,000 138,000 20,000 235,800 46,000 484,000 24.000 26,000 18,000 188,000 40,000 32,000 34,000 58,000 24.800 $1,134,800 $1,134800 Required 1. Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended December 31, 2017; (b) the statement of retained earnings for the year ended December 31, 2017: and (C) the balance sheet as of December 31, 2017. 2. Compute the profit margin for year 2017 (use total revenues as the denominator). Check (1) Total assets, $600.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts