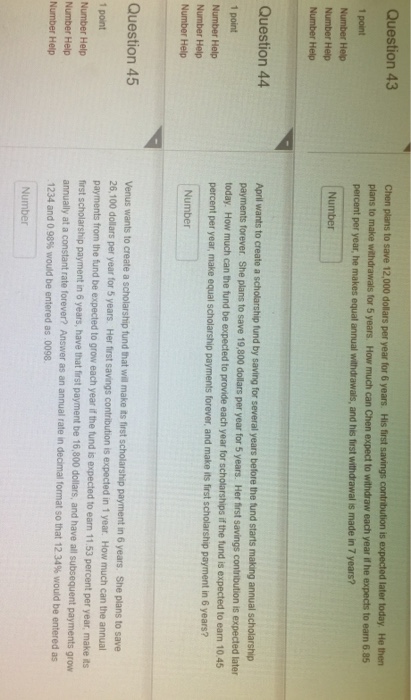

Question: PLEASE HELP!!!!!!! Chen plans to save 12,000 dollars per year for 6 years. His first savings contribution is expected later today. He then plans to

PLEASE HELP!!!!!!!

PLEASE HELP!!!!!!! Chen plans to save 12,000 dollars per year for 6 years. His first savings contribution is expected later today. He then plans to make withdrawals for 5 years. How much can Chen expect to withdraw each year if he expects to earn 6.85 percent per year, he makes equal annual withdrawals, and his first withdrawal is made in 7 years? April wants to create a scholarship fund by saving for several years before the fund starts making annual scholarship payments forever. She plans to save 19,800 dollars per year for 5 years. Her first savings contribution is expected later today. How much can the fund be expected to provide each year for scholarships if the fund is expected to earn 10.45 percent per year, make equal scholarship payments forever, and make its first scholarship payment in 6 years? Venus wants to create a scholarship fund that make its first scholarship payment in 6 years. She plans to save 26,100 dollars per year for 5 years. Her first savings contribution is expected in 1 year. How much can the annual payments from the fund are expected to grow each year if the fund is expected to earn 11.53 percent per year, make its first scholarship payment in 6 years, have that first payment be 16,800 dollars, and have all subsequent payments grow annually at a constant rate forever? Answer as an annual rate 12.34% would be entered as 1234 and 0 98% would be entered as 0098

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts