Question: please help . choose answer choice A financial planner is examining the portfolios held by several of her clients. Which of the following portfolios is

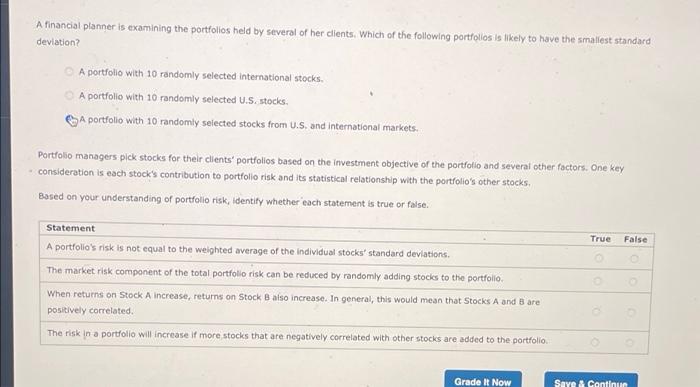

A financial planner is examining the portfolios held by several of her clients. Which of the following portfolios is likely to have the smallest standard deviation? A portfolio with 10 randomly selected international stocks A portfolio with 10 randomly selected U.S. stocks. A portfolio with 10 randomly selected stocks from U.S. and international markets, Portfolio managers pick stocks for their clients portfolios based on the investment objective of the portfolio and several other factors. One key consideration is each stock's contribution to portfolio risk and its statistical relationship with the portfolio's other stocks, Based on your understanding of portfolio risk, Identify whether each statement is true or false. True False Statement A portfolio's risk is not equal to the weighted average of the individual stocks' standard deviations The market risk component of the total portfolio risk can be reduced by randomly adding stocks to the portfolio When returns on Stock A increase, returns on Stock B also increase. In general, this would mean that Stocks A and Bare positively correlated The risk in a portfolio will increase if more stocks that are negatively correlated with other stocks are added to the portfolio Grade It Now Save Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts