Question: please help complete the table as well, thank you! 9. (10pts) Your firm currently has $100 million in debt outstanding with a 10% interest rate.

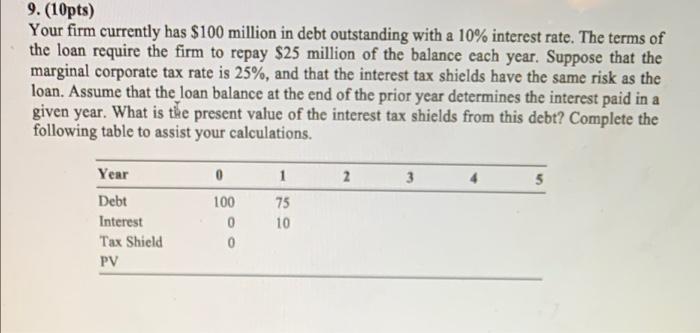

9. (10pts) Your firm currently has $100 million in debt outstanding with a 10% interest rate. The terms of the loan require the firm to repay $25 million of the balance each year. Suppose that the marginal corporate tax rate is 25%, and that the interest tax shields have the same risk as the loan. Assume that the loan balance at the end of the prior year determines the interest paid in a given year. What is the present value of the interest tax shields from this debt? Complete the following table to assist your calculations. Year 0 1 2 3 4 5 Debt 100 75 Interest 0 10 Tax Shield 0 PV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts