Question: PLEASE HELP COMPLETE THIS QUESTION ASAPPPP!!! 10) Andrea buys a condo for $300,000 and has taken out a 15-year mortgage with monthly payments. (6 marks

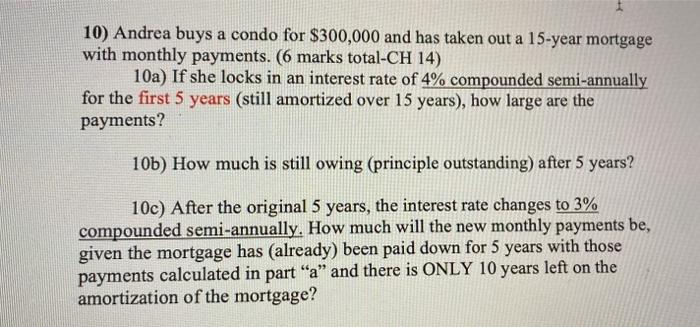

10) Andrea buys a condo for $300,000 and has taken out a 15-year mortgage with monthly payments. (6 marks total-CH 14) 10a) If she locks in an interest rate of 4% compounded semi-annually for the first 5 years (still amortized over 15 years), how large are the payments? 10b) How much is still owing (principle outstanding) after 5 years? 10c) After the original 5 years, the interest rate changes to 3% compounded semi-annually. How much will the new monthly payments be, given the mortgage has already) been paid down for 5 years with those payments calculated in part a and there is ONLY 10 years left on the amortization of the mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts