Question: please help compute the ratios for 2025 The comparative statements of Oriole Company are presented here. Oriole Company Balance Sheets December 31 begin{tabular}{l} 2025

please help compute the ratios for 2025

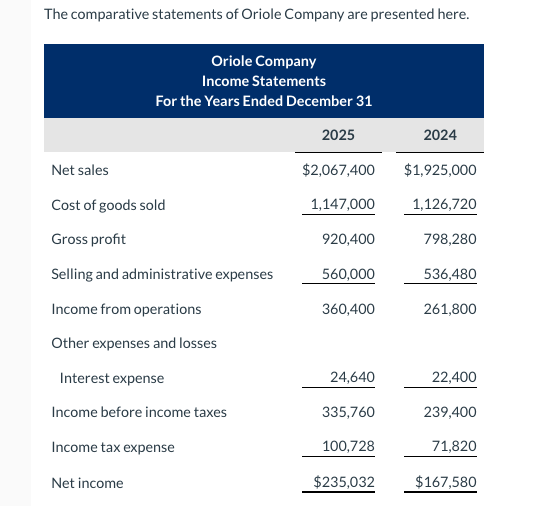

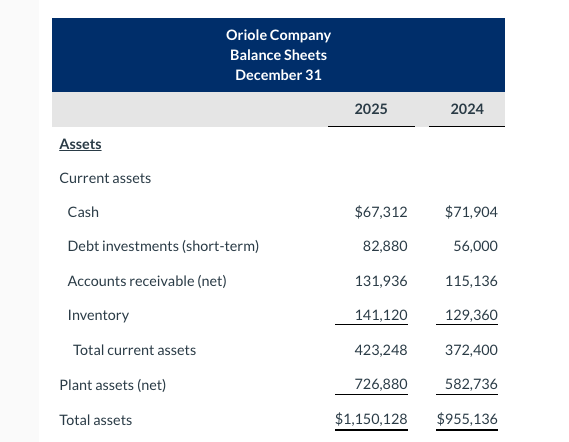

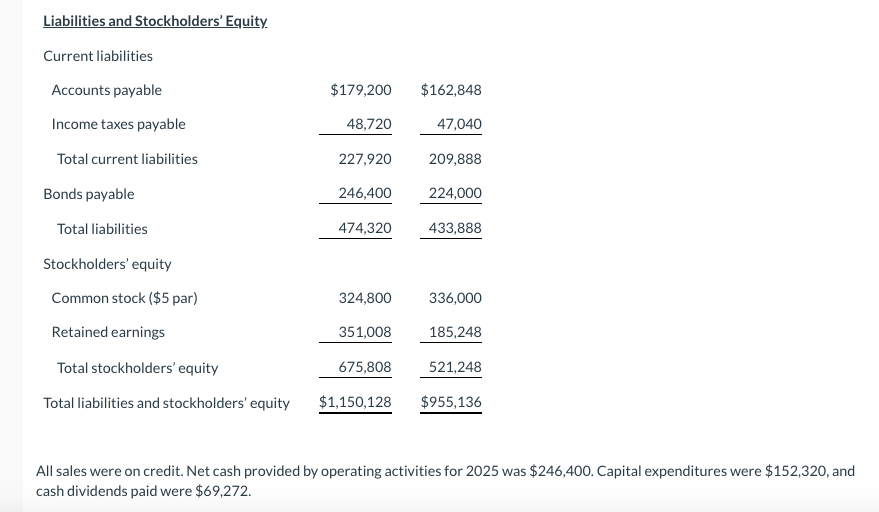

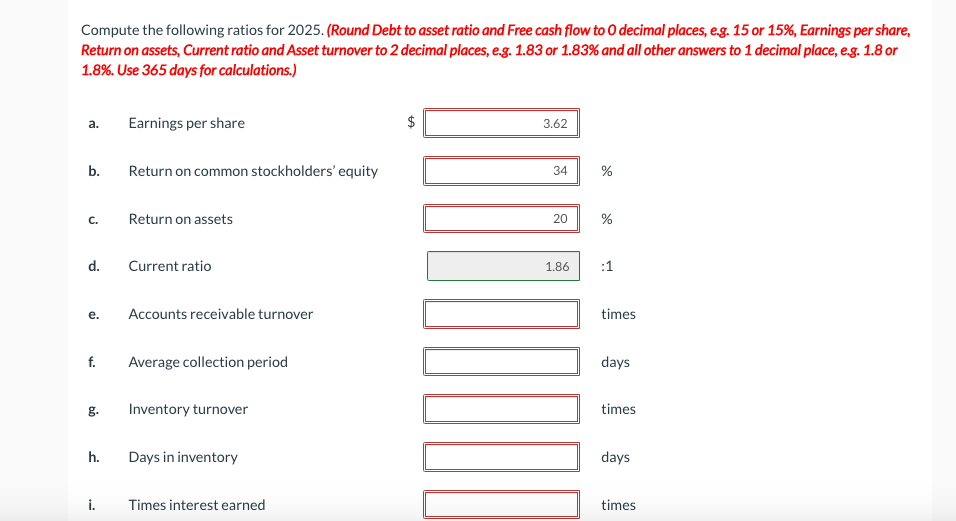

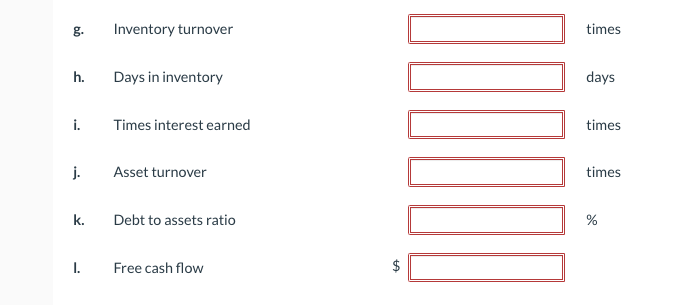

The comparative statements of Oriole Company are presented here. Oriole Company Balance Sheets December 31 \begin{tabular}{l} 2025 \\ \hline \end{tabular} Assets Current assets All sales were on credit. Net cash provided by operating activities for 2025 was $246,400. Capital expenditures were $152,320, and cash dividends paid were $69,272 Compute the following ratios for 2025. (Round Debt to asset ratio and Free cash flow to 0 decimal places, e.g. 15 or 15\%, Earnings per share, Return on assets, Current ratio and Asset turnover to 2 decimal places, e.g. 1.83 or 1.83% and all other answers to 1 decimal place, e.g. 1.8 or 1.8\%. Use 365 days for calculations.) g. Inventory turnover times h. Days in inventory days i. Times interest earned times j. Asset turnover times k. Debt to assets ratio % I. Free cash flow The comparative statements of Oriole Company are presented here. Oriole Company Balance Sheets December 31 \begin{tabular}{l} 2025 \\ \hline \end{tabular} Assets Current assets All sales were on credit. Net cash provided by operating activities for 2025 was $246,400. Capital expenditures were $152,320, and cash dividends paid were $69,272 Compute the following ratios for 2025. (Round Debt to asset ratio and Free cash flow to 0 decimal places, e.g. 15 or 15\%, Earnings per share, Return on assets, Current ratio and Asset turnover to 2 decimal places, e.g. 1.83 or 1.83% and all other answers to 1 decimal place, e.g. 1.8 or 1.8\%. Use 365 days for calculations.) g. Inventory turnover times h. Days in inventory days i. Times interest earned times j. Asset turnover times k. Debt to assets ratio % I. Free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts