Question: PLEASE HELP!!!! Construct the forecasted financial statements assuming that these changes are made. What are the firm's f notes payable and long-term debt balances? What

PLEASE HELP!!!!

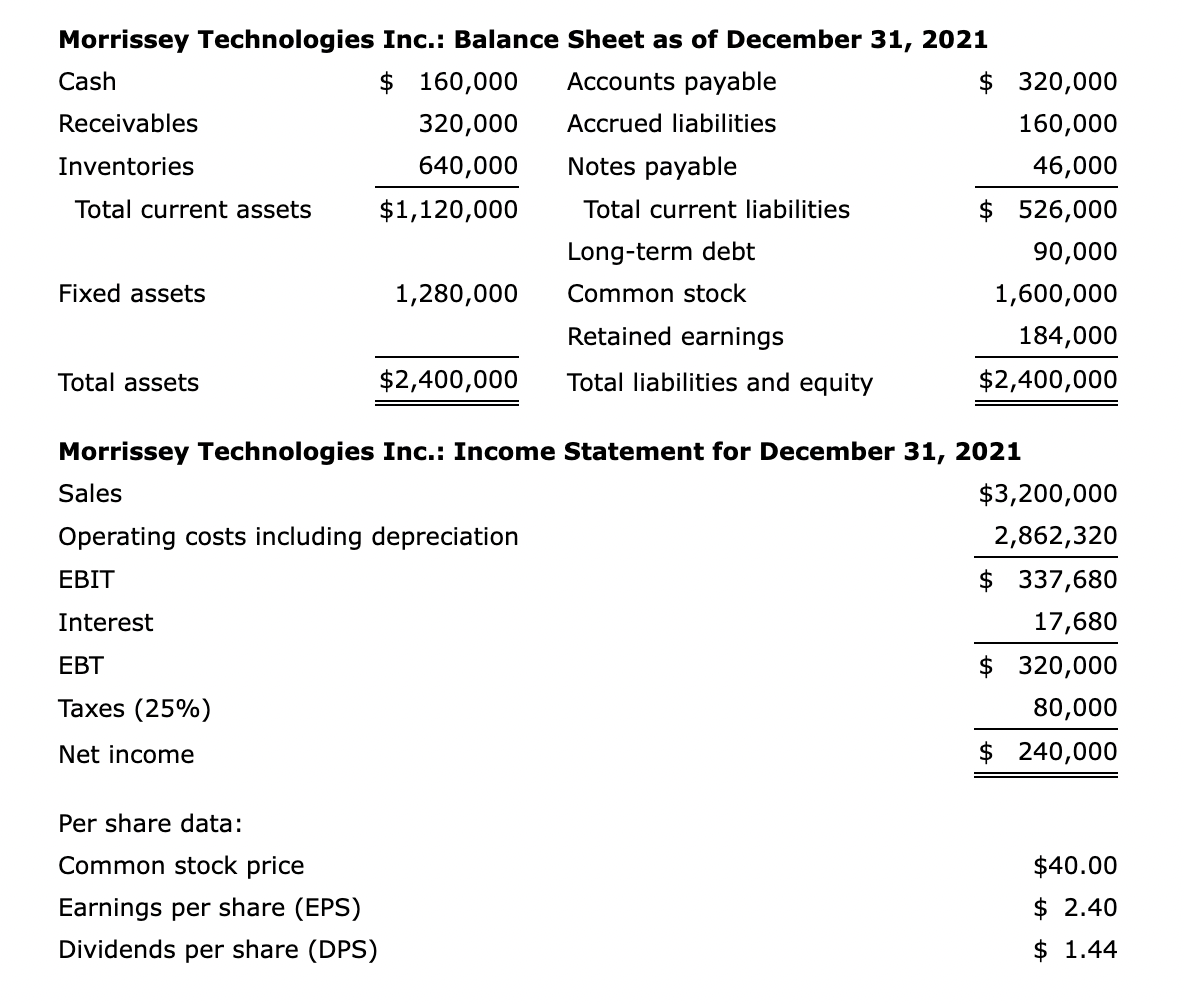

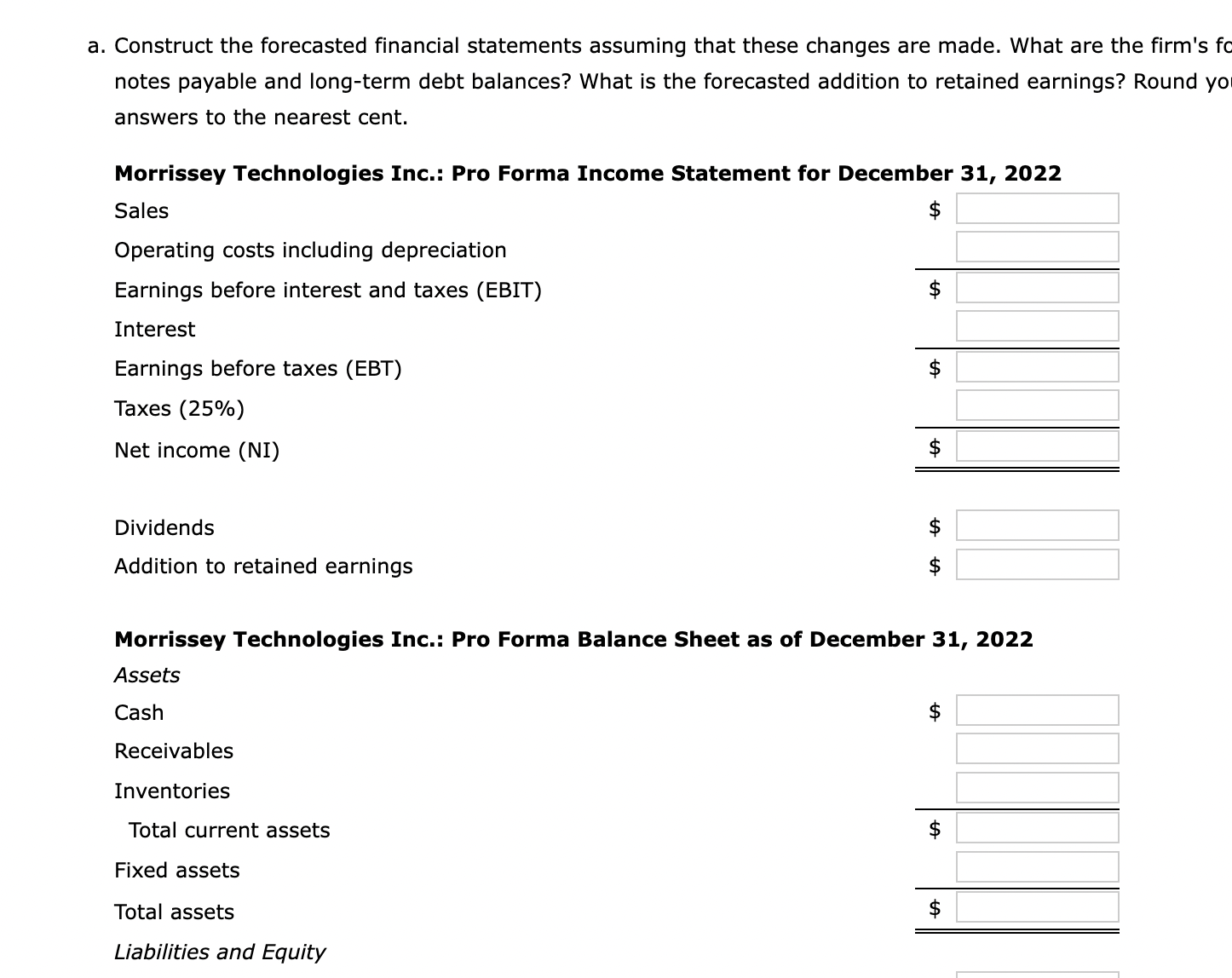

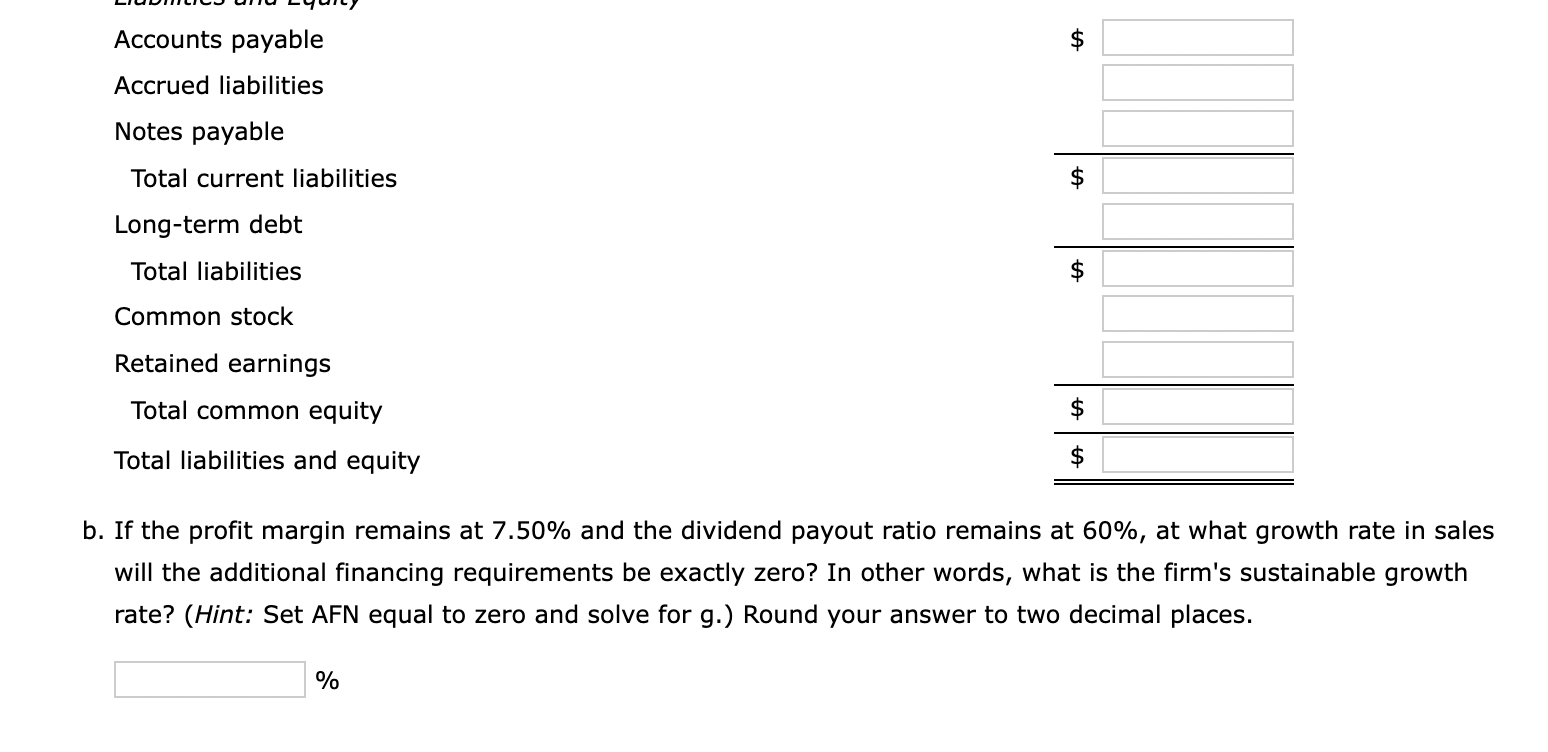

Construct the forecasted financial statements assuming that these changes are made. What are the firm's f notes payable and long-term debt balances? What is the forecasted addition to retained earnings? Round y answers to the nearest cent. b. If the profit margin remains at 7.50% and the dividend payout ratio remains at 60%, at what growth rate in sales will the additional financing requirements be exactly zero? In other words, what is the firm's sustainable growth rate? (Hint: Set AFN equal to zero and solve for g.) Round your answer to two decimal places. % Morrissey Technologies Inc.: Income Statement for December 31, 2021 Sales Operating costs including depreciation EBIT Interest EBT Taxes (25\%) Net income Per share data: Common stock price Earnings per share (EPS) Dividends per share (DPS) $3,200,000 $337,6802,862,320 17,680 $320,000 80,000$240,000 $40.00 $2.40 $1.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts