Question: please help Convertible Note Example: The seed investors are considering a $750,000 investment in the form of a convertible, which will convert at the lower

please help

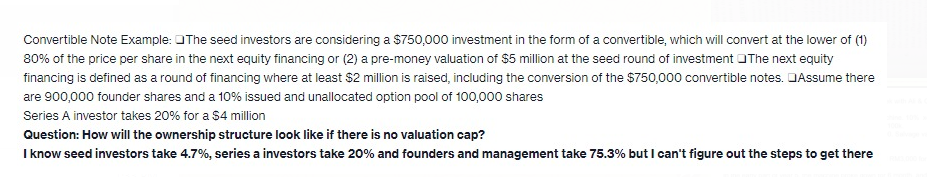

Convertible Note Example: The seed investors are considering a $750,000 investment in the form of a convertible, which will convert at the lower of (1) 80% of the price per share in the next equity financing or (2) a pre-money valuation of $5 million at the seed round of investment aThe next equity financing is defined as a round of financing where at least $2 million is raised, including the conversion of the $750,000 convertible notes. Assume there are 900,000 founder shares and a 10% issued and unallocated option pool of 100,000 shares Series A investor takes 20% for a $4 million Question: How will the ownership structure look like if there is no valuation cap? I know seed investors take 4.7%, series a investors take 20% and founders and management take 75.3% but I can't figure out the steps to get there

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts