Question: Please help! correct answers def get thumbs up , not all the same questions! Many thanks in advance (practice exam) On November 7. Mura Company

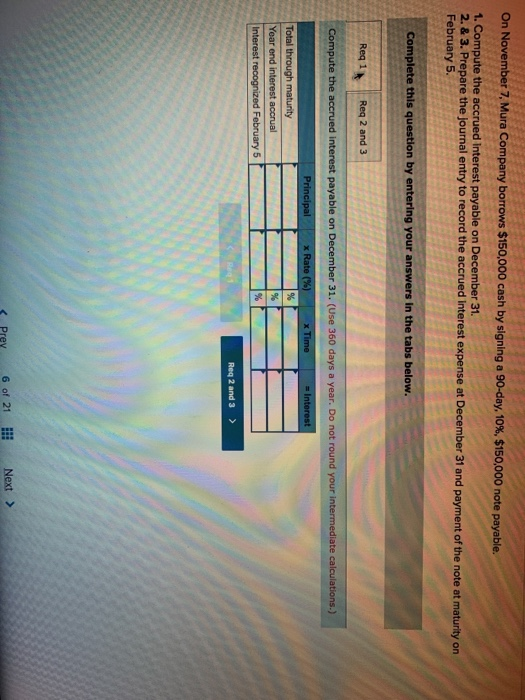

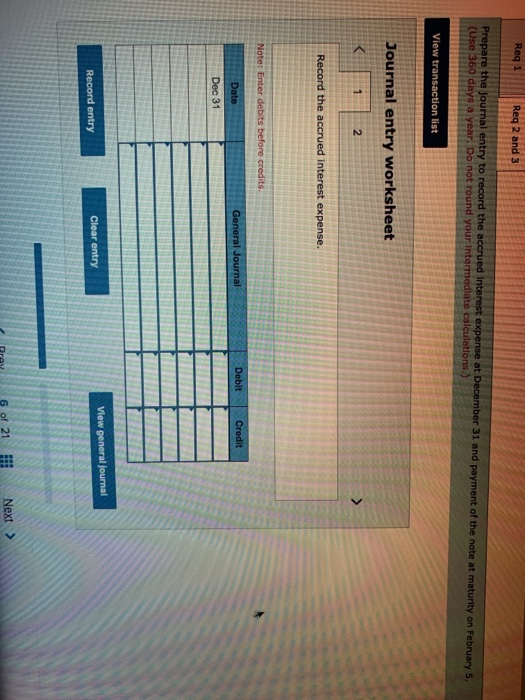

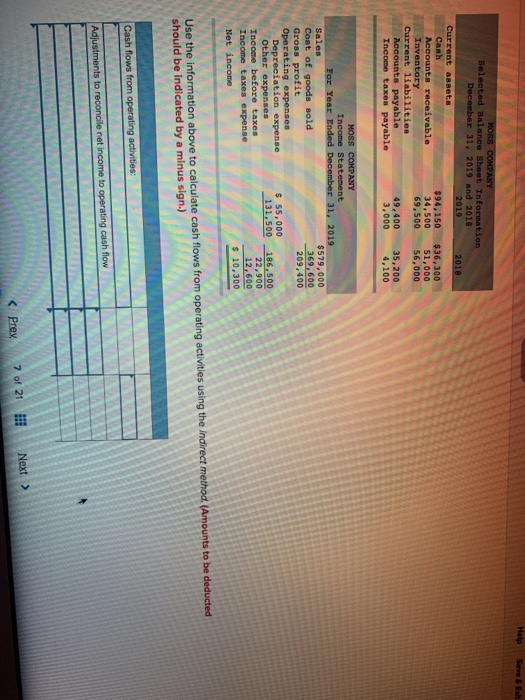

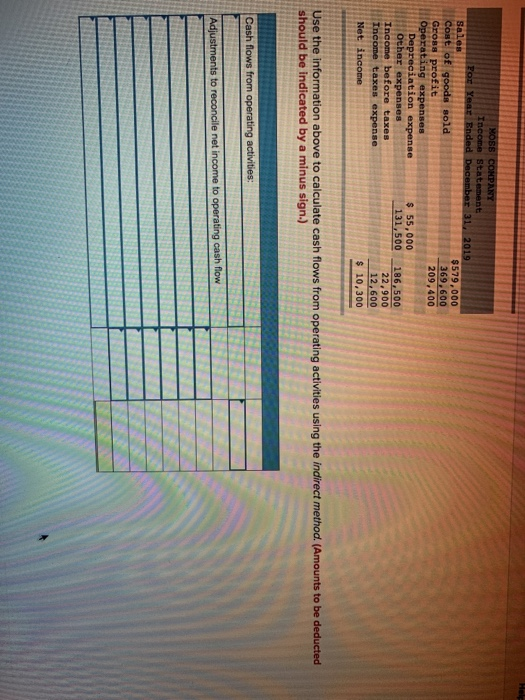

On November 7. Mura Company borrows $150,000 cash by signing a 90-day, 10%, $150,000 note payable. 1. Compute the accrued Interest payable on December 31. 2. & 3. Prepare the journal entry to record the accrued Interest expense at December 31 and payment of the note at maturity on February 5. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Compute the accrued interest payable on December 31. (Use 360 days a year. Do not round your intermediate calculations.) Principal Rate (%) * Time = Interest Total through maturity Year end interest accrual Interest recognized February 5 Reg 2 and 3 > Reg 1 Req 2 and 3 Prepare the journal entry to record the accrued Interest expense at December 31 and payment of the note at maturity on February 5. (Use 360 days a year. Do not round your intermediate calculations.) View transaction list Journal entry worksheet Record the accrued interest expense. Note: Enter debits before credits General Journal Debit Credit Date Dec 31 View general journal Record entry Clear entry Prey 6 of 21 Next Help Save & Exh HOS COMPANY Selected Balance Sheet Information December 31, 2019 and 2018 2019 2018 Current Assets Canh $94,150 $36,300 Accounts receivable 34,500 51,000 Inventory 69,500 56,000 Current liabilities Accounts payable 49,400 35,200 Income taxes payable 3,000 4,100 MOSS COMPANY Income Statement For Year Ended December 31, 2019 Sales $579,000 Cost of goods sold 369,600 Gross profit 209,400 Operating expenses Depreciation expense $ 55,000 Other expenses 131,500 186,500 Income before taxes 22,900 Income taxes expense 12,600 Net income $ 10,300 Use the information above to calculate cash flows from operating activities using the Indirect method. (Amounts to be deducted should be indicated by a minus sign.) Cash flows from operating activities: Adjustments to reconcile net income to operating cash flow MOBS COMPANY Income Statement For Year Ended December 31, 2019 Sales $579,000 Cost of goods sold 369,600 Gross profit 209,400 Operating expenses Depreciation expense $ 55,000 other expenses 131,500 186,500 Income before taxes 22,900 Income taxes expense 12,600 Net income $ 10,300 Use the information above to calculate cash flows from operating activities using the indirect method. (Amounts to be deducted should be indicated by a minus sign.) Cash flows from operating activities: Adjustments to reconcile net income to operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts