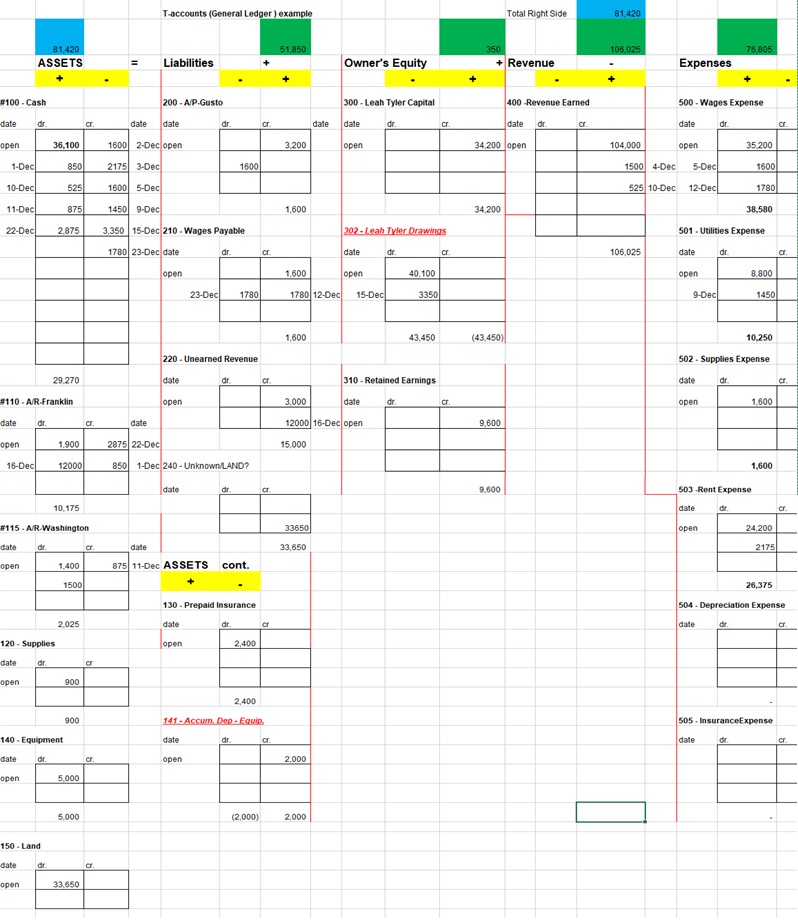

Question: Please Help Correct. Here are the Teachers notes: Make sure you are calling accounts by their true name- it's not Rent, it's Rent Expense You

Please Help Correct. Here are the Teachers notes: Make sure you are calling accounts by their true name- it's not Rent, it's Rent Expense You are missing the Dec 31 AJE and some of the JE

Enter Trasncations:

Dec. 1st Collected $850 from Franklin from a previous engagement in Oct. done

Dec. 2nd Paid $1,600 on Gustos Inc. invoice from a previously recorded transaction with check #1301.

Dec 3rd Paid December rent of $2,175 with check #1302.

Dec 4th Completed additional work for Washington, sent invoice #Y77P for $1,500 due in 1 month.

Dec. 5th Paid employee from work previously expensed in Nov. with payment due Dec. 5th using check #1303.

Dec. 8th Purchased land on a note for $33,650 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240, respectively.

Dec. 9th Paid $1,450 to cover all utilities for the month of Dec using check #1304.

Dec. 10th - Completed $525 worth of work for a repeat customer who pays cash immediately upon completion.

Dec. 11th - Collected $875 from Washington from a previous engagement in Nov.

Dec. 12th Our employee earned two weeks of pay amounting to $1,780, to be paid Dec. 23rd.

*employee took vacation from Dec. 15th-Dec. 31st. No pay will accrue*

Dec. 15th - Leah Tyler, the owner, withdrew $3,350 for personal use using check #1305.

Dec. 16th Completed a large job for Franklin for $12,000. Sent invoice #Y78P due Jan. 31st.

Dec. 22nd Franklin paid $2,875 to pay off some of his balance due.

Dec. 23rd Paid our employee for the work expensed Dec. 12th.

Dec 24th-Dec. 31st Owner took off the rest of the year.

Adjustments

1. The equipment was used for the third year.

2. Prepaid insurance was adjusted for Oct-Dec usage.

3. Unearned revenue was updated to show 3 months of work completed.

4. A final count of supplies showed $365 remaining.

| GENERAL JOURNAL | p. 1 | |||||

| **Skip lines between transaction dates | ||||||

| Date | Transaction | Post. Ref. | Debit | Credit | ||

| Sample | Debit account | XXX | ||||

| (indent) credit account | XXX | |||||

| *skip a line between transactions* | ||||||

| 1-Dec | CASH | 850 | ||||

| FRANKLIN ACCOUNT | 850 | |||||

| 2-Dec | ACCOUNTS PAYABLE | 1600 | ||||

| CASH | 1600 | |||||

| 3-Dec | RENT | 2175 | ||||

| CASH | 2175 | |||||

| 4-Dec | ACCOUNTS RECIEVABLE | 1500 | ||||

| REVENUE EARNED | 1500 | |||||

| 5-Dec | WAGES EXPENSE | 1302 | 1600 | |||

| CASH | 1600 | |||||

| 8-Dec | LAND | 33650 | ||||

| CASH | 33650 | |||||

| 9-Dec | UTILITIES EXPENSE | 1450 | ||||

| CASH | 1450 | |||||

| 10-Dec | CASH | 525 | ||||

| REVENUE EARNED | 525 | |||||

| 11-Dec | CASH | 875 | ||||

| ACCOUNTS RECIEVABLE | 875 | |||||

| 12-Dec | WAGE EXPENSE | 1780 | ||||

| WAGES PAYABLE | 1780 | |||||

| 15-Dec | LEAH | 3350 | ||||

| CASH | 3350 | |||||

| 16-Dec | ACCOUNT RECEIVABLE | 12000 | ||||

| REVENUE EARNED | 12000 | |||||

| 22-Dec | CASH | 2875 | ||||

| ACCOUNTS RECEIVABLE | 2875 | |||||

| 23-Dec | WAGES PAYABLE | 1780 | ||||

| CASH | 1780 | |||||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts