Question: PLEASE HELP CORRECT!! Question 7 of 12 -/1 E View Policies Current Attempt in Progress Melissa Peters' regular hourly wage rate is $36, and she

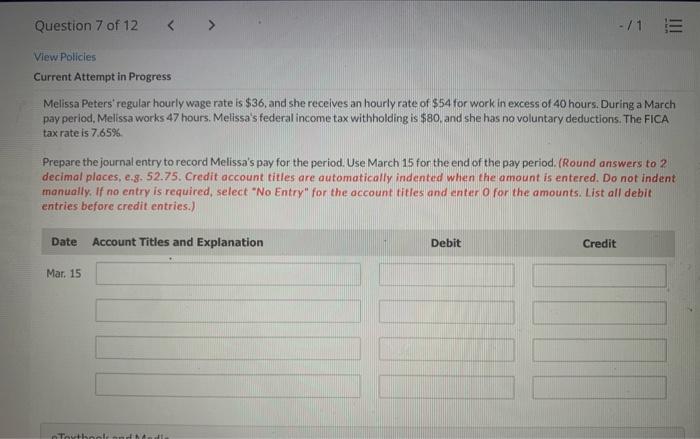

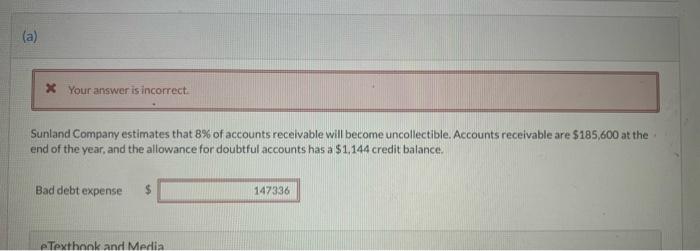

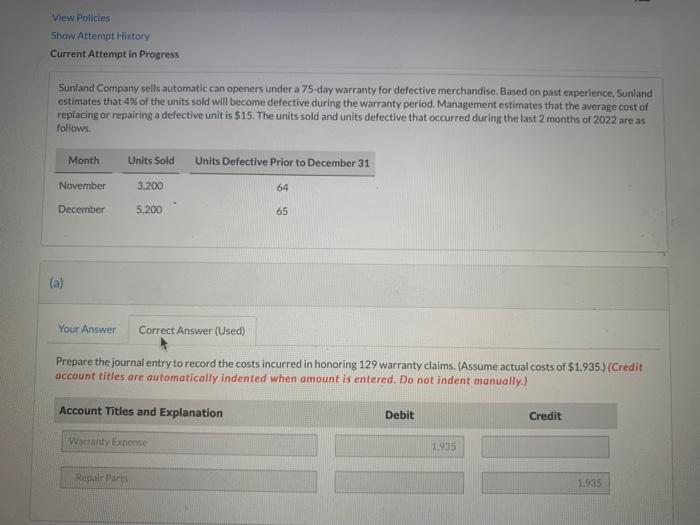

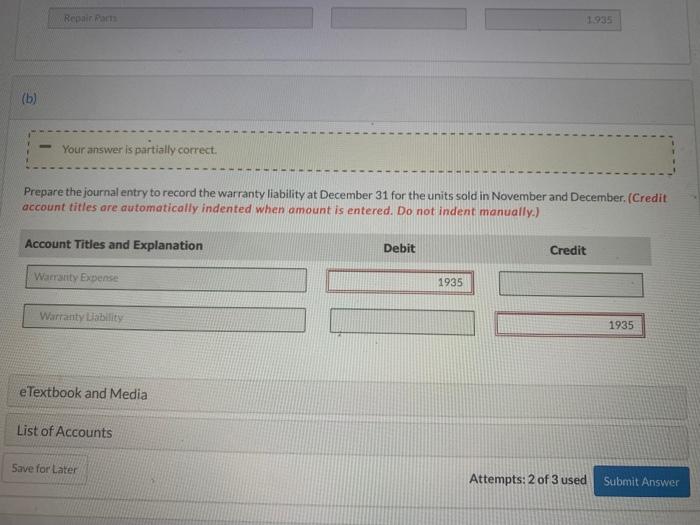

Question 7 of 12 -/1 E View Policies Current Attempt in Progress Melissa Peters' regular hourly wage rate is $36, and she receives an hourly rate of $54 for work in excess of 40 hours. During a March pay period. Melissa works 47 hours, Melissa's federal income tax withholding is $80, and she has no voluntary deductions. The FICA tax rate is 7,65% Prepare the journal entry to record Melissa's pay for the period. Use March 15 for the end of the pay period. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit Mar. 15 Tube (a) * Your answer is incorrect Sunland Company estimates that 8% of accounts receivable will become uncollectible. Accounts receivable are $185,600 at the end of the year, and the allowance for doubtful accounts has a $1,144 credit balance. Bad debt expense 147336 e Texthank and Media View Policies Show Attempt History Current Attempt in Progress Sunland Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Sunland estimates that 4% of the units sold will become defective during the warranty period. Management estimates that the average cost of replacing or repairing a defective unit is $15. The units sold and units defective that occurred during the last 2 months of 2022 areas follows Month Units Sold Units Defective Prior to December 31 November 3,200 64 December 5.200 65 (a) Your Answer Correct Answer (Used) Prepare the journal entry to record the costs incurred in honoring 129 warranty claims. Assume actual costs of $1,935.) (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Tities and Explanation Debit Credit Warranty Expense 1935 Rapal Parts 1,935 Repair 1.935 (b) Your answer is partially correct. Prepare the journal entry to record the warranty liability at December 31 for the units sold in November and December. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Warranty Expense 1935 Warranty ability 1935 eTextbook and Media List of Accounts Save for Later Attempts: 2 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts