Question: please help correct We nowy worrapures u questo s ursprayeu veuw. Brooks Company purchases debt investments as trading securities at a cost of $66,000 on

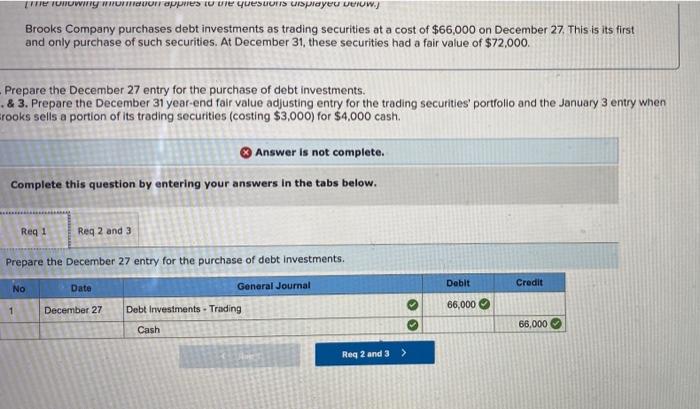

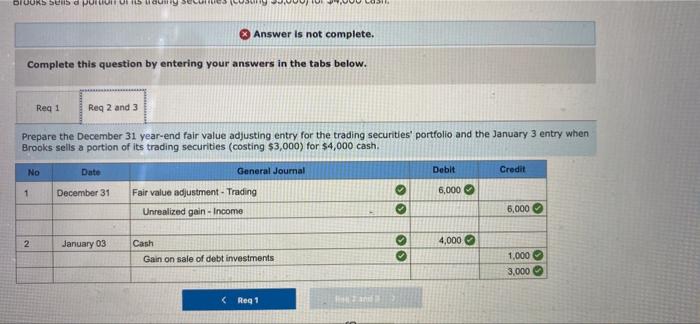

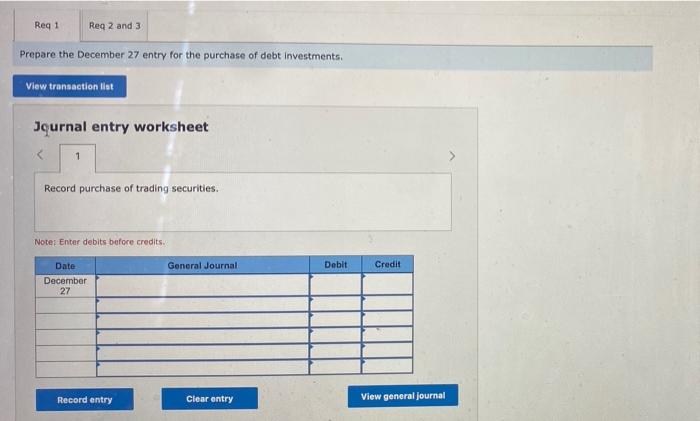

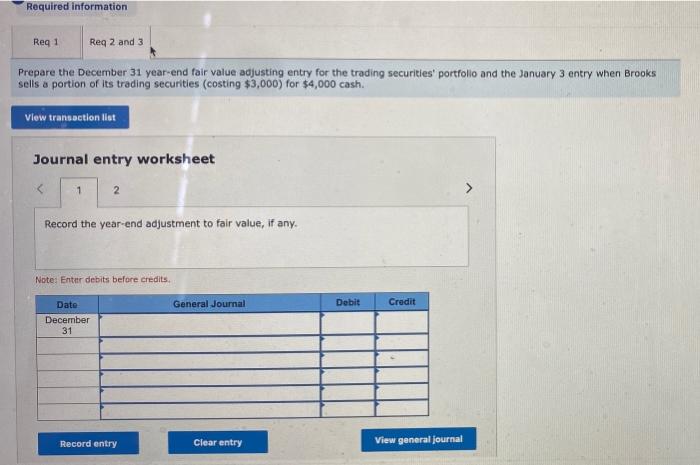

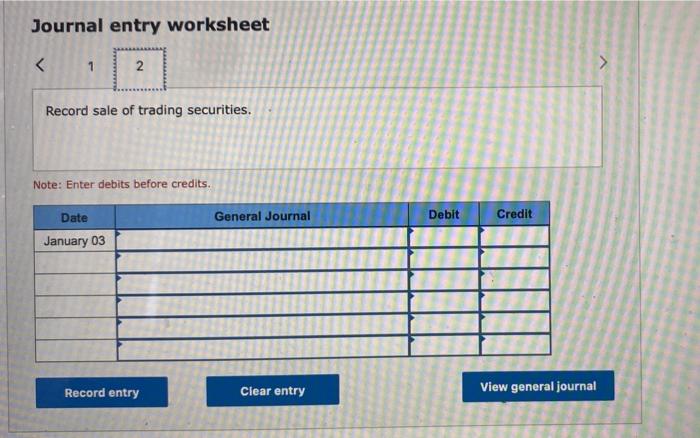

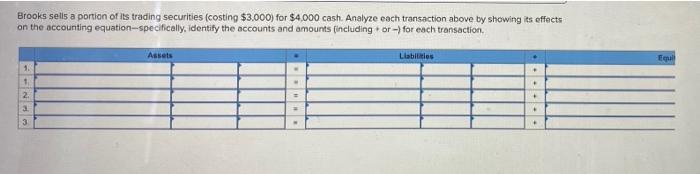

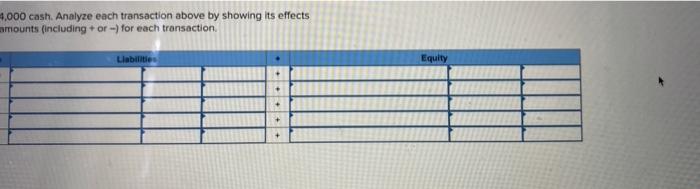

We nowy worrapures u questo s ursprayeu veuw. Brooks Company purchases debt investments as trading securities at a cost of $66,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $72,000. Prepare the December 27 entry for the purchase of debt investments. .& 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when rooks sells a portion of its trading securities (costing $3,000) for $4,000 cash. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Dobit Credit Prepare the December 27 entry for the purchase of debt investments. No Date General Journal 1 December 27 Debt Investments - Trading Cash 66,000 66,000 Reg 2 and 3 > DIVOKS Sens d purus uduty se Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $3,000) for $4,000 cash. No Date General Journal Debit Credit 1 December 31 6,000 Fair value adjustment - Trading Unrealized gain -Income 6,000 2 January 03 4,000 Cash Gain on sale of debt investments O 1.000 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts