Question: Please help! Create a 2021 form 1065, along with its schedules K and M and any other necessary, as well as schedule K-1 for the

Please help! Create a 2021 form 1065, along with its schedules K and M and any other necessary, as well as schedule K-1 for the partner Gary.

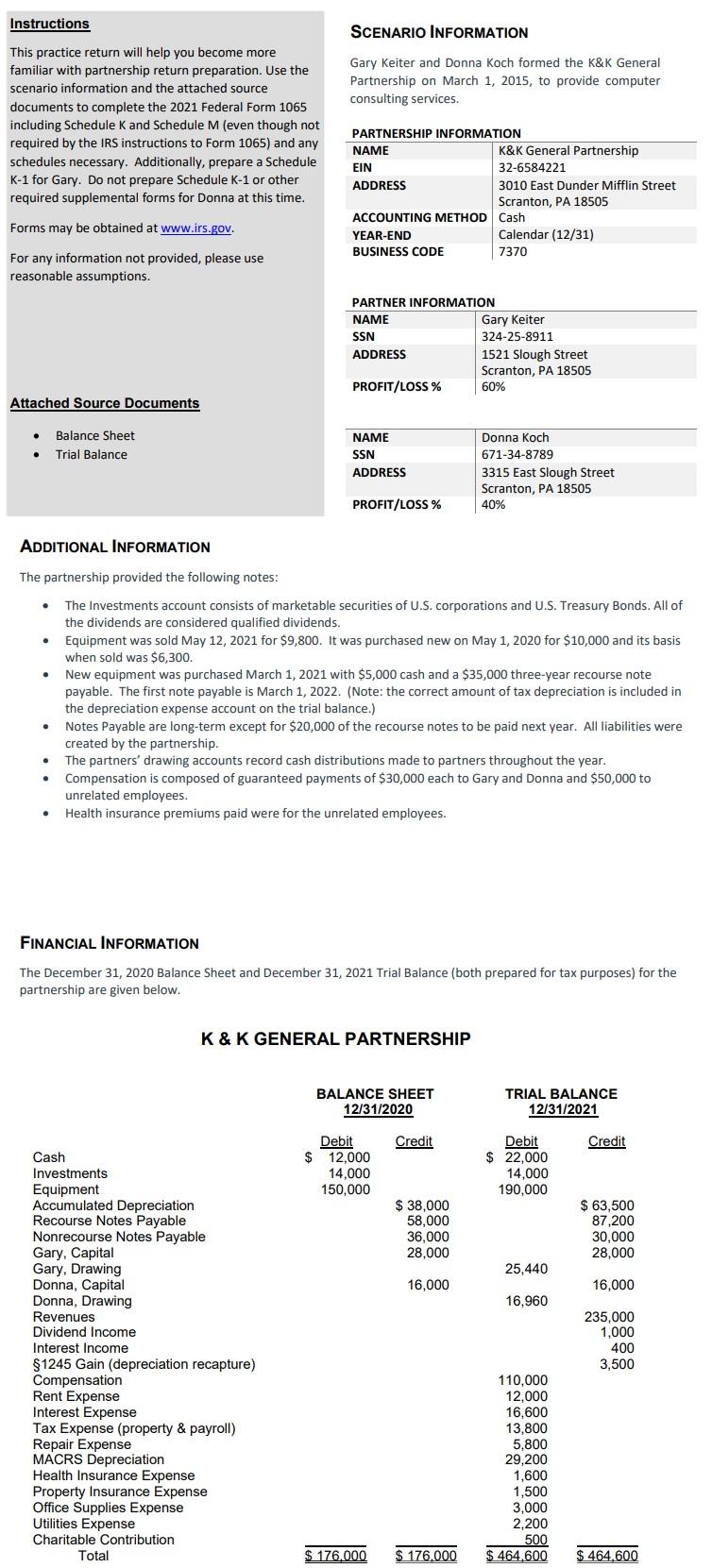

Instructions SCENARIO INFORMATION This practice return will help you become more familiar with partnership return preparation. Use the Gary Keiter and Donna Koch formed the K\&K General scenario information and the attached source Partnership on March 1, 2015, to provide computer documents to complete the 2021 Federal Form 1065 consulting services. including Schedule K and Schedule M (even though not required by the IRS instructions to Form 1065) and any schedules necessary. Additionally, prepare a Schedule K-1 for Gary. Do not prepare Schedule K-1 or other required supplemental forms for Donna at this time. Forms may be obtained at www.irs.gov. For any information not provided, please use reasonable assumptions. Attached Source Documents - Balance Sheet - Trial Balance ADDITIONAL INFORMATION The partnership provided the following notes: - The Investments account consists of marketable securities of U.S. corporations and U.S. Treasury Bonds. All of the dividends are considered qualified dividends. - Equipment was sold May 12, 2021 for $9,800. It was purchased new on May 1, 2020 for $10,000 and its basis when sold was $6,300. - New equipment was purchased March 1, 2021 with $5,000 cash and a $35,000 three-year recourse note payable. The first note payable is March 1,2022 . (Note: the correct amount of tax depreciation is included in the depreciation expense account on the trial balance.) - Notes Payable are long-term except for $20,000 of the recourse notes to be paid next year. All liabilities were created by the partnership. - The partners' drawing accounts record cash distributions made to partners throughout the year. - Compensation is composed of guaranteed payments of $30,000 each to Gary and Donna and $50,000 to unrelated employees. - Health insurance premiums paid were for the unrelated employees. FINANCIAL INFORMATION The December 31, 2020 Balance Sheet and December 31, 2021 Trial Balance (both prepared for tax purposes) for the partnership are given below. K \& K GENERAL PARTNERSHIP Instructions SCENARIO INFORMATION This practice return will help you become more familiar with partnership return preparation. Use the Gary Keiter and Donna Koch formed the K\&K General scenario information and the attached source Partnership on March 1, 2015, to provide computer documents to complete the 2021 Federal Form 1065 consulting services. including Schedule K and Schedule M (even though not required by the IRS instructions to Form 1065) and any schedules necessary. Additionally, prepare a Schedule K-1 for Gary. Do not prepare Schedule K-1 or other required supplemental forms for Donna at this time. Forms may be obtained at www.irs.gov. For any information not provided, please use reasonable assumptions. Attached Source Documents - Balance Sheet - Trial Balance ADDITIONAL INFORMATION The partnership provided the following notes: - The Investments account consists of marketable securities of U.S. corporations and U.S. Treasury Bonds. All of the dividends are considered qualified dividends. - Equipment was sold May 12, 2021 for $9,800. It was purchased new on May 1, 2020 for $10,000 and its basis when sold was $6,300. - New equipment was purchased March 1, 2021 with $5,000 cash and a $35,000 three-year recourse note payable. The first note payable is March 1,2022 . (Note: the correct amount of tax depreciation is included in the depreciation expense account on the trial balance.) - Notes Payable are long-term except for $20,000 of the recourse notes to be paid next year. All liabilities were created by the partnership. - The partners' drawing accounts record cash distributions made to partners throughout the year. - Compensation is composed of guaranteed payments of $30,000 each to Gary and Donna and $50,000 to unrelated employees. - Health insurance premiums paid were for the unrelated employees. FINANCIAL INFORMATION The December 31, 2020 Balance Sheet and December 31, 2021 Trial Balance (both prepared for tax purposes) for the partnership are given below. K \& K GENERAL PARTNERSHIP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts