Question: Please help create an income and expense statement (Step 1) show work if possible. all information provided. 1. Create an income and expense statement based

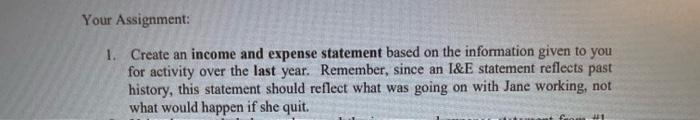

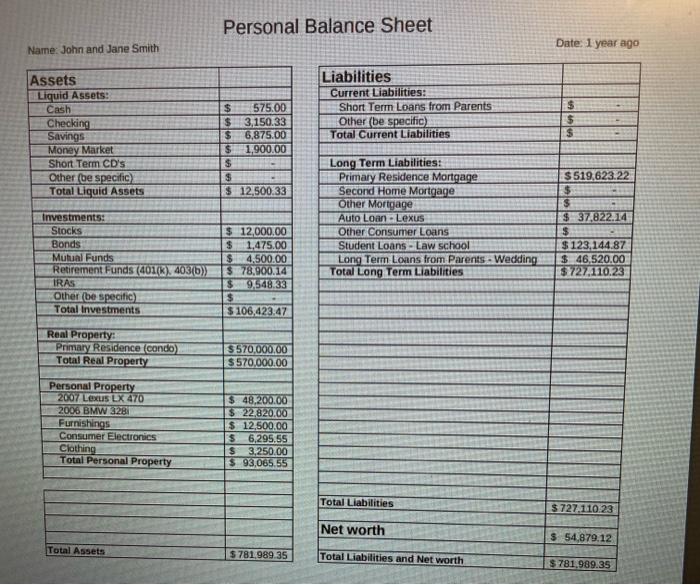

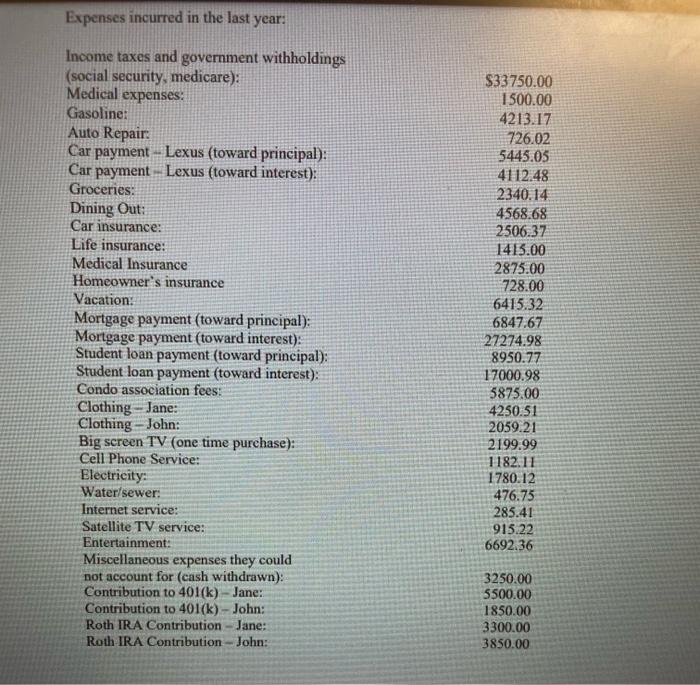

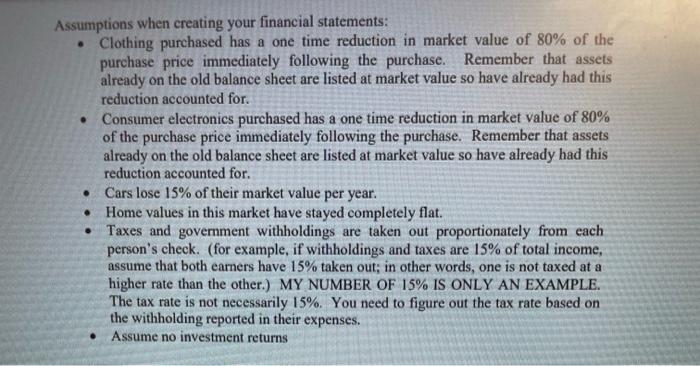

1. Create an income and expense statement based on the information given to you for activity over the last year. Remember, since an I\&E statement reflects past history, this statement should reflect what was going on with Jane working, not what would happen if she quit. Personal Balance Sheet Date: 1 year ago Expenses incurred in the last year: Income taxes and government withholdings (social security, medicare): Medical expenses: Gasoline: Auto Repair: Car payment - Lexus (toward principal): Car payment - Lexus (toward interest): Groceries: Dining Out: Car insurance: Life insurance: Medical Insurance Homeowner's insurance Vacation: Mortgage payment (toward principal): Mortgage payment (toward interest): Student loan payment (toward principal): Student loan payment (toward interest): Condo association fees: Clothing - Jane: Big screen TV (one time purchase): Cell Phone Service: Electricity: Water/sewer: Internet service: Satellite TV service: Entertainment: Miscellaneous expenses they could not account for (cash withdrawn): Contribution to 401(k) - Jane: Contribution to 401(k) - John: Roth IRA Contribution - Jane: Roth IRA Contribution - John: Assumptions when creating your financial statements: - Clothing purchased has a one time reduction in market value of 80% of the purchase price immediately following the purchase. Remember that assets already on the old balance sheet are listed at market value so have already had this reduction accounted for. - Consumer electronics purchased has a one time reduction in market value of 80% of the purchase price immediately following the purchase. Remember that assets already on the old balance sheet are listed at market value so have already had this reduction accounted for. - Cars lose 15% of their market value per year. - Home values in this market have stayed completely flat. - Taxes and government withholdings are taken out proportionately from each person's check. (for example, if withholdings and taxes are 15% of total income, assume that both earners have 15% taken out; in other words, one is not taxed at a higher rate than the other.) MY NUMBER OF 15% IS ONLY AN EXAMPLE. The tax rate is not necessarily 15%. You need to figure out the tax rate based on the withholding reported in their expenses. - Assume no investment returns 1. Create an income and expense statement based on the information given to you for activity over the last year. Remember, since an I\&E statement reflects past history, this statement should reflect what was going on with Jane working, not what would happen if she quit. Personal Balance Sheet Date: 1 year ago Expenses incurred in the last year: Income taxes and government withholdings (social security, medicare): Medical expenses: Gasoline: Auto Repair: Car payment - Lexus (toward principal): Car payment - Lexus (toward interest): Groceries: Dining Out: Car insurance: Life insurance: Medical Insurance Homeowner's insurance Vacation: Mortgage payment (toward principal): Mortgage payment (toward interest): Student loan payment (toward principal): Student loan payment (toward interest): Condo association fees: Clothing - Jane: Big screen TV (one time purchase): Cell Phone Service: Electricity: Water/sewer: Internet service: Satellite TV service: Entertainment: Miscellaneous expenses they could not account for (cash withdrawn): Contribution to 401(k) - Jane: Contribution to 401(k) - John: Roth IRA Contribution - Jane: Roth IRA Contribution - John: Assumptions when creating your financial statements: - Clothing purchased has a one time reduction in market value of 80% of the purchase price immediately following the purchase. Remember that assets already on the old balance sheet are listed at market value so have already had this reduction accounted for. - Consumer electronics purchased has a one time reduction in market value of 80% of the purchase price immediately following the purchase. Remember that assets already on the old balance sheet are listed at market value so have already had this reduction accounted for. - Cars lose 15% of their market value per year. - Home values in this market have stayed completely flat. - Taxes and government withholdings are taken out proportionately from each person's check. (for example, if withholdings and taxes are 15% of total income, assume that both earners have 15% taken out; in other words, one is not taxed at a higher rate than the other.) MY NUMBER OF 15% IS ONLY AN EXAMPLE. The tax rate is not necessarily 15%. You need to figure out the tax rate based on the withholding reported in their expenses. - Assume no investment returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts