Question: please help Current Attempt in Progress Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement

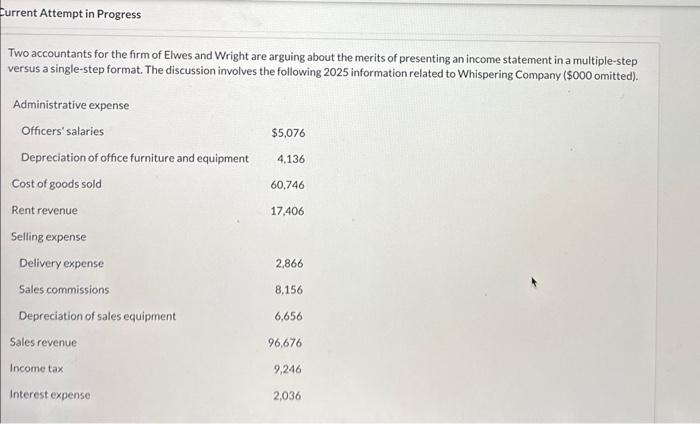

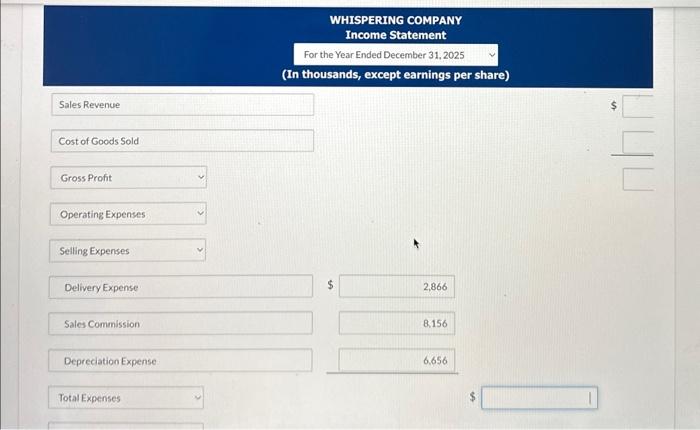

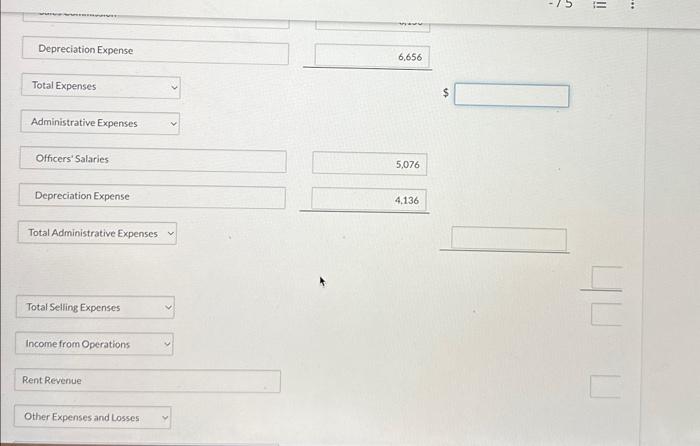

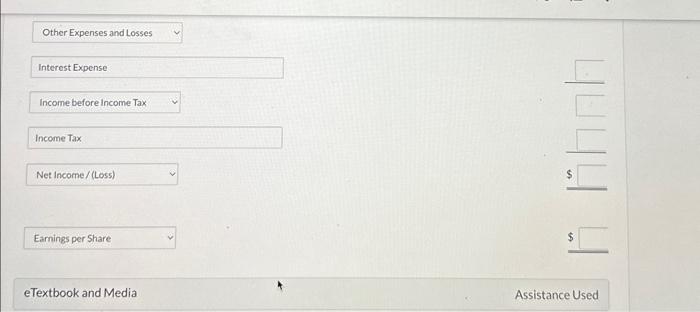

Current Attempt in Progress Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step format. The discussion involves the following 2025 information related to Whispering Company ( $000 omitted). WHISPERING COMPANY Income Statement For the Year Ended December 31, 2025 (In thousands, except earnings per share) Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Delivery Expense $2,866 Sales Commission 8,156 Depreciation Expense Total Expenses Depreciation Expense Total Expenses Administrative Expenses Officers' Salaries Depreciation Expense Total Administrative Expenses Total Selling Expenses Income from Operations Rent Revenue Other Expenses and Losses Interest Expense Income before income Tax Income Tax Net income / (Loss) Earnings per Share eTextbook and Media Assistance Used Current Attempt in Progress Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step format. The discussion involves the following 2025 information related to Whispering Company ( $000 omitted). WHISPERING COMPANY Income Statement For the Year Ended December 31, 2025 (In thousands, except earnings per share) Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Delivery Expense $2,866 Sales Commission 8,156 Depreciation Expense Total Expenses Depreciation Expense Total Expenses Administrative Expenses Officers' Salaries Depreciation Expense Total Administrative Expenses Total Selling Expenses Income from Operations Rent Revenue Other Expenses and Losses Interest Expense Income before income Tax Income Tax Net income / (Loss) Earnings per Share eTextbook and Media Assistance Used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts