Question: please help :( D Question 3 0.06 pts Scoring models, when used to maximize value of a project portfolio, requires the stakeholders to assess the

please help :(

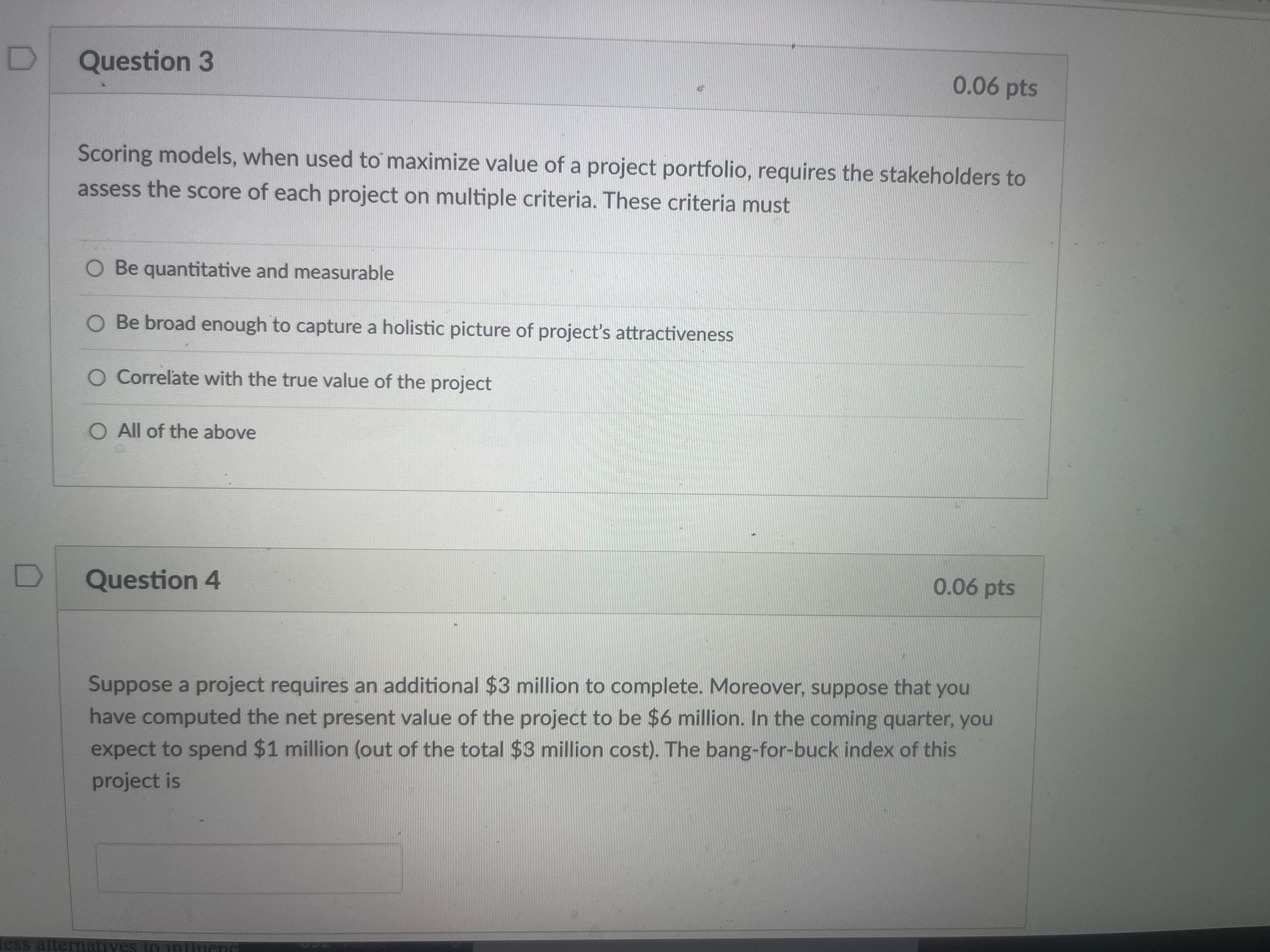

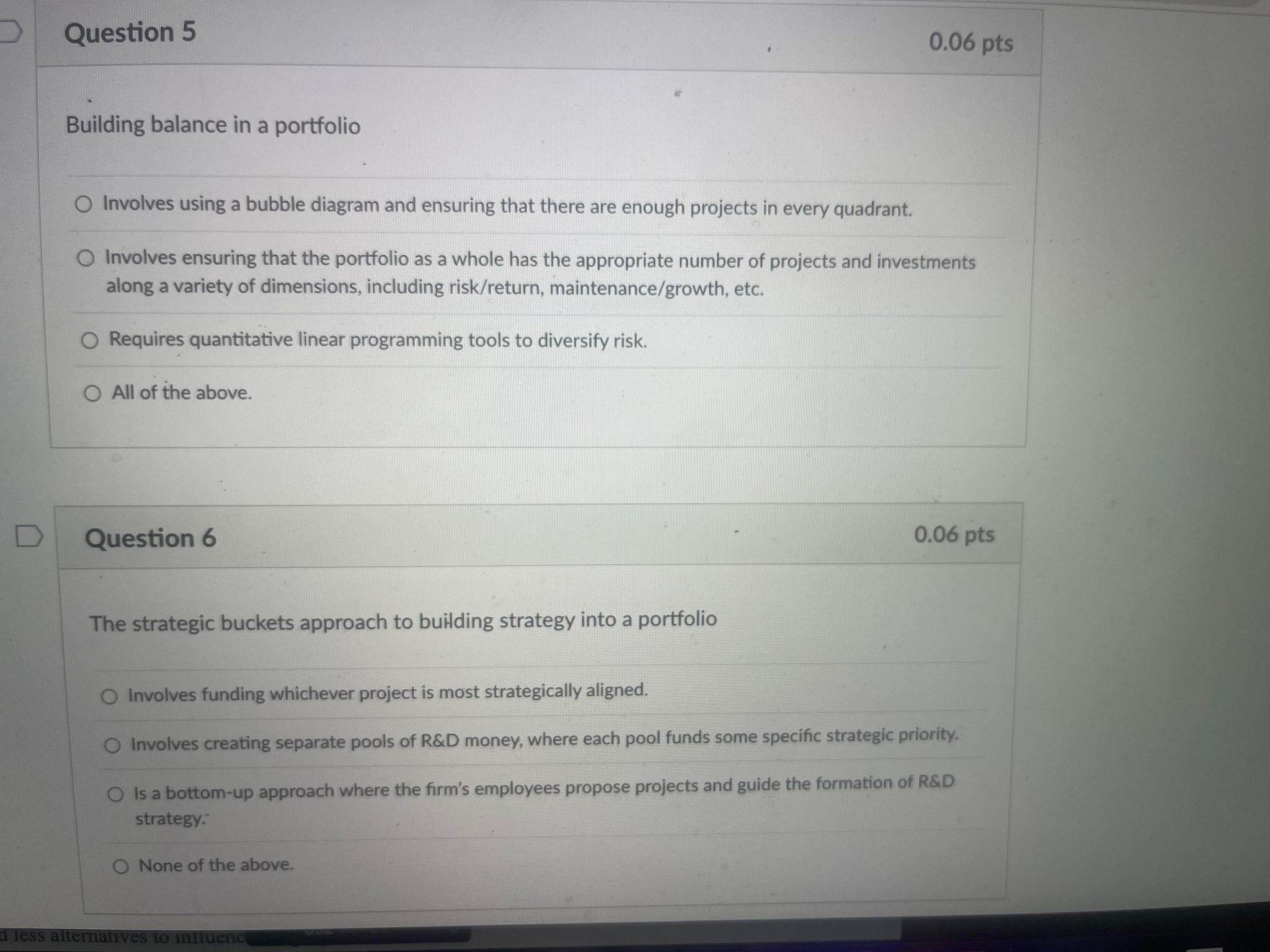

D Question 3 0.06 pts Scoring models, when used to maximize value of a project portfolio, requires the stakeholders to assess the score of each project on multiple criteria. These criteria must O Be quantitative and measurable Be broad enough to capture a holistic picture of project's attractiveness O Correlate with the true value of the project O All of the above D Question 4 0.06 pts Suppose a project requires an additional $3 million to complete. Moreover, suppose that you have computed the net present value of the project to be $6 million. In the coming quarter, you expect to spend $1 million (out of the total $3 million cost). The bang-for-buck index of this project isebook courses/41262/quizzes/115072/take Question 1 0.06 pts Project portfolio management is concerned with O Leveraging learning from one project to enhance the outcome from next Allocation of resources between projects Managing the schedules and scopes of multiple projects O All of the above D Question 2 0.06 pts The three approaches to managing portfolios are O Decrease cost, increase performance, and decrease time. Maximize value, manage balance, and build strategy into the portfolio Manage learning, manage stage-gates, and create and enforce project goals Real options approach, net present value computations, and qualitative judgements D Question 3 0.06 ptsQuestion 5 0.06 pts Building balance in a portfolio O Involves using a bubble diagram and ensuring that there are enough projects in every quadrant. O Involves ensuring that the portfolio as a whole has the appropriate number of projects and investments along a variety of dimensions, including risk/return, maintenance/growth, etc. O Requires quantitative linear programming tools to diversify risk. O All of the above. D Question 6 0.06 pts The strategic buckets approach to building strategy into a portfolio O Involves funding whichever project is most strategically aligned. O Involves creating separate pools of R&D money, where each pool funds some specific strategic priority. Is a bottom-up approach where the firm's employees propose projects and guide the formation of R&D strategy. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts