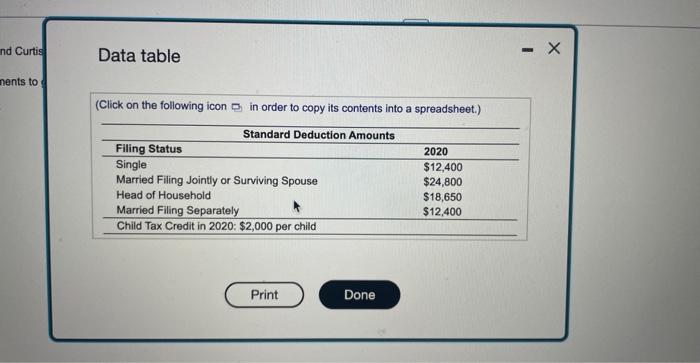

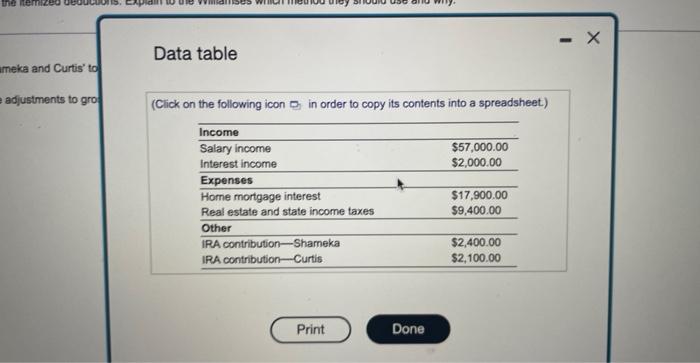

Question: please help Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table imeka and Curtis' to adjustments

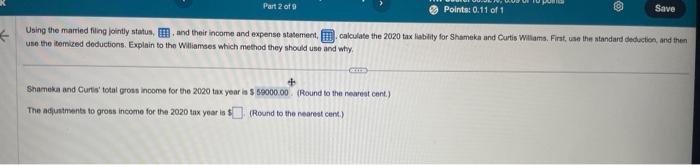

Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table imeka and Curtis' to adjustments to gro (Click on the following icon D in order to copy its contents into a spreadsheet.) Using the married filing lointly status,_ and their income and expense statement, calculate the 2020 tax lability for Shameka and Curtis Wilams. First, use the atandard deduction, and then use the tomiced deductions. Explain to the Wiliamses which method they should uso and why. Shameka and Curts' total gross income for the 2020 tax year is s (Round to the nearest cent.) The agustnsents to gross income for the 2020 tax year is 1 (Round to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table imeka and Curtis' to adjustments to gro (Click on the following icon D in order to copy its contents into a spreadsheet.) Using the married filing lointly status,_ and their income and expense statement, calculate the 2020 tax lability for Shameka and Curtis Wilams. First, use the atandard deduction, and then use the tomiced deductions. Explain to the Wiliamses which method they should uso and why. Shameka and Curts' total gross income for the 2020 tax year is s (Round to the nearest cent.) The agustnsents to gross income for the 2020 tax year is 1 (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts