Question: please help Decai lindustries is analyzing an average-risk project, and the following data have been developed. Onit sales wil be constant, but the sales price

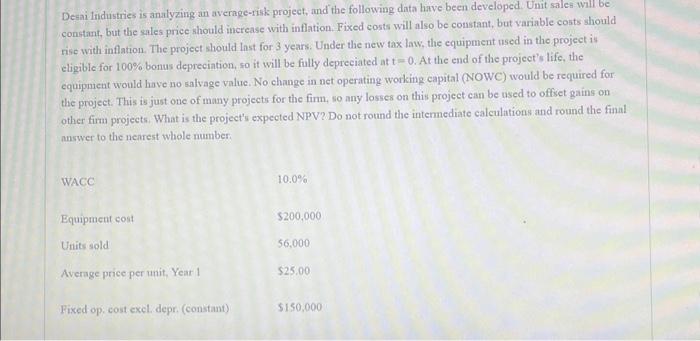

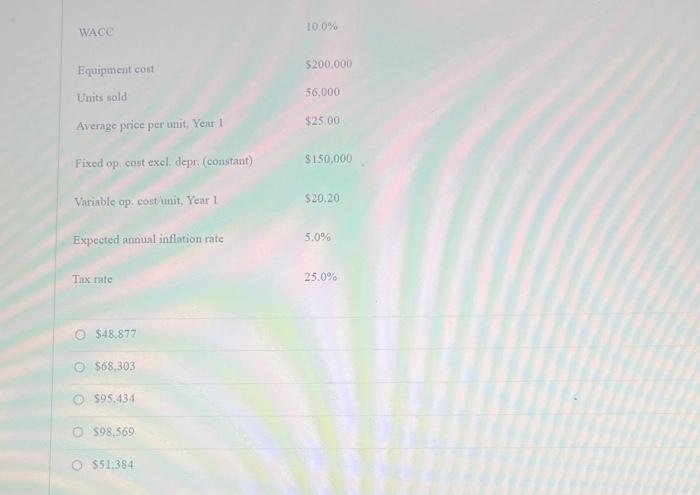

Decai lindustries is analyzing an average-risk project, and the following data have been developed. Onit sales wil be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t=0. At the end of the project's life, the equipment would have no salvage value. No change in net operating working capital (NOWC) would be required for the project. This is just one of many projects for the finm, so any losses on this project can be used to offset gains on other firm projects. What is the project's expected NPV? Do not round the intermediate calculations and round the funal answer to the nemest whole number: $48,877 $68,303 595.434 598.569 $51,384

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts