Question: please help . . Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer

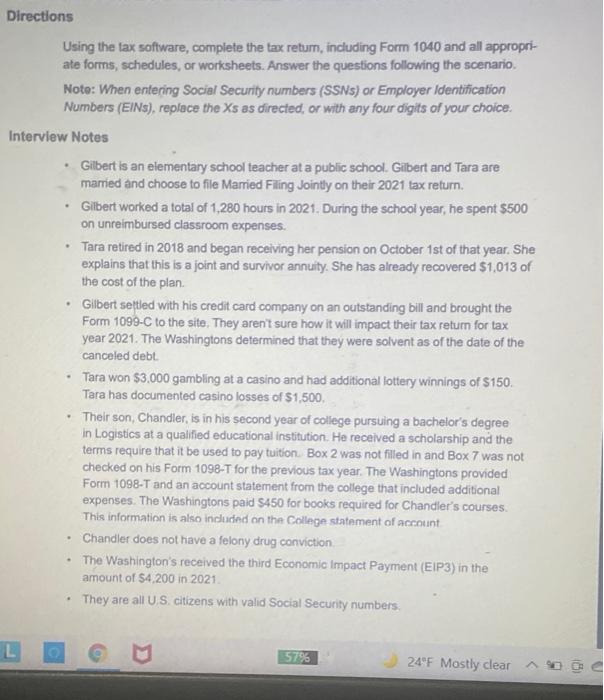

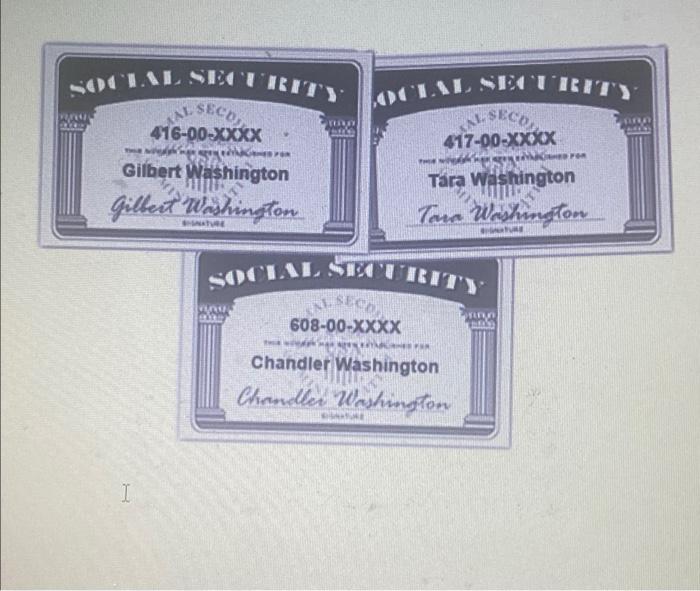

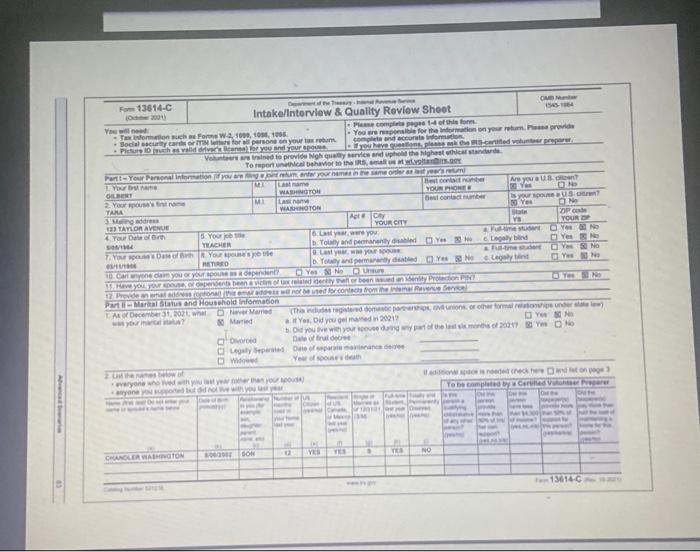

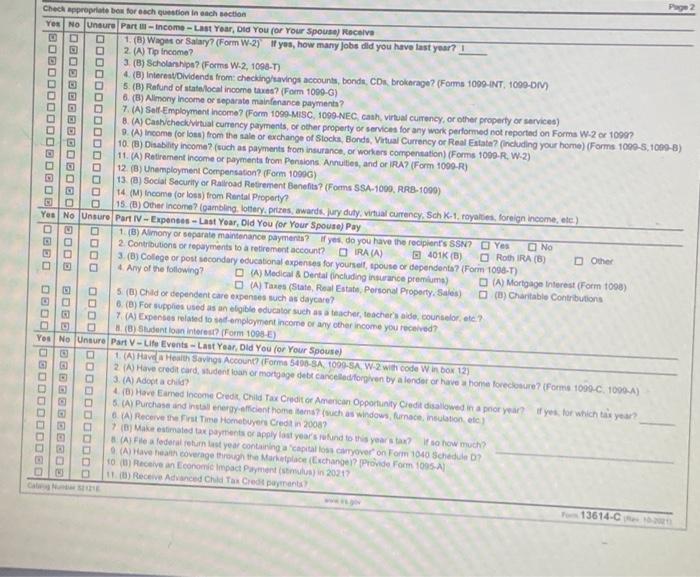

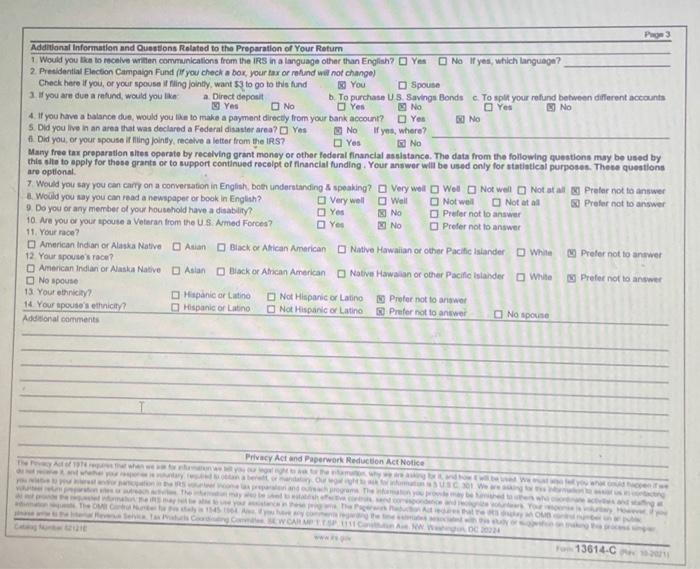

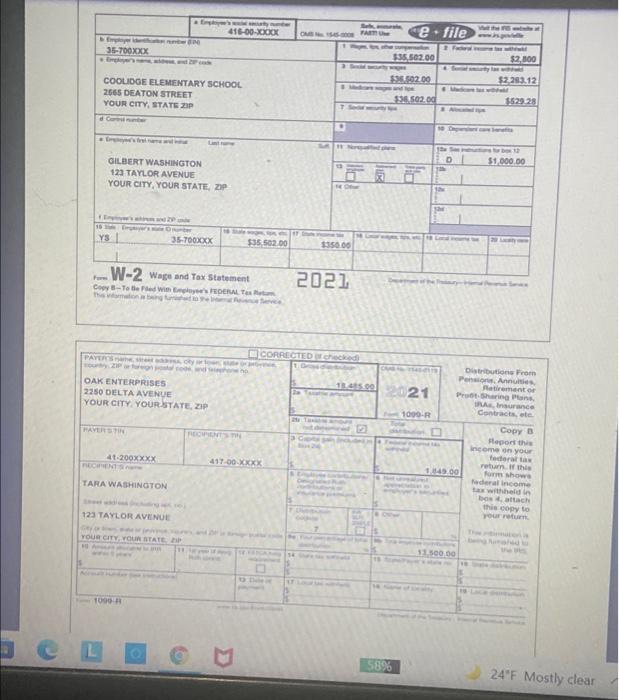

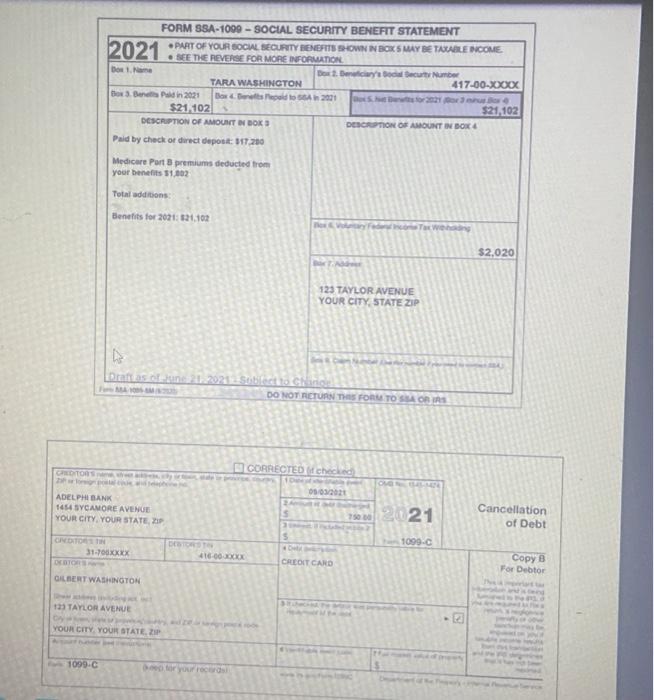

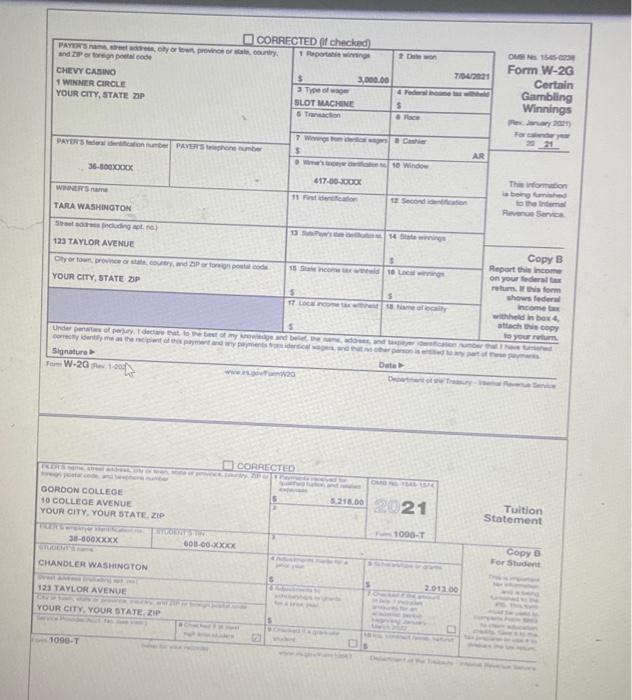

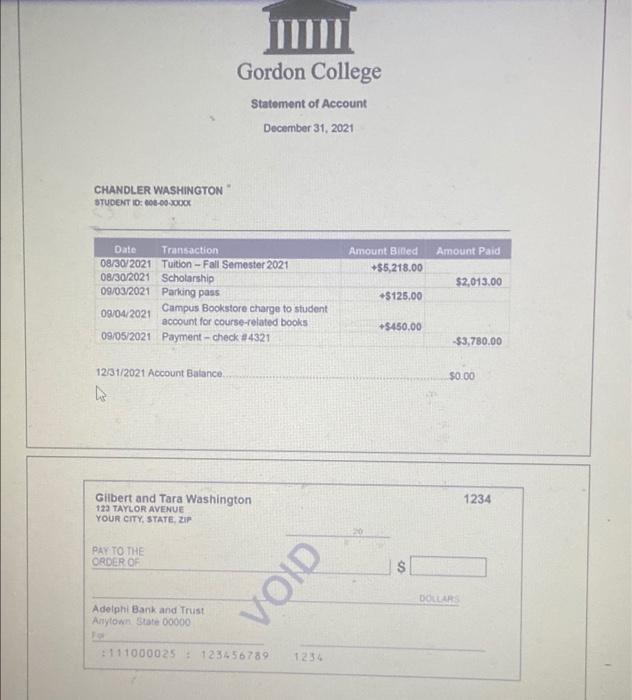

. . Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSNS) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes Gilbert is an elementary school teacher at a public school. Gilbert and Tara are married and choose to file Married Filing Jointly on their 2021 tax return. Gilbert worked a total of 1,280 hours in 2021. During the school year, he spent $500 on unreimbursed classroom expenses. Tara retired in 2018 and began receiving her pension on October 1st of that year. She explains that this is a joint and survivor annuity. She has already recovered $1,013 of the cost of the plan Gilbert settled with his credit card company on an outstanding bill and brought the Form 1099-C to the site. They aren't sure how it will impact their tax return for tax year 2021. The Washingtons determined that they were solvent as of the date of the canceled debt Tara won $3,000 gambling at a casino and had additional lottery winnings of S150. Tara has documented casino losses of $1,500 Their son, Chandler, is in his second year of college pursuing a bachelor's degree in Logistics at a qualified educational institution. He received a scholarship and the terms require that it be used to pay tuition Box 2 was not filled in and Box 7 was not checked on his Form 1098-T for the previous tax year. The Washingtons provided Form 1098-T and an account statement from the college that included additional expenses. The Washingtons paid 5450 for books required for Chandler's courses This information is also included on the College statement of account Chandler does not have a felony drug conviction The Washington's received the third Economic Impact Payment (EIP3) in the amount of $4,200 in 2021 They are all US citizens with valid Social Security numbers. - . L 57% 24F Mostly clear SOCIIL SECURITY AL SECO OCLIL SECURITY NE SECO 416-00-XXXX Gilbert Washington Gilbert Washington 417-00-XXXX SO Tara Washington Tara Washington SOCIAL SECURITY co 608-00-XXXX Chandler Washington Chandler Washington 1 For 13614-C OM Intake/Interview & Quality Review Shoot com 14 of the form - Taxon FormW 2.500,00 You are response for the worn on your provide Social curtyard for person your tahan durante hvad en you and your terrained to provide Nighlarvice and hold the Mighest that standarde To reparateal theari, Part Your Personal information unter your homme You M name Best Are you a US. DET WASHINGTON YOUR HOME Yes 2. You're M La si contact yours TARA WATOTO 30 Yes ON des FC OP TAYLOR AVENUE YOUR CITY YOUR 4. Your Dail 15. Your 6 were you YN TEACHER Tuy and permanent Yes Lind Yes 7 Yer Youtube Law met Yes No RETUD Touard party Yes No Lagay Cartone You YOU pendent Yes No YOU Centender lyden PN 12 db.contrommel Service Parti Martinus and Household Information LA December 31, 2021 www Married (This regard to the tomando You Did you gelmand 2021 Y Old you live in your mother 2017 ON fral Operations Wio To be completed by God TE SON VE TES NO 3 CHANCLER WAGON 13014 Page 2 Check appropriate ben for each question in each section Yes No Unauro Part -Income-Last Year, Did You for Your Spouse) Receive 1. (B) Wings of Salary(Form W-2) If yes, how many jobs did you have last year? 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest Dividends from:checking savings accounts, bonds, CDs brokerage? (Forma 1009-INT, 1000-01) 5. (B) Ratund of state local income to? (Form 1099-G) 6. (B) Alimony income of separate main fenance payment? 7. (A) Self-Employment incoma? (Form 1099-MISC, 1000-NEC, cash, virtual currency, or other property or services) 8. (A) Cash check/virtual currency payments, or other property of services for any work performed not reported on Forma W-2 or 10907 9. (A) Income (or lon) from the sale or exchange of Stocks, Bonds, Virtual Currency or Real Estate (including your home) (Forms 1000-5,1089-8) 10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms 1000-R, W-2) 11. (A) Retirement income or payments from Pensions Annuites and or IRA? (Form 1009-R) 12. (B) Unemployment Compensation? (Form 1090G) 13. (B) Social Security or Railroad Retirement Benefits? (Forms SSA-1000, RRB-1000) 14. (M) Income (or loss) from Rental Property 15 (6) Other income? (gambling lotterypets, awards jy duty walcurrency. Sch k 1. royalties foreign income, ale) Yes No Unsur Part IV-Expenses-Last Year Old You for Your Spouse) Pay 1. (B) Alimony or separate maintenance payments? If yes, do you have the recipients SSN? Yes No 2 Contributions of payments to a retirement account? RA (A) 401K (0) O Roth IRA (6) Other 3. (B) College or post secondary educational expenses for yourself spouse or dependenta? (Form 1096-T) 4. Any of the following? A) Medical & Dental (including insurance premium) DA) Mortgage Interest (Form 1098) O AT (State Real Estate, Personal Property Sales) (B) Charitable contributions 5 (B) Child or dependent care expenses such as daycare? 6. (B) For supplies used as an eligible education such as a teacher teacher's courte? 7. (Expenses related to employment income or any other income you received? (B) Student loan interest? (Form 1095) You No Unsur Party - Life Events - Last Year, Did You for Your Spouse) 0 1. (AHave Health Savings Account Forms 5000 SA 1090-SA W-2 with code WI DO 12) 2) Have credit card, toon or mortgage de canceledforgiven by alender or have a home foreclosure? (Forme 1099-C, 1090-A) 3. (A) Adopt a child 2 (0) Have Earned Income Credit Chi Tax Credit of American Opportunity Credit disallowed in a poor year? if yes, for which tax year? 5. (A) Purchase and legyent home such as windows fumacente 6. A) Receive the First Time Homebuyers Creditin 2008 7 (0) Makestimated to payments or apply for years and to this year's tax to how much? e federal rust year containing to carryover on Form 1040 Sched? (A) Have a coverage through place Exchange Provide Form 1005 10 () Receive an Economic impad Payment) 20217 11.16) Receive Advanced Child Tax Credit payment CHE 13614-C ODD001 OOOOOO 0000OCOBOGBO OOOOEDG000 DDOGOGO23000 BOLE? GOGOGOEGDE 10000 ODOO ODOO 00000000000 Po 3 Additional Information and Questions Related to the Preparation of Your Retur 1 Would you like to move written communications from the IRS in a language other than English? Yes No If yes, which language? 2. Presidential Election Campaign Fund (you check a box your tax or refund will not change) Check here if you, or your spouse ling Jointly, want 53 to go to this fund You Spouse 3. you are due a refund, would you like a Direct deposit . To purchase US. Savings Bonds To split your refund between different accounts Yes No Yes No Yes No 4. If you have a balance due, would you like to make a payment directly from your bank account? Yes NO 5. Did you live in an area that was declared a Federal disaster area? Yes No If yes, where? 6 Did you or your spouse if ing Jointly receive a letter from the IRS? Yos No Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for those grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional 7. Would you say you can carry on a conversation in English, both understanding & speaking? Very well Wol Not weil Notatal Prefer not to answer Would you say you can read a newspaper or book in English? Very well Well Not well Not at all 9. Do you or any member of your household have a disability O Prefer not to answer Yes No Prefer not to answer 10. Ne you or your spouse a Veteran from the US Armed Forces? Yes No Prefer not to answer 11. Your race? American Indian or Alaska Native Atan Black or African American Native Hawaian or other Pacific Islander White Prefer not to an 12 Your spouse's race? anawer American Indian or Alaska Native Asian Black or Ancan American Native Hawalan or other Pacific Islander White Prefer not to answer No spouse 13 Your ethnicity Hispanic or Latino Not Hispanic or Latino I Prefer not to ariewet 14. Your spouse's ethnicity? Hispanic or Latino Not Hispanic or Latino S Prefer not to answer No spouse Additional comments Privacy Act and Paperwork Reduction Act Notice RS We TOO 11 OU WARMTEC 13614-C 416-00-00 OM TA de . file 35-700XOCX 5:35.502.00 $2.000 $35.502.00 $2.28.3.12 COOLIDGE ELEMENTARY SCHOOL 2665 DEATON STREET YOUR CITY, STATS ZIP . 25.502.00 1529.28 . DI 51.000.00 GILBERT WASHINGTON 123 TAYLOR AVENUE YOUR CITY YOUR STATE, ZIP 101 YS 35-700CXX $35.502.00 350.00 W-2 Wage and Tax Statement 2021 Cowy - To Be WinPEDERAL PAVERSE CORRECTED checked OAK ENTERPRISES 2250 DELTA AVENUE YOUR CITY YOUR STATE ZIP 11.415.00 PAVERS Distributions From Penso Annus Hamonto 21 PetShare Plans rance Contracte 1000-R Copy o Report this income you fecerata return the 149.00 um show federal income tax with be attache this copy to 41.200XXXX 417-00-XXX TARA WASHINGTON 123 TAYLOR AVENUE YOUR CITY YOUR STATE 115000 1090 L 58% 24F Mostly clear 2021 FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TALABLE INCOME . SEE THE REVERSE FOR MORE INFORMATION Dosta Domenica a curt Mumber TARA WASHINGTON 417.00.00 Box Band in 2021 Boxed 2001 Dohor $21 102 $21,102 DESCRIPTION OF AMOUNT IN BOK3 DESCONO AMOUNT IN BOX & Paid by check or direct deposit 117.00 Medicare Part 3 premium deducted from your benefits 11.002 Total additions Benefits for 2021: 21.102 $2,020 123 TAYLOR AVENUE YOUR CITY STATE ZIP Danas 220212 Sobiect CH DO NOT RETURN TO FORM TO SAOR IRS CHOTOS CORRECTEDM checked 09032021 ADELPHI BANK 1454 SYCAMORE AVENUE YOUR CITY YOUR STATE, 7221 Cancellation of Debt 1099.c COTON 31-700XXXX DOORS CLBERT WASHINGTON 416.00 XXX CREDIT CARD Copy B For Debtor TAYLOR AVENUE CA YOUR CITY YOUR STATE 1099.c or record CORRECTED I checked powing PAYS and store plade CHEVY CASINO 1 WINNER CIRCLE YOUR CITY, STATE ZIP $ 3.000.00 3 Type of SLOT MACHINE Transaction OM 10 Form W-2G Certain Gambling Winnings 2001 5 PAYEN'S PAVERS 21 7 WC $ 10 Window AR 36-300XDOCK 417.00-2000 This mon WERS TAMLA WASHINGTON 11 Foto othermal ve Service 123 TAYLOR AVENUE Cartoon Porno YOUR CITY STATE 2 15 S1 L 5 Copy B Report this income on your federal return form who feder Income withheld is box ch your Under proceed Signature W-2000 Date 20 CORRECTED OORDON COLLEGE 10 COLLEGE AVENUE YOUR CITY, YOUR STATE, ZIP 5.218.00 2021 Tuition Statement 35-600XXXX 1000-T 608-00- Copy For Stadt CHANDLER WASHINGTON 5 133 TAYLOR AVENUE YOUR CITY. YOUR STATE 2 1090-T Gordon College Statement of Account December 31, 2021 CHANDLER WASHINGTON STUDENT 10:00-00-00 Amount Paid Amount Billed $5,218.00 $2,013.00 Date Transaction 08/30/2021 Tuition - Fall Semester 2021 08/30/2021 Scholarship 09/03/2021 Parking pass 09/04/2021 Campus Bookstore charge to student account for course-related books 09/05/2021 Payment -check $4321 $125.00 +$450,00 -$3,780.00 12/31/2021 Account Balance $0.00 1234 Gilbert and Tara Washington 123 TAYLOR AVENUE YOUR CITY STATE, 2P PAY TO THE ORDER OF $ VOID DOLLAR Adelphi Bank and Trust Anytown State 00000 111000025 123456789 1234 16. Tara's taxable social security income is $ (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 17. Gambling winnings and canceled debt are reported as other income on the Washington's Form 1040, Schedule 1. O True O False 18. Gilbert is eligible to claim $ Schedule 1. as qualified educator expenses on Form 1040, (Do not enter dollar signs, commas, periods, or decimal points in your answer.) [1] Back Next Skin Cirnton

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts