Question: please help Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. The Dried Fruit Corp. stock

please help

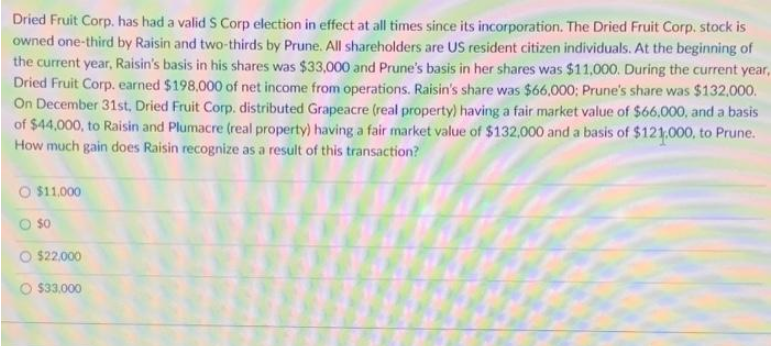

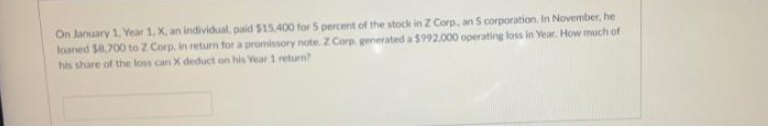

Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. The Dried Fruit Corp. stock is owned one-third by Raisin and two-thirds by Prune. All shareholders are US resident citizen individuals. At the beginning of the current year, Raisin's basis in his shares was $33,000 and Prune's basis in her shares was $11,000. During the current year, Dried Fruit Corp. earned $198,000 of net income from operations. Raisin's share was $66,000; Prune's share was $132,000. On December 31st, Dried Fruit Corp. distributed Grapeacre (real property) having a fair market value of $66.000, and a basis of $44,000, to Raisin and Plumacre (real property) having a fair market value of $132,000 and a basis of $121:000, to Prune. How much gain does Raisin recognize as a result of this transaction? O $11,000 O $22,000 $33,000On January 1. Year 1, X, an individual, paid $15,400 for 5 percent of the stock in Z Corp, an 5 corporation, In November, he loaned $8,700 to Z Corp. In return for a promissory note. Z Corp. generated a $992,000 operating loss in Year. How much of his share of the loss can * deduct on his Year 1 return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts