Question: please help due in 1 hour!!!! Panel A Initial Balance Sheets. The FOMC has instructed the FRBNY Trading Desk to purchase $500 million in U.S.

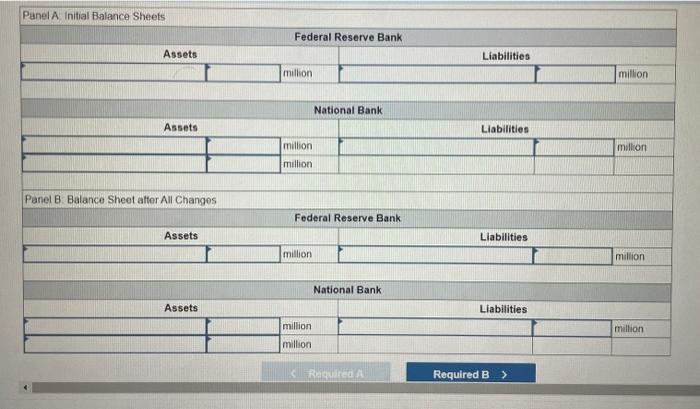

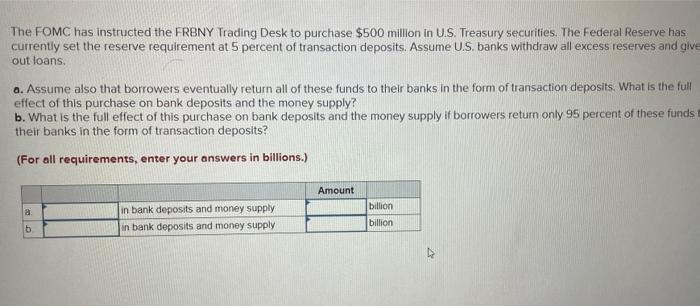

Panel A Initial Balance Sheets. The FOMC has instructed the FRBNY Trading Desk to purchase $500 million in U.S. Treasury securities. The Federal Reserve has currently set the reserve requirement at 5 percent of transaction deposits. Assume U.S. banks withdraw all excess reserves and give out loans, a. Assume also that borrowers eventually return all of these funds to their banks in the form of transaction deposits. What is the full effect of this purchase on bank deposits and the money supply? b. What is the full effect of this purchase on bank deposits and the money supply if borrowers return only 95 percent of these funds their banks in the form of transaction deposits? (For all requirements, enter your answers in billions.) Panel A Initial Balance Sheets. The FOMC has instructed the FRBNY Trading Desk to purchase $500 million in U.S. Treasury securities. The Federal Reserve has currently set the reserve requirement at 5 percent of transaction deposits. Assume U.S. banks withdraw all excess reserves and give out loans, a. Assume also that borrowers eventually return all of these funds to their banks in the form of transaction deposits. What is the full effect of this purchase on bank deposits and the money supply? b. What is the full effect of this purchase on bank deposits and the money supply if borrowers return only 95 percent of these funds their banks in the form of transaction deposits? (For all requirements, enter your answers in billions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts