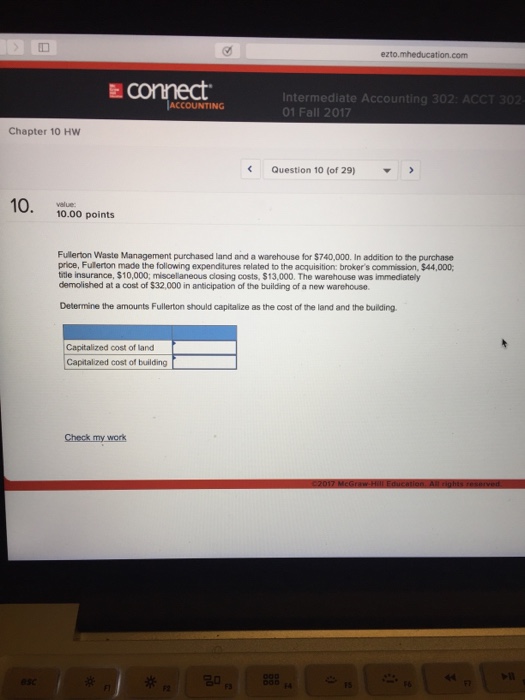

Question: Please help due tomorrow e connect Intermediate Accounting 302: ACCT 3 CCOUNTING Chapter 10 HW Question 10 (of 29) 10.00 points Fullerton Waste Management purchased

e connect Intermediate Accounting 302: ACCT 3 CCOUNTING Chapter 10 HW Question 10 (of 29) 10.00 points Fullerton Waste Management purchased land and a warehouse for $740,000. In addition to the purchase price, Fulerton made the following expenditures related to the acquisition: broker's commission, $44,000; tile insurance, $10,000 miscellaneous closing costs, $13,000. The warehouse was immediately demolished at a cost of $32,000 in anticipation of the building of a new warehouse. Determine the amounts Fullerton should capitalize as the cost of the land and the building Capitalized cost of land Capitalized cost of building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts