Question: PLEASE HELP E ANSWER ALL THE QUESTIONS. PLEASE Use the Capital Budgeting ideas discussed in class so far to prepare a capital budgeting plan for

PLEASE HELP E ANSWER ALL THE QUESTIONS. PLEASE

Use the Capital Budgeting ideas discussed in class so far to prepare a capital budgeting plan for buying a house. You estimate the space needed for you and your family to live in. This is the space that is definitely needed and you do not want to settle for a smaller space at the moment. With the estimated space required in mind, you look at potential buying and renting opportunities. You find a suitable buying opportunity and a suitable renting opportunity. These opportunities are mutually exclusive. Hence, you need to pick one of the two projects. To decide, you use the NPV ideas and Capital budgeting ideas from AF620. The goal of this assignment is to arrive at the NPV of buying a house. For convenience, assume that it is December 31, 2022 and you will need to take this decision tonight and all money transfers, legal documentation happens overnight. In other words, if you decide to buy the house, you can move in tomorrow. Same with renting.

The following information is available to make this decision:

A. House Price: $600,000

B. You are ready to make the down-payment of 20% of the price and if you decide to buy the house, the money can be transferred instantly and ownership acquired instantly. You will need to borrow the rest of the price i.e. take a loan for 80% of $600,000 if you decide to buy the house. If you choose, not to buy the house, the money that you have can be invested to create a 30-year annuity that has a 1.5% APR and compounds monthly and pays monthly. The 1.5% APR is also the discount rate you can use for the finding PVs in this exercise.

C. 30-year Mortgage loans available at 4% APR Fixed with monthly payments expected. Fixed means that your interest rate will not change. For simplicity, assume that there will be no refinance opportunities to lower your rates.

D. Other expenses include Real estate tax, HOA and other sundry items expected to be assessed at 2% of the value of the house. These annual expenses will be paid on a monthly basis. For example, if at the beginning of 2025 (end of 2024), your house has a book value of $500,000, then your Other Monthly expenses for each month of 2025 will be (2% X $500,000)/12

E. Depreciation using straight line method. Use the time period of 27.5 years for the straight-line method

F. If you do not buy the house, you will have to rent. The current rent for the rental opportunity is $2,500 per month and changes based on inflation. Right now, the expected inflation over the next 30 years is expected to be about 2.3% per year. This means that if you rent, then for each month of 2023, you will pay $2,500. Then, for each month of 2024, you will 2.3% more than the rental price of 2023. Then, for each month of 2025, you will pay 2.3% more than the rental price of 2024, and so on.

G. If you buy the house, you will need to do regular repairs. You estimate that at the end of every year, you will need to some expenditure (analogous to CAPEX). This expense is estimated to be 1.4% of the house price of $600,000 for the first year and then expected to rise at the inflation rate (2.3%). This capex adds to the book value of the house.

H. At the end of the 30 years, you plan to sell the house. For now, assume that you will be able to sell it at the book value of the house at the end of 30 years. We will later consider other values (salvage value, expected market price etc) I. Your family income (from jobs or other sources) will be sufficient to pay the monthly payments irrespective of your choice of renting or borrowing. You still want to pick the choice that saves money.

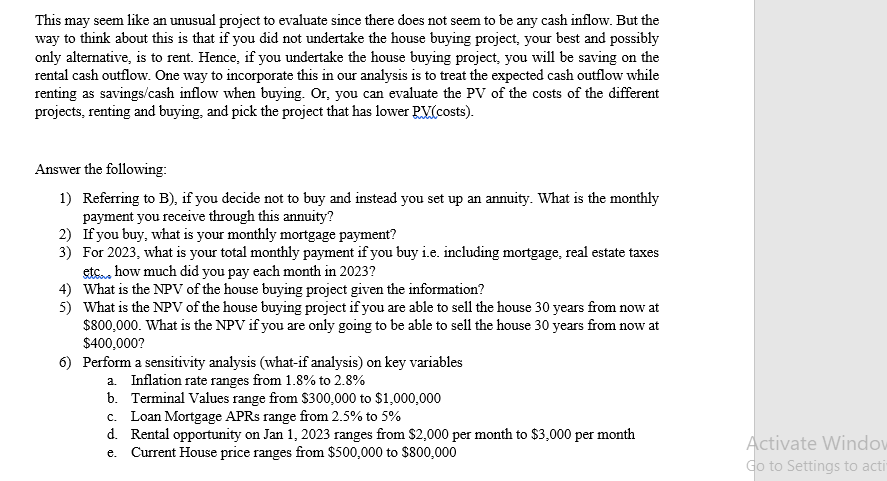

This may seem like an unusual project to evaluate since there does not seem to be any cash inflow. But the way to think about this is that if you did not undertake the house buying project, your best and possibly only alternative, is to rent. Hence, if you undertake the house buying project, you will be saving on the rental cash outflow. One way to incorporate this in our analysis is to treat the expected cash outflow while renting as savings/cash inflow when buying. Or, you can evaluate the PV of the costs of the different projects, renting and buying, and pick the project that has lower PV(costs). Answer the following: 1) Referring to B), if you decide not to buy and instead you set up an annuity. What is the monthly payment you receive through this annuity? 2) If you buy, what is your monthly mortgage payment? 3) For 2023, what is your total monthly payment if you buy i.e. including mortgage, real estate taxes etso how much did you pay each month in 2023? 4) What is the NPV of the house buying project given the information? 5) What is the NPV of the house buying project if you are able to sell the house 30 years from now at $800,000. What is the NPV if you are only going to be able to sell the house 30 years from now at $400,000? 6) Perform a sensitivity analysis (what-if analysis) on key variables a. Inflation rate ranges from 1.8% to 2.8% b. Terminal Values range from $300,000 to $1,000,000 C. Loan Mortgage APRs range from 2.5% to 5% d. Rental opportunity on Jan 1, 2023 ranges from $2,000 per month to $3,000 per month e. Current House price ranges from $500,000 to $800,000 a Activate Window Go to Settings to acti This may seem like an unusual project to evaluate since there does not seem to be any cash inflow. But the way to think about this is that if you did not undertake the house buying project, your best and possibly only alternative, is to rent. Hence, if you undertake the house buying project, you will be saving on the rental cash outflow. One way to incorporate this in our analysis is to treat the expected cash outflow while renting as savings/cash inflow when buying. Or, you can evaluate the PV of the costs of the different projects, renting and buying, and pick the project that has lower PV(costs). Answer the following: 1) Referring to B), if you decide not to buy and instead you set up an annuity. What is the monthly payment you receive through this annuity? 2) If you buy, what is your monthly mortgage payment? 3) For 2023, what is your total monthly payment if you buy i.e. including mortgage, real estate taxes etso how much did you pay each month in 2023? 4) What is the NPV of the house buying project given the information? 5) What is the NPV of the house buying project if you are able to sell the house 30 years from now at $800,000. What is the NPV if you are only going to be able to sell the house 30 years from now at $400,000? 6) Perform a sensitivity analysis (what-if analysis) on key variables a. Inflation rate ranges from 1.8% to 2.8% b. Terminal Values range from $300,000 to $1,000,000 C. Loan Mortgage APRs range from 2.5% to 5% d. Rental opportunity on Jan 1, 2023 ranges from $2,000 per month to $3,000 per month e. Current House price ranges from $500,000 to $800,000 a Activate Window Go to Settings to acti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts