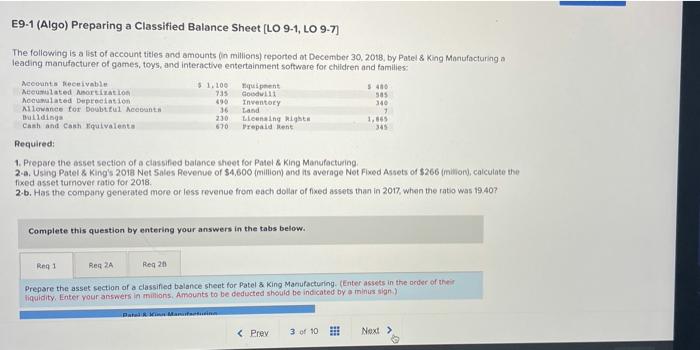

Question: please HELP!!!! E9-1 (Algo) Preparing a Classified Balance Sheet (LO 9-1, LO 9-7) The following is a list of account titles and amounts (in millions)

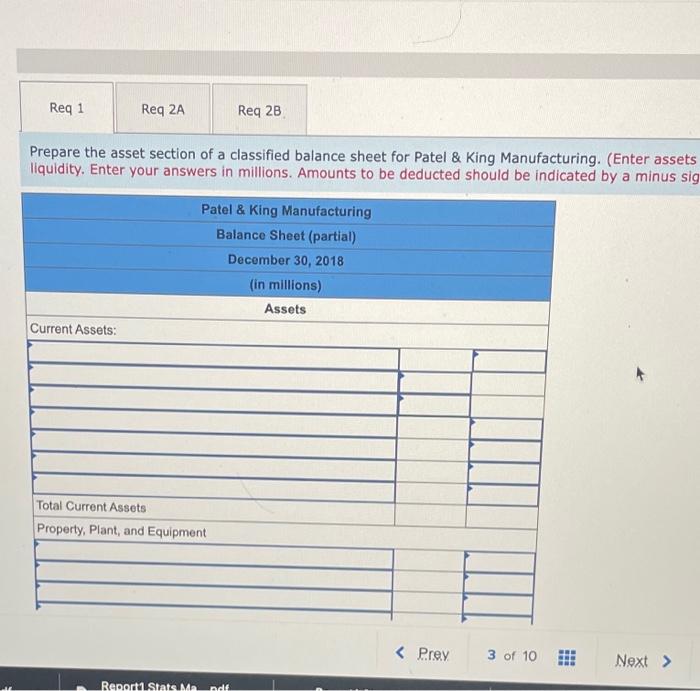

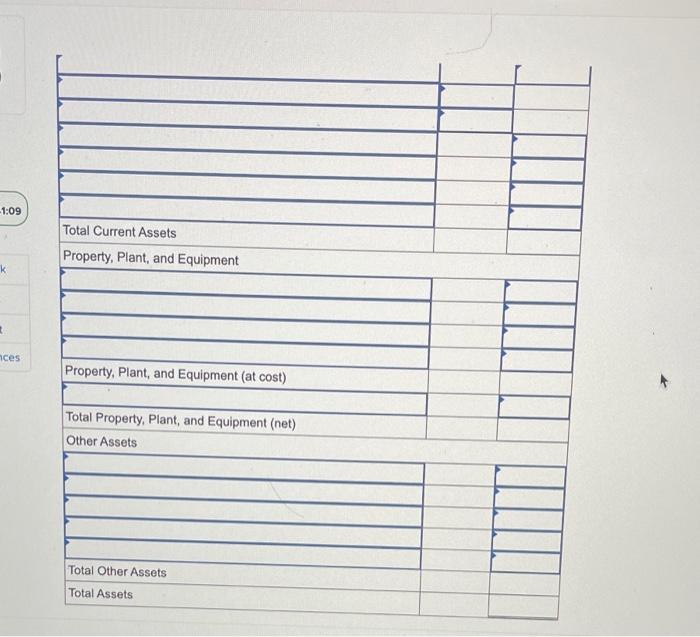

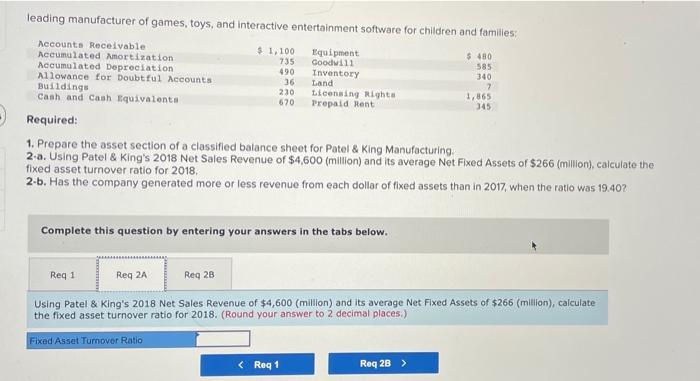

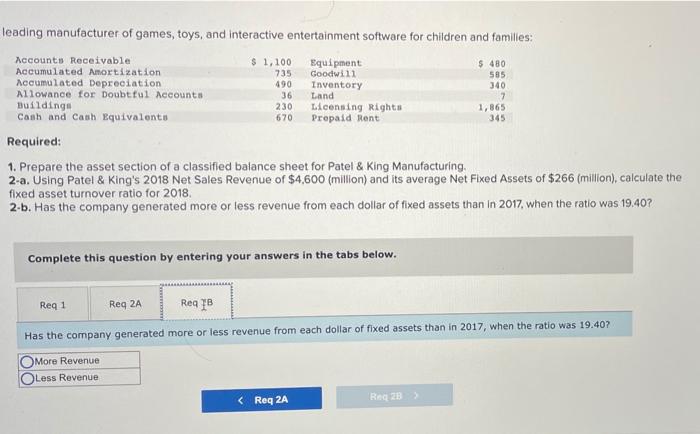

E9-1 (Algo) Preparing a Classified Balance Sheet (LO 9-1, LO 9-7) The following is a list of account titles and amounts (in millions) reported at December 30, 2018, by Patel & King Manufacturing leading manufacturer of games, toys, and interactive entertainment software for children and families: Accounts Receivable 5 1.100 quent Acoustilated Anortation 735 Goodwill 585 Noclated Depreciation 490 Inventory 340 Allowance for boubitul Account 36 Land 1 Bulding 230 Licensing Rights 1.865 Cash and Cash Equivalents 670 Prepaid Rent 345 Required: 1. Prepare the asset section of a classified balance sheet for Patel & King Manufacturing 2.0. Using Potel & King's 2018 Net Sales Revenue of $4,600 million) and its average Not Fixed Assets of $266 (mitor), calculate the fixed asset turnover ratio for 2018 2.b. Has the company generated more or less revenue from each dollar of twed assets than in 2017, when the ratio was 19.407 Complete this question by entering your answers in the tabs below. Reg1 Reg 2 Reg 20 Prepare the asset section of a classified balance sheet for Patel & King Manufacturing (Enter assets in the order of the liquidity. Enter your answers in millions. Amounts to be deducted should be indicated by a minussion) Parai Req 1 Req 2A Req 2B Prepare the asset section of a classified balance sheet for Patel & King Manufacturing. (Enter assets liquidity. Enter your answers in millions. Amounts to be deducted should be indicated by a minus sig Patel & King Manufacturing Balance Sheet (partial) December 30, 2018 (in millions) Assets Current Assets: Total Current Assets Property, Plant, and Equipment Report1.Stats Ma adt -1:09 Total Current Assets Property, Plant, and Equipment K nces Property, Plant, and Equipment (at cost) Total Property, Plant, and Equipment (net) Other Assets Total Other Assets Total Assets leading manufacturer of games, toys, and interactive entertainment software for children and familles: Accounts Receivable $1,100 Equipment Accumulated Amortization $ 480 735 Goodwill 585 Accumulated Depreciation 490 Inventory 340 Allowance for Doubtful Accounts 36 Land 7 Buildings 230 Licensing Rights 1,865 Cash and Cash Equivalent 670 Prepaid Rent 345 Required: 1. Prepare the asset section of a classified balance sheet for Patel & King Manufacturing 2-a. Using Patel & King's 2018 Net Sales Revenue of $4,600 (million) and its average Net Fixed Assets of $266 (million), calculate the fixed asset turnover ratio for 2018, 2-b. Has the company generated more or less revenue from each dollar of fixed assets than in 2017, when the ratio was 19.402 Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 28 Using Patel & King's 2018 Net Sales Revenue of $4,600 (million) and its average Net Fixed Assets of $266 million), calculate the fixed asset turnover ratio for 2018. (Round your answer to 2 decimal places) Fixed Asset Turnover Ratio leading manufacturer of games, toys, and interactive entertainment software for children and familles: Accounts Receivable Accumulated Amortization Accumulated Depreciation Allowance for Doubtful Accounts Building Cash and Cash Equivalents $1,100 735 490 36 230 670 Equipment Goodwill Inventory Land Licensing Rights Prepaid Rent $ 480 585 340 7 1,865 345 Required: 1. Prepare the asset section of a classified balance sheet for Patel & King Manufacturing 2-a. Using Patel & King's 2018 Net Sales Revenue of $4,600 million) and its average Net Fixed Assets of $266 (million), calculate the fixed asset turnover ratio for 2018 2-b. Has the company generated more or less revenue from each dollar of fixed assets than in 2017, when the ratio was 19.40? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 18 Has the company generated more or less revenue from each dollar of fixed assets than in 2017, when the ratio was 19.40 More Revenue Less Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts