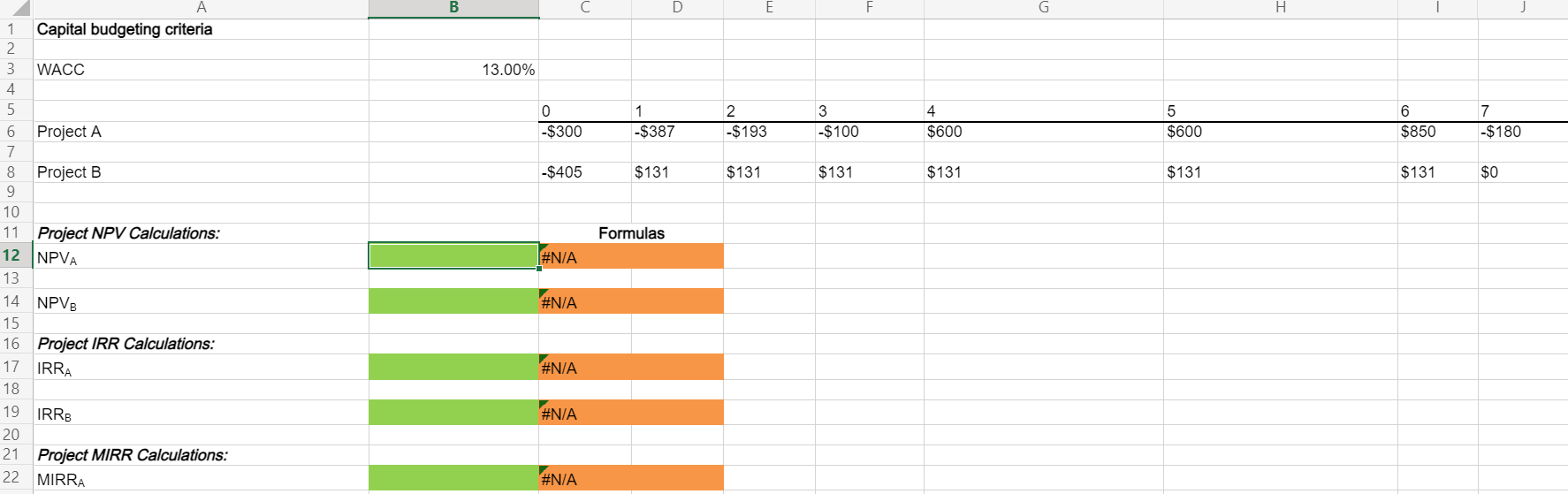

Question: ***********************PLEASE HELP ESPECIALLY PART E, F, AND G*************************** B C D E G H 13.00% 5 0 -$300 1 -$387 2 -$193 3 $100 4

***********************PLEASE HELP ESPECIALLY PART E, F, AND G***************************

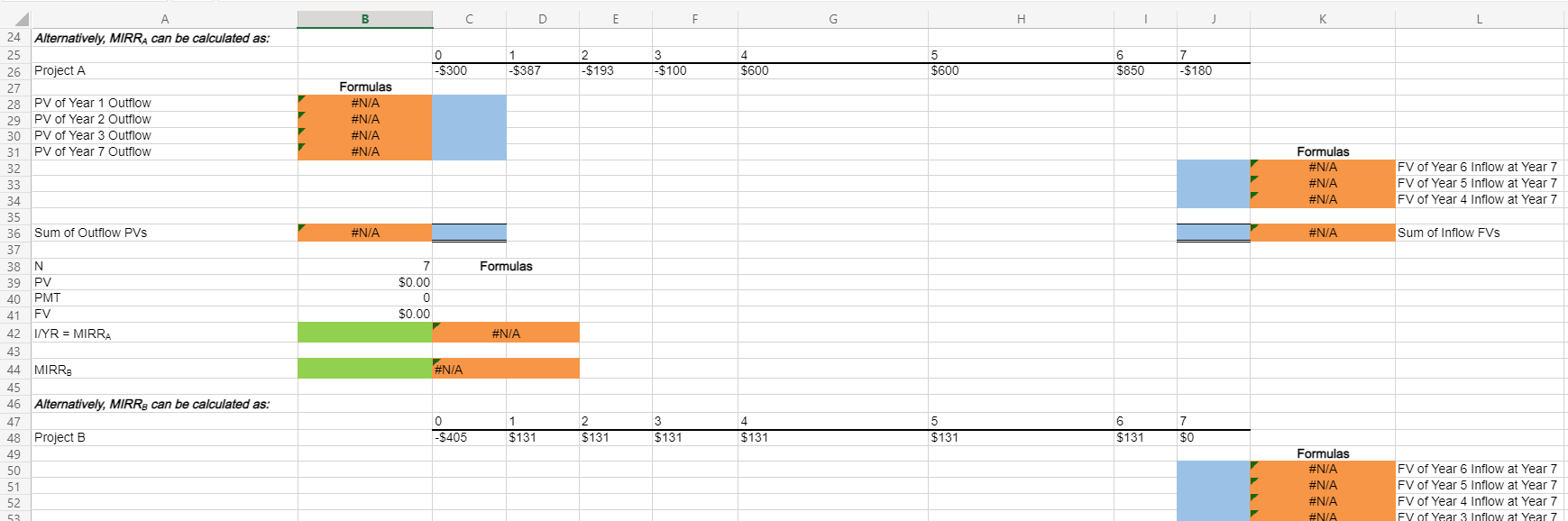

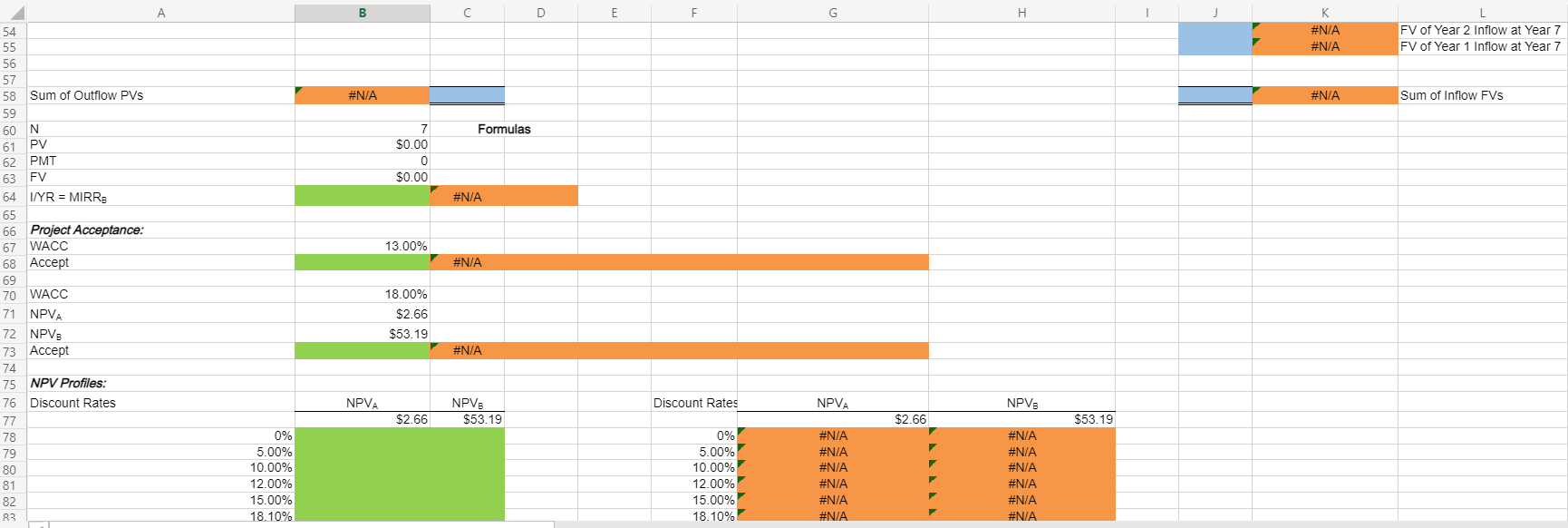

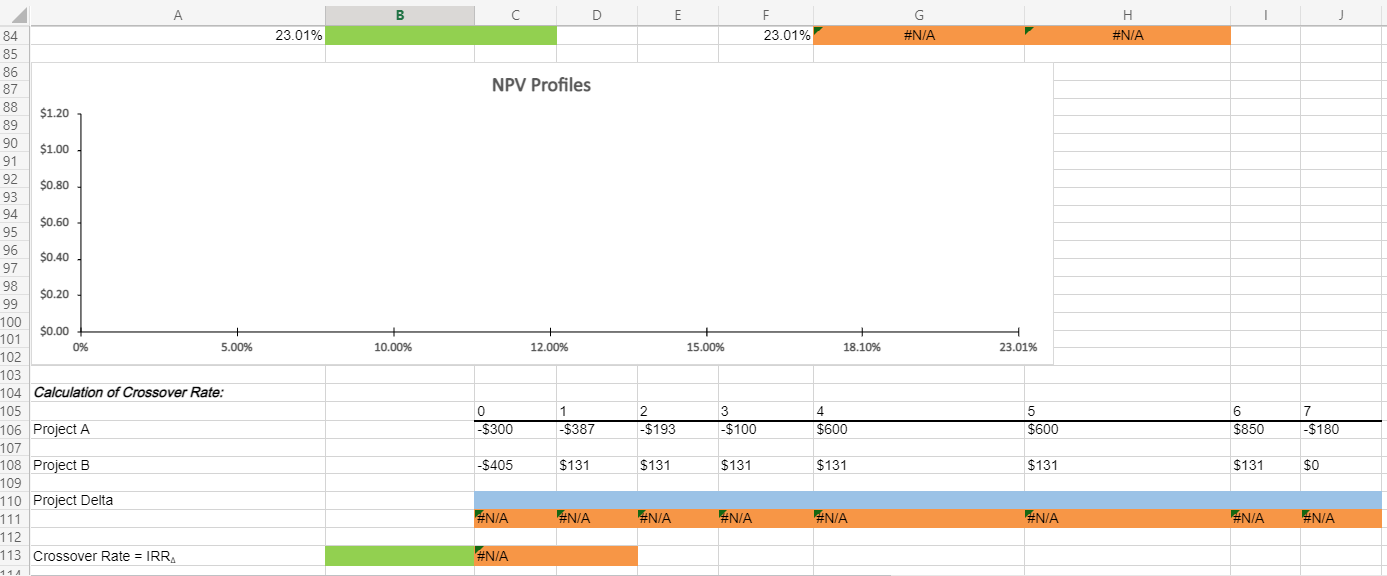

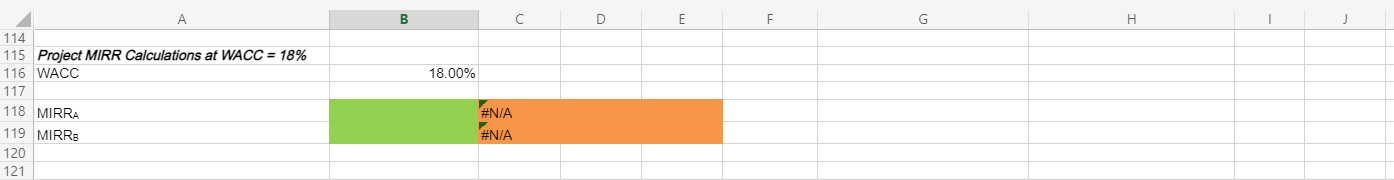

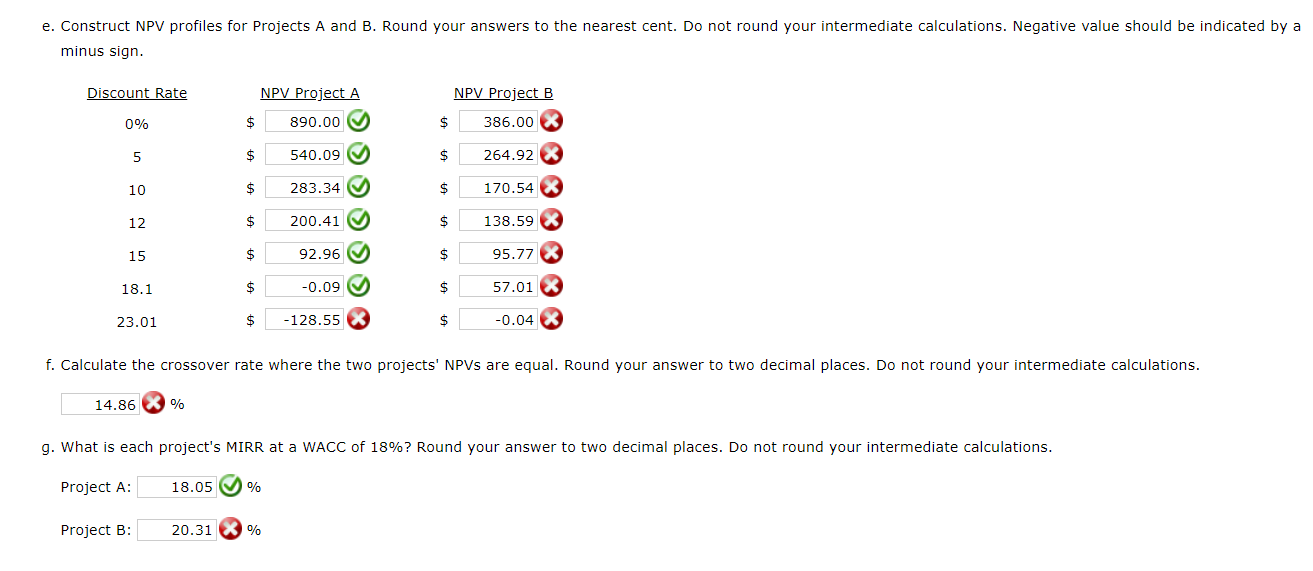

B C D E G H 13.00% 5 0 -$300 1 -$387 2 -$193 3 $100 4 $600 6 $850 7 -$180 $600 -$405 $131 $131 $131 $131 $131 $131 $0 Formulas 1 Capital budgeting criteria 2. 3 WACC 4 5 6 Project A 7 8 Project B 9 10 11 Project NPV Calculations: 12 NPVA 13 14 NPVB 15 16 Project IRR Calculations: 17 IRRA 18 19 IRRB 20 21 Project MIRR Calculations: 22 MIRRA #N/A #N/A #N/A #N/A #N/A B C D E F G H 1 K L 0 -$300 1 -$387 2 -$193 3 $100 4 $600 5 $600 6 $850 7 $180 Formulas #N/A #N/A #N/A #N/A Formulas #N/A #N/A #N/A FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 #N/A #N/A Sum of Inflow FVS 24 Alternatively, MIRRA can be calculated as: 25 26 Project A 27 28 PV of Year 1 Outflow 29 PV of Year 2 Outflow 30 PV of Year 3 Outflow 31 PV of Year 7 Outflow 32 33 34 35 36 Sum of Outflow PVS 37 38 N 39 PV 40 PMT 41 FV 42 I/YR = MIRRA 43 44 MIRRS 45 46 Alternatively, MIRR8 can be calculated as: 47 48 Project B 49 50 51 52 53 Formulas 7 $0.00 0 $0.00 #N/A #N/A 2 3 0 -$405 1 $131 4 $131 $131 5 $131 $131 6 $131 7 $0 Formulas #N/A #N/A #N/A #N/A FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 FV of Year 3 Inflow at Year 7 B D E F H K #N/A #N/A FV of Year 2 Inflow at Year 7 FV of Year 1 Inflow at Year 7 #N/A #N/A Sum of Inflow FVS Formulas 7 $0.00 0 $0.00 #N/A 13.00% #N/A 54 55 56 57 58 Sum of Outflow PVS 59 60 N 61 PV 62 PMT 63 FV 64 I/YR = MIRRE 65 66 Project Acceptance: 67 WACC 68 Accept 69 70 WACC 71 NPVA 72 NPVE 73 Accept 74 75 NPV Profiles: 76 Discount Rates 77 78 79 80 81 82 83 18.00% $2.66 $53.19 #N/A NPVA Discount Rates NPVA NPVE $2.66 NPVE $53.19 $2.66 $53.19 0% 5.00% 10.00% 12.00% 15.00% 0% 5.00% 10.00% 12.00% 15.00% 18.10% #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A 18.10% B D E F H G #N/A 23.01% 23.01% #N/A NPV Profiles A 84 85 86 87 88 $1.20 89 90 $1.00 91 92 $0.80 93 94 $0.60 95 96 $0.40 97 98 $0.20 99 100 $0.00 101 0% 5.00% 102 103 104 Calculation of Crossover Rate: 105 106 Project A 107 108 Project B 109 110 Project Delta 111 112 113 Crossover Rate = IRRA 11A 10.00% 12.00% 15.00% 18.10% 23.01% 0 -$300 1 -$387 2 -$193 3 -$100 4 $600 5 $600 6 $850 7 $180 -$405 $131 $131 $131 $131 $131 $131 $0 #N/A #N/A #N/A #N/A #N/A #N/A #N/A N/A #N/A B D E F G H 18.00% A 114 115 Project MIRR Calculations at WACC = 18% 116 WACC 117 118 MIRRA 119 MIRRE 120 121 #N/A #N/A e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. Discount Rate NPV Project A NPV Project B 0% $ 890.00 $ 386.00 5 $ 540.09 $ 264.92 10 $ 283.34 $ 170.54 x 12 $ 200.41 $ 138.59 X 15 $ 92.96 M $ 95.77 X 18.1 $ -0.09 $ 57.01 X 23.01 $ -128.55 $ -0.04 X f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations. 14.86 % g. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: 18.05 % Project B: 20.31 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts