Question: Please help!! Exam #2 Redo Problems On February 1, 2018, Arrow Construction Company entered into a three-year construction contract to build a bridge for a

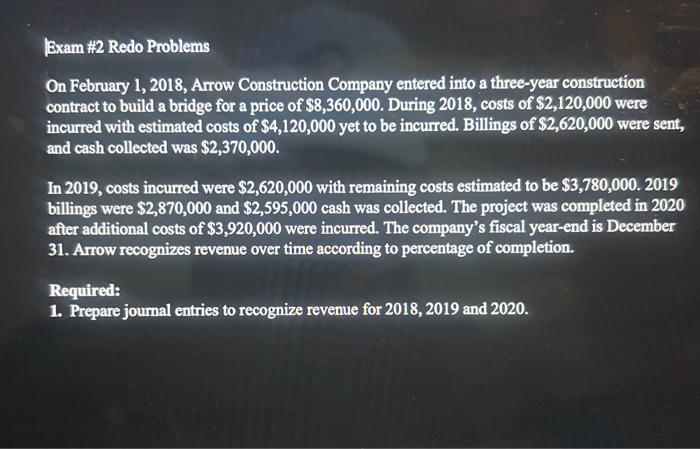

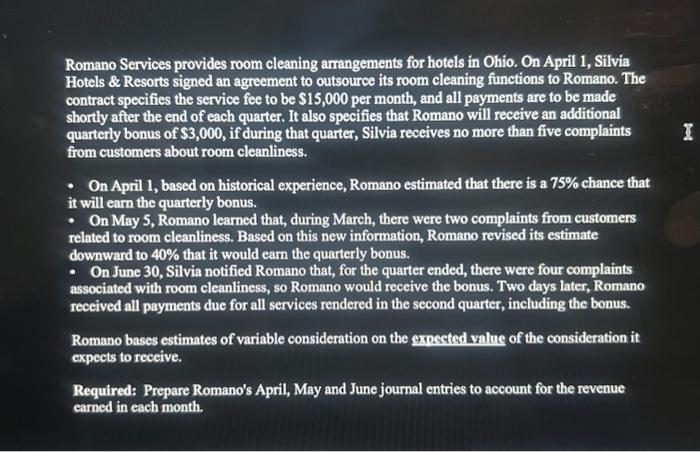

Exam \#2 Redo Problems On February 1, 2018, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,360,000. During 2018 , costs of $2,120,000 were incurred with estimated costs of $4,120,000 yet to be incurred. Billings of $2,620,000 were sent, and cash collected was $2,370,000. In 2019 , costs incurred were $2,620,000 with remaining costs estimated to be $3,780,000.2019 billings were $2,870,000 and $2,595,000 cash was collected. The project was completed in 2020 after additional costs of $3,920,000 were incurred. The company's fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage of completion. Required: 1. Prepare joumal entries to recognize revenue for 2018,2019 and 2020. Romano Services provides room cleaning arrangements for hotels in Ohio. On April 1, Silvia Hotels \& Resorts signed an agreement to outsource its room cleaning functions to Romano. The contract specifies the service fee to be $15,000 per month, and all payments are to be made shortly after the end of each quarter. It also specifies that Romano will receive an additional quarterly bonus of $3,000, if during that quarter, Silvia receives no more than five complaints from customers about room cleanliness. - On April 1, based on historical experience, Romano estimated that there is a 75% chance that it will earn the quarterly bonus. - On May 5, Romano learned that, during March, there were two complaints from customers related to room cleanliness. Based on this new information, Romano revised its estimate downward to 40% that it would earn the quarterly bonus. - On June 30, Silvia notified Romano that, for the quarter ended, there were four complaints associated with room cleanliness, so Romano would receive the bonus. Two days later, Romano received all payments due for all services rendered in the second quarter, including the bonus. Romano bases estimates of variable consideration on the exnected value of the consideration it expects to receive. Required: Prepare Romano's April, May and June journal entries to account for the revenue earned in each month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts