Question: please help! Example X P7-19 (similar to) Find both the arithmetic growth rate and the geometric growth rate of the dividends for Excellent Pizza Franchises.

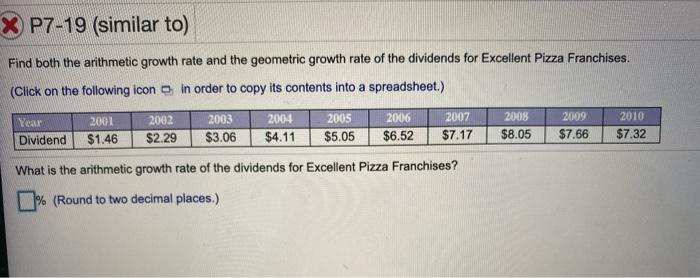

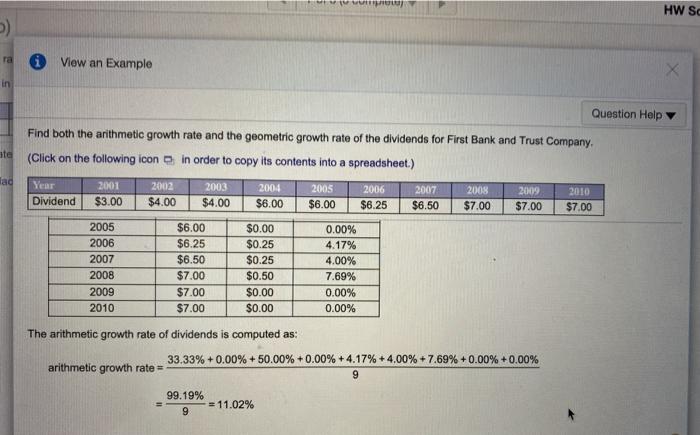

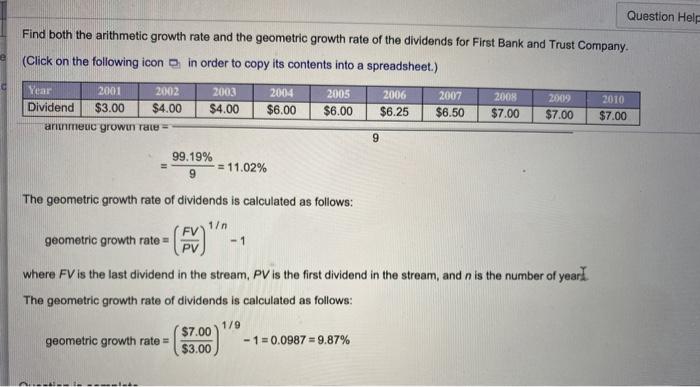

X P7-19 (similar to) Find both the arithmetic growth rate and the geometric growth rate of the dividends for Excellent Pizza Franchises. (Click on the following icon in order to copy its contents into a spreadsheet.) Year Dividend 2001 $1.46 2002 $2.29 2003 $3.06 2004 $4.11 2005 $5.05 2006 $6.52 2007 $7.17 2008 $8.05 2009 $7.66 2010 $7.32 What is the arithmetic growth rate of the dividends for Excellent Pizza Franchises? % (Round to two decimal places.) WWW HW SC ) ra * View an Example X in Question Help Find both the arithmetic growth rate and the geometric growth rate of the dividends for First Bank and Trust Company, (Click on the following icon in order to copy its contents into a spreadsheet.) ite ad Year Dividend 2001 $3.00 2002 $4.00 2003 $4.00 2004 $6.00 2005 $6.00 2006 $6.25 2007 $6.50 2008 $7.00 2009 $7.00 2010 $7.00 2005 2006 2007 2008 2009 2010 $6.00 $6.25 $6.50 $7.00 $7.00 $7.00 $0.00 $0.25 $0.25 $0.50 $0.00 $0.00 0.00% 4.17% 4.00% 7.69% 0.00% 0.00% The arithmetic growth rate of dividends is computed as: 33.33% +0.00% + 50.00% +0.00% +4.17% +4.00% +7.69% +0.00% +0.00% arithmetic growth rate 9 99.19% 9 = 11.02% Question Help Find both the arithmetic growth rate and the geometric growth rate of the dividends for First Bank and Trust Company. (Click on the following icon in order to copy its contents into a spreadsheet.) Year 2001 2002 Dividend $3.00 $4.00 arimeve grown rate= 2003 $4.00 2004 $6.00 2005 $6.00 2006 $6.25 2007 $6.50 2008 $7.00 2009 $7.00 2010 $7.00 9 99.19% 9 = 11.02% The geometric growth rate of dividends is calculated as follows: FV geometric growth rate= 1 -1 where FV is the last dividend in the stream, PV is the first dividend in the stream, and n is the number of year I The geometric growth rate of dividends is calculated as follows: geometric growth rate= $7.00 $3.00 1/9 -1=0.0987 = 9.87%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts