Question: please help Exercise 10-4 Direct Labor and Variable Manufacturing Overhead Variances [LO10-2, LO10-3] Erle Company manufactures a moble fitness device called the Jogging Mate. The

please help

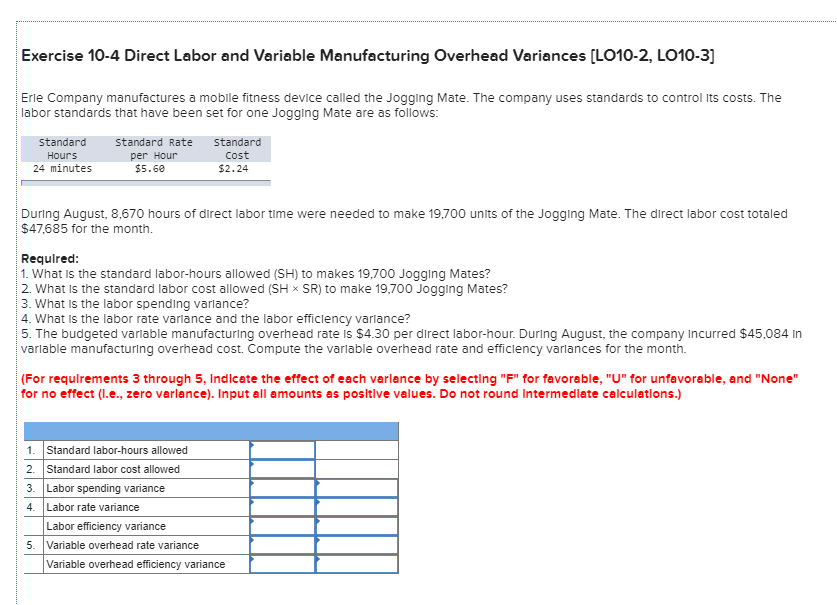

Exercise 10-4 Direct Labor and Variable Manufacturing Overhead Variances [LO10-2, LO10-3] Erle Company manufactures a moble fitness device called the Jogging Mate. The company uses standards to control Its costs. The labor standards that have been set for one Jogging Mate are as follows Standard Hours 24 minutes Standard Rate Standard Cost $2.24 per Hour $5.60 During August, 8,670 hours of direct labor time were needed to make 19,700 units of the Jogging Mate. The direct labor cost totaled $47685 for the month. Requirec 1. What Is the standard labor-hours allowed (SH) to makes 19,700 Jogging Mates? 2. What is the standard labor cost allowed (SH x SR) to make 19,700 Jogging Mates? 3. What Is the labor spending varlance? 4. What Is the labor rate varlance and the labor efficiency varlance? 5. The budgeted varlable manufacturing overhead rate Is $4.30 per direct labor-hour. During August, the company Incurred $45,084 In varlable manufacturing overhead cost. Compute the varlable overhead rate and efficiency varlances for the month. (For requlrements 3 through 5, Indicete the effect of each verlence by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero varlance). Input all amounts as posltive values. Do not round Intermedlate calculatlons.) 1. Standard labor-hours allowed 2. Standard labor cost allowed 3. Labor spending variance 4. Labor rate variance Labor efficiency variance 5. Variable overhead rate variance Variable overhead efficiency variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts