Question: Please Help! Exercise 21.12 (Static) Pricing a Special Order (LO 21-1, LO21-2, LO21-3) Mazeppa Corporation sells relays at a selling price of $28 per unit.

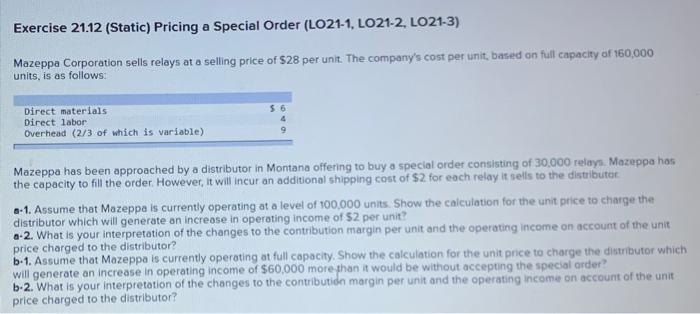

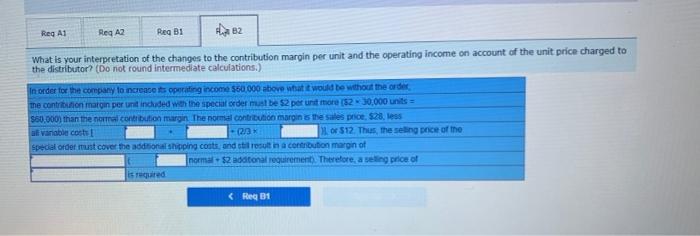

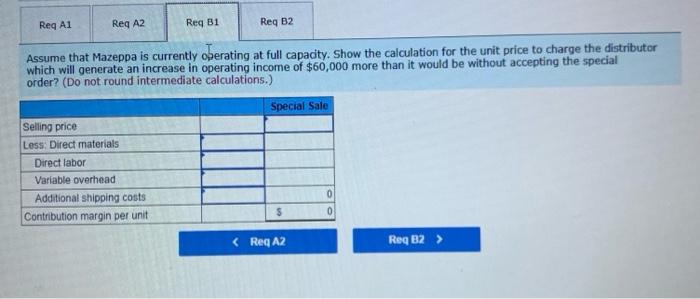

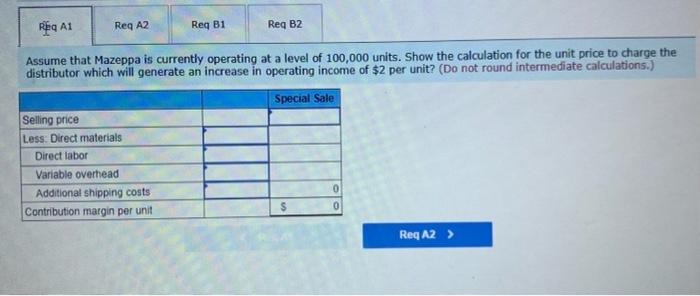

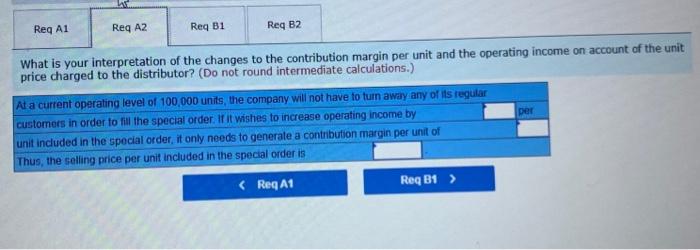

Exercise 21.12 (Static) Pricing a Special Order (LO 21-1, LO21-2, LO21-3) Mazeppa Corporation sells relays at a selling price of $28 per unit. The company's cost per unit, based on full capacity of 160,000 units, is as follows: Direct materials Direct labor Overhead (2/3 of which is variable) Mazeppa has been approached by a distributor in Montana offering to buy a special order consisting of 30,000 relays, Mazeppa has the capacity to fill the order. However, it will incur an additional shipping cost of $2 for each relay it sells to the distributor -1. Assume that Mazeppa is currently operating at a level of 100,000 units. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $2 per unit? .-2. What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? b-1. Assume that Mazeppa is currently operating at full capacity. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $60,000 more than it would be without accepting the special order? b.2. What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? Reg A1 Reg AZ Reg Bi A B2 What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? (Do not round intermediate calculations.) In order for the company to increase its operating income $50.000 above what it would be without the order me contrition matgin per unit included with the special order must be s2 per unit more (52 30,000 units $50,000) than the normal contribution margin The normal contribution margin the sales price $28. less all variable costs - (2.3 of $12 Thus, the selling price of the Spedal ordet munt cover the additional shipping costs and the result in a contribution margin of normal $2 additonal requirement. Therefore, a seling price of is required REQAI Reg A2 Req B1 Reg B2 Assume that Mazeppa is currently operating at a level of 100,000 units. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $2 per unit? (Do not round intermediate calculations.) Special Sale Selling price Less: Direct materials Direct labor Variable overhead Additional shipping costs Contribution margin per unit 0 $ 0 Req A2 > Reg A1 Reg A2 Req B1 Req B2 What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? (Do not round intermediate calculations.) per At a current operating level of 100,000 units, the company will not have to turn away any of its regular customers in order to fill the special order. It it wishes to increase operating income by unit included in the special order, it only needs to generate a contribution margin per unit of Thus, the selling price per unit included in the special order is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts