Question: please help! Exercise 6 The Elonton Compny is considering the introduction of a new product. It would have a five-year life, and sales and earnings

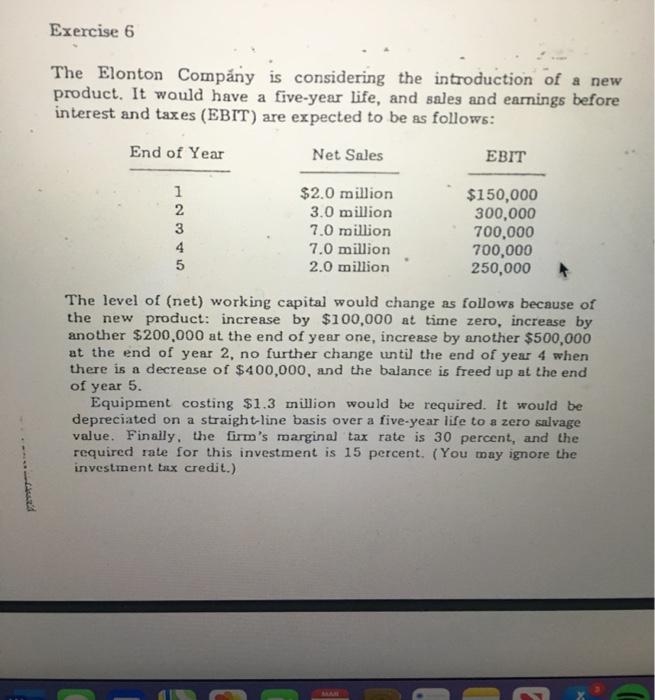

Exercise 6 The Elonton Compny is considering the introduction of a new product. It would have a five-year life, and sales and earnings before interest and taxes (EBIT) are expected to be as follows: End of Year Net Sales EBIT 1 $2.0 million $150,000 2 3.0 million 300,000 3 7.0 million 700,000 4 7.0 million 700,000 5 2.0 million 250,000 RACUNH The level of (net) working capital would change as follows because of the new product: increase by $100,000 at time zero, increase by another $200,000 at the end of year one, increase by another $500,000 at the end of year 2, no further change until the end of year 4 when there is a decrease of $400,000, and the balance is freed up at the end of year 5. Equipment costing $1.3 million would be required. It would be depreciated on a straight-line basis over a five-year life to a zero salvage value. Finally, the firm's marginal tax rate is 30 percent, and the required rate for this investment is 15 percent. (You may ignore the investment tax credit.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts