Question: please help explain abd answer form 6252! especially confused on line 5. thank you! Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 10 Instructions

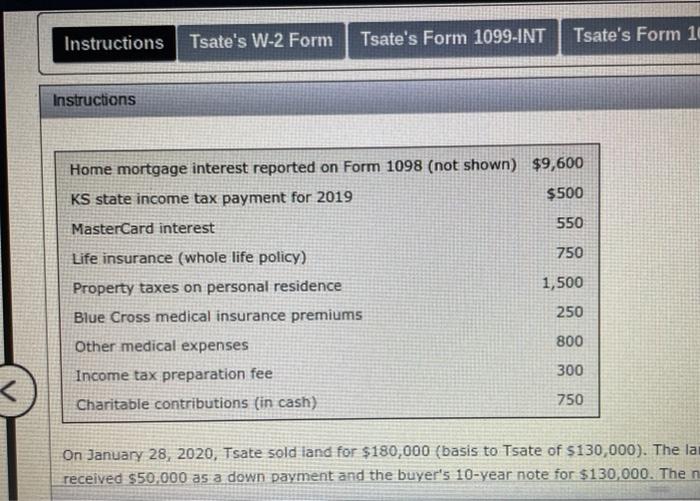

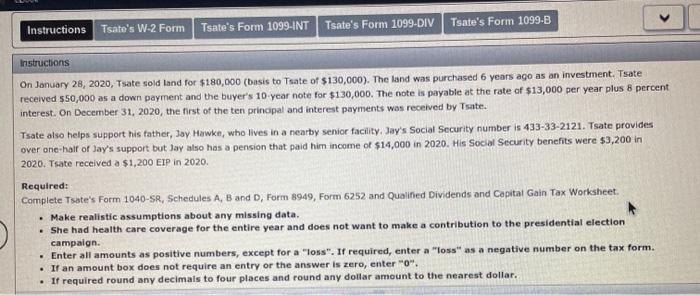

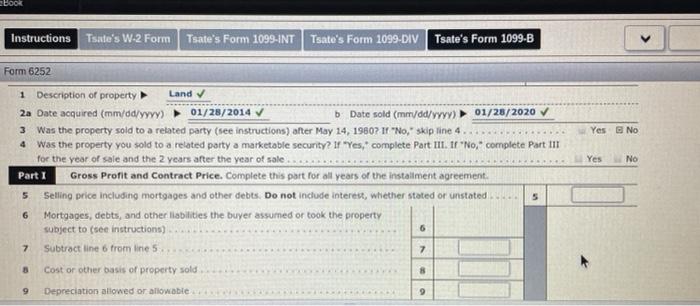

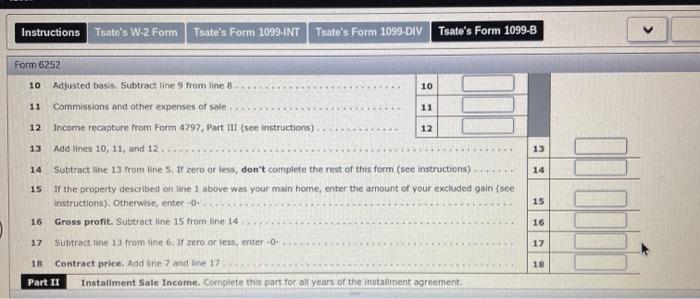

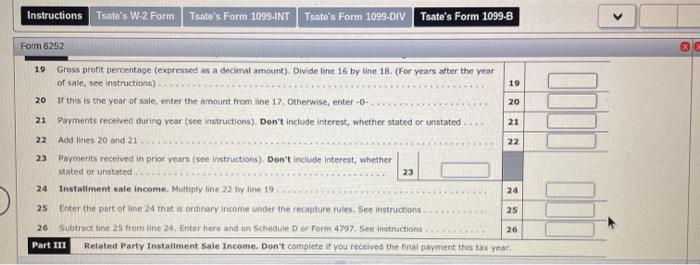

Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 10 Instructions Home mortgage interest reported on Form 1098 (not shown) $9,600 KS state income tax payment for 2019 $500 MasterCard interest 550 750 1,500 250 Life insurance (whole life policy) Property taxes on personal residence Blue Cross medical insurance premiums Other medical expenses Income tax preparation fee Charitable contributions (in cash) 800 300 750 On January 28, 2020, Tsate sold land for $180,000 (basis to Tsate of $130,000). The la received $50,000 as a down payment and the buyer's 10-year note for $130,000. Then Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 1099-DIV Tsate's Form 1099-B Instructions On January 28, 2020, Tsate sold land for $180,000 (basis to Toate of $130,000). The land was purchased 6 years ago as an investment. Tsate received $50,000 as a down payment and the buyer's 10 year note for $130,000. The note is payable at the rate of $13,000 per year plus 8 percent interest. On December 31, 2020, the first of the ten principal and interest payments was received by Tsate. Tsate also helps support his father, Jay Hawke, who lives in a nearby senior facility. Jay's Social Security number is 433-33-2121. Tsate provides over one-half of Jay's support but Jay also has a pension that paid him income of $14,000 in 2020. His Social Security benefits were $3,200 in 2020. Tsate received a $1,200 EIP in 2020. Required: Complete Tsate's Form 1040-SR, Schedules A, B and D, Form 8949, Form 6252 and Qualified Dividends and Capital Gain Tax Worksheet. Make realistic assumptions about any missing data. She had health care coverage for the entire year and does not want to make a contribution to the presidential election campaign. . Enter all amounts as positive numbers, except for a "loss". If required, enter a loss as a negative number on the tax form. . If an amount box does not require an entry or the answer is zero, enter"0". If required round any decimals to four places and round any dollar amount to the nearest dollar. Book Instructions Tsale's W-2 Form Tsate's Form 1099-INT Tsate's Form 1099-DIV Tsate's Form 1099-B Form 6252 Yes No Yes No 1 Description of property Land 2a Date acquired (mm/dd/yyyy) 01/28/2014 Date sold (mm/dd/yyyy) 01/28/2020 3 Was the property sold to a related party (ree instructions) after May 14, 1980? If "No," skip line 4 4 was the property you sold to a related party a marketable security? If "Yes, complete Part III. If "No, complete Part 11 for the year of sale and the 2 years after the year of sale Part I Gross Profit and Contract Price. Complete this part for all years or the installment agreement. Selling price including mortgages and other debts. Do not include interest, whether stated or unstated. Mortgages, debts, and other liabilities the buyer assumed or took the property subject to see instructions) Subtract line 6 from line 5 Cost or other basis of property sold 5 6 7 7 8 8 9 Depreciation allowed or allowable 9 Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 1099-DIV Tsate's Form 1099-B Form 6252 10 Adjusted basis. Subtract line 9 from line 8 10 11 11 12 Commissions and other expenses of sale Income recapture from Form 4797, Part III (see instructions) Add lines 10, 11, and 12 12 13 13 14 14 15 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form (sce instructions) If the property described on line 1 above was your main home, enter the amount of your excluded gain (see instructions). Otherwise, enter-O- Gross profit. Subtract line 15 from line 14 15 16 16 17 Subtract line 13 from line 6. If zero or less, entero- 17 18 18 Contract price. Add line 7 and line 17 Part II Installment Sale Income. Complete this part for all years of the installment agreement. 19 20 21 21 Instructions Tsate's W-2 Form Tsate's Form 1099.INT Tsate's Form 1099-DIV Tsate's Form 1099-8 Form 6252 19 Gross prorit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after the year of sale, see instructions) 20 If this is the year of sale, enter the amount from ine 17. Otherwise, enter -0. Payments received during year (nee instructions) Don't include interest, whether stated or unstated 22 Add lines 20 and 21 Payments received in prior years (see instructions) Don't include Interest, whether stated or unstated 23 Installment sale income. Multiply line 22 by line 19 25 Enter the part of line 24 that is ordinary income under the recapture rules. See instructions 26 Subtract line 25 from tine 246. Enter here and on schedule Dor Form 4797. See Instructions Related Party Installment Sale Income. Don't complete if you received the final payment this tax year 22 23 24 24 25 26 Part III Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 10 Instructions Home mortgage interest reported on Form 1098 (not shown) $9,600 KS state income tax payment for 2019 $500 MasterCard interest 550 750 1,500 250 Life insurance (whole life policy) Property taxes on personal residence Blue Cross medical insurance premiums Other medical expenses Income tax preparation fee Charitable contributions (in cash) 800 300 750 On January 28, 2020, Tsate sold land for $180,000 (basis to Tsate of $130,000). The la received $50,000 as a down payment and the buyer's 10-year note for $130,000. Then Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 1099-DIV Tsate's Form 1099-B Instructions On January 28, 2020, Tsate sold land for $180,000 (basis to Toate of $130,000). The land was purchased 6 years ago as an investment. Tsate received $50,000 as a down payment and the buyer's 10 year note for $130,000. The note is payable at the rate of $13,000 per year plus 8 percent interest. On December 31, 2020, the first of the ten principal and interest payments was received by Tsate. Tsate also helps support his father, Jay Hawke, who lives in a nearby senior facility. Jay's Social Security number is 433-33-2121. Tsate provides over one-half of Jay's support but Jay also has a pension that paid him income of $14,000 in 2020. His Social Security benefits were $3,200 in 2020. Tsate received a $1,200 EIP in 2020. Required: Complete Tsate's Form 1040-SR, Schedules A, B and D, Form 8949, Form 6252 and Qualified Dividends and Capital Gain Tax Worksheet. Make realistic assumptions about any missing data. She had health care coverage for the entire year and does not want to make a contribution to the presidential election campaign. . Enter all amounts as positive numbers, except for a "loss". If required, enter a loss as a negative number on the tax form. . If an amount box does not require an entry or the answer is zero, enter"0". If required round any decimals to four places and round any dollar amount to the nearest dollar. Book Instructions Tsale's W-2 Form Tsate's Form 1099-INT Tsate's Form 1099-DIV Tsate's Form 1099-B Form 6252 Yes No Yes No 1 Description of property Land 2a Date acquired (mm/dd/yyyy) 01/28/2014 Date sold (mm/dd/yyyy) 01/28/2020 3 Was the property sold to a related party (ree instructions) after May 14, 1980? If "No," skip line 4 4 was the property you sold to a related party a marketable security? If "Yes, complete Part III. If "No, complete Part 11 for the year of sale and the 2 years after the year of sale Part I Gross Profit and Contract Price. Complete this part for all years or the installment agreement. Selling price including mortgages and other debts. Do not include interest, whether stated or unstated. Mortgages, debts, and other liabilities the buyer assumed or took the property subject to see instructions) Subtract line 6 from line 5 Cost or other basis of property sold 5 6 7 7 8 8 9 Depreciation allowed or allowable 9 Instructions Tsate's W-2 Form Tsate's Form 1099-INT Tsate's Form 1099-DIV Tsate's Form 1099-B Form 6252 10 Adjusted basis. Subtract line 9 from line 8 10 11 11 12 Commissions and other expenses of sale Income recapture from Form 4797, Part III (see instructions) Add lines 10, 11, and 12 12 13 13 14 14 15 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form (sce instructions) If the property described on line 1 above was your main home, enter the amount of your excluded gain (see instructions). Otherwise, enter-O- Gross profit. Subtract line 15 from line 14 15 16 16 17 Subtract line 13 from line 6. If zero or less, entero- 17 18 18 Contract price. Add line 7 and line 17 Part II Installment Sale Income. Complete this part for all years of the installment agreement. 19 20 21 21 Instructions Tsate's W-2 Form Tsate's Form 1099.INT Tsate's Form 1099-DIV Tsate's Form 1099-8 Form 6252 19 Gross prorit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after the year of sale, see instructions) 20 If this is the year of sale, enter the amount from ine 17. Otherwise, enter -0. Payments received during year (nee instructions) Don't include interest, whether stated or unstated 22 Add lines 20 and 21 Payments received in prior years (see instructions) Don't include Interest, whether stated or unstated 23 Installment sale income. Multiply line 22 by line 19 25 Enter the part of line 24 that is ordinary income under the recapture rules. See instructions 26 Subtract line 25 from tine 246. Enter here and on schedule Dor Form 4797. See Instructions Related Party Installment Sale Income. Don't complete if you received the final payment this tax year 22 23 24 24 25 26 Part

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts