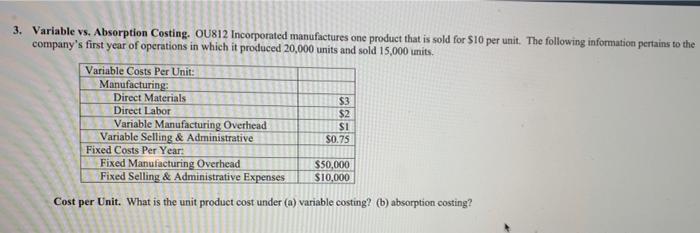

Question: please help. explain answer thoroughly please. 3. Variable vs. Absorption Costing. OU812 Incorporated manufactures one product that is sold for $10 per unit. The following

3. Variable vs. Absorption Costing. OU812 Incorporated manufactures one product that is sold for $10 per unit. The following information pertains to the company's first year of operations in which it produced 20,000 units and sold 15,000 units. Variable Costs Per Unit: Manufacturing Direct Materials $3 Direct Labor Variable Manufacturing Overhead Variable Selling & Administrative $0.75 Fixed Costs Per Year: Fixed Manufacturing Overhead $50,000 Fixed Selling & Administrative Expenses $10,000 Cost per Unit. What is the unit product cost under (a) variable costing? (b) absorption costing? $2 SI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts