Question: Please help explain how you got your solution! Thanks in advance! :) ubsidiary paid $1,000 and $10,500 for dividends in 2018 and 2019. he amount

Please help explain how you got your solution! Thanks in advance! :)

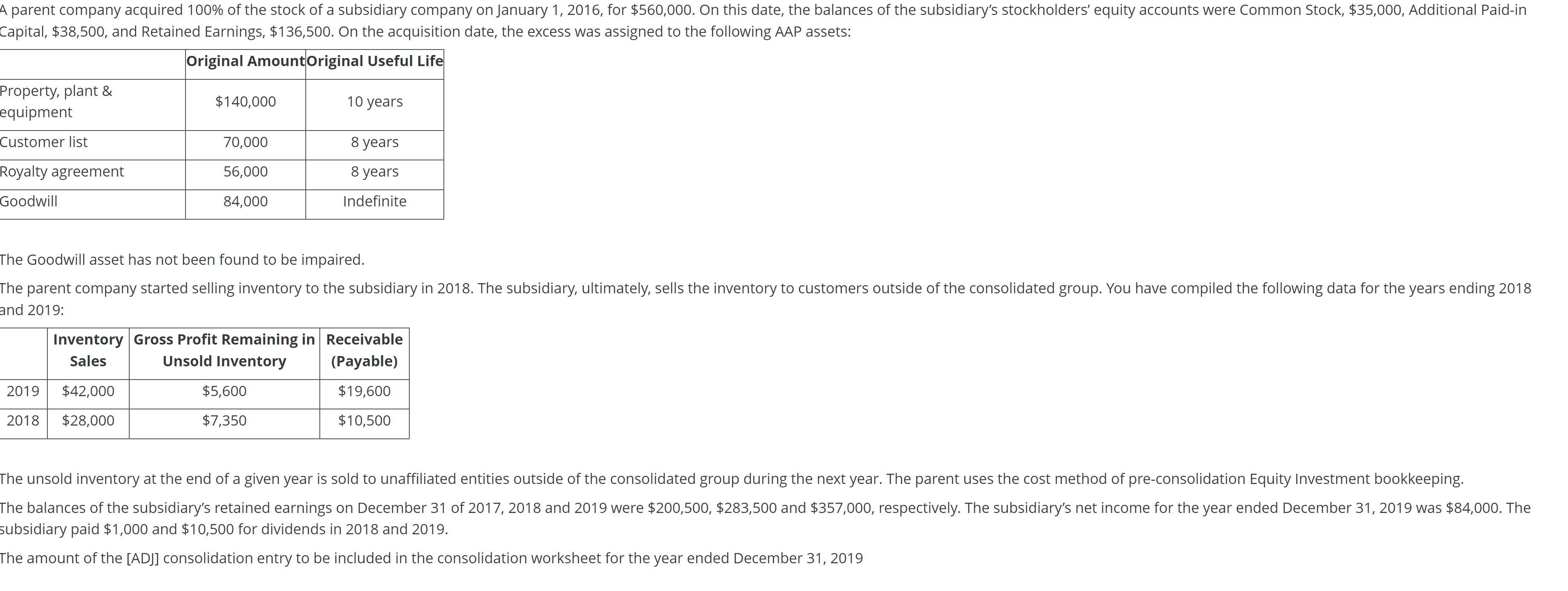

ubsidiary paid $1,000 and $10,500 for dividends in 2018 and 2019. he amount of the [ADJ] consolidation entry to be included in the consolidation worksheet for the year ended December 31,2019 The unsold inventory at the end of a given year is sold to unaffiliated entities outside of the consolidated group during the next year. The parent uses the cost method of pre-consolidation Equity Investment bookkeeping. The balances of the subsidiary's retained earnings on December 31 of 2017,2018 and 2019 were $200,500,$283,500 and $357,000, respectively. The subsidiary's net income for the year ended December 31,2019 was $84,000. The subsidiary paid $1,000 and $10,500 for dividends in 2018 and 2019. The amount of the [ADJ] consolidation entry to be included in the consolidation worksheet for the year ended December 31, 2019 Select one: a. 3000x b. 3500 c. 4500 d. 0 e. 1500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts