Question: please help explain Problem 1 Last semester, we calculated the payments received by Bobby Bonilla, a former MLB player who deferred his final salary for

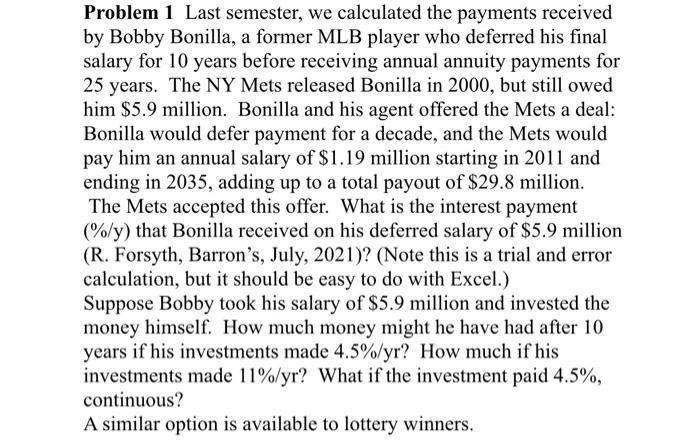

Problem 1 Last semester, we calculated the payments received by Bobby Bonilla, a former MLB player who deferred his final salary for 10 years before receiving annual annuity payments for 25 years. The NY Mets released Bonilla in 2000 , but still owed him $5.9 million. Bonilla and his agent offered the Mets a deal: Bonilla would defer payment for a decade, and the Mets would pay him an annual salary of \$1.19 million starting in 2011 and ending in 2035, adding up to a total payout of $29.8 million. The Mets accepted this offer. What is the interest payment (%/y) that Bonilla received on his deferred salary of $5.9 million (R. Forsyth, Barron's, July, 2021)? (Note this is a trial and error calculation, but it should be easy to do with Excel.) Suppose Bobby took his salary of $5.9 million and invested the money himself. How much money might he have had after 10 years if his investments made 4.5%/yr ? How much if his investments made 11%/yr ? What if the investment paid 4.5%, continuous? A similar option is available to lottery winners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts