Question: please help & explain(if possible) thanks a bunch! SPRING 2019 ACCT 300 INTERMEDIATE ACCOUNTING1 Homework #3 covering chapters 4 and 5. Due on Thursday, March

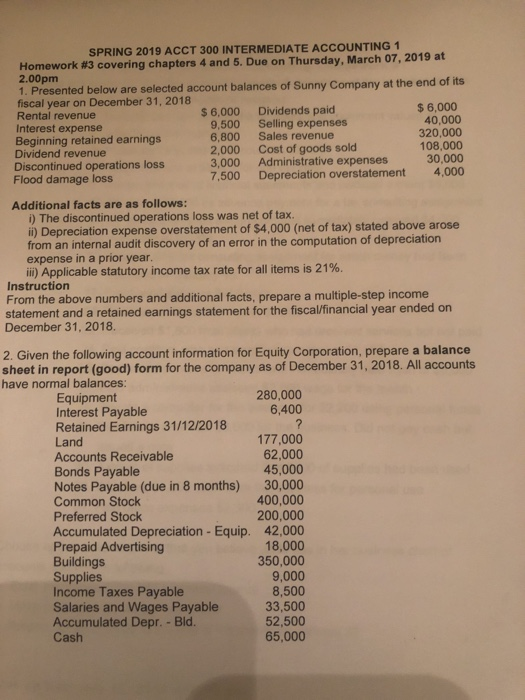

SPRING 2019 ACCT 300 INTERMEDIATE ACCOUNTING1 Homework #3 covering chapters 4 and 5. Due on Thursday, March 07, 2019 at 2.00pm 1. Presented below are selected account balances of Sunny Company at the end of its fiscal year on December 31, 2018 Rental revenue Interest expense Beginning retained earnings Dividend revenue Discontinued operations loss Flood damage loss $ 6,000 9,500 6,800 2,000 3,000 7,500 Dividends paid Selling expenses Sales revenue Cost of goods sold Administrative expenses Depreciation overstatement $ 6,000 40,000 320,000 108,000 4,000 ement 30 00 Additional facts are as follows: i) The discontinued operations loss was net of tax. i) Depreciation expense overstatement of $4,000 (net of tax) stated above arose from an internal audit discovery of an error in the computation of depreciation expense in a prior year iii) Applicable statutory income tax rate for all items is 21%. Instruction From the above numbers and additional facts, prepare a multiple-step income statement and a retained earnings statement for the fiscal/financial year ended on December 31, 2018. 2. Given the following account information for Equity Corporation, prepare a balance sheet in report (good) form for the company as of December 31, 2018. All accounts have normal balances: 280,000 6,400 Equipment Interest Payable Retained Earnings 31/12/2018 Land Accounts Receivable Bonds Payable Notes Payable (due in 8 months) Common Stock Preferred Stock Accumulated Depreciation - Equip. Prepaid Advertising Buildings Supplies Income Taxes Payable Salaries and Wages Payable Accumulated Depr. - Bld. Cash 177,000 62,000 45,000 30,000 400,000 200,000 42,000 18,000 350,000 9,000 8,500 33,500 52,500 65,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts