Question: Please Help fill In all charts! I will rate. Thank you! Entries for Payroll and Payroll Taxes The following information about the payroll for the

Please Help fill In all charts! I will rate. Thank you!

Please Help fill In all charts! I will rate. Thank you!

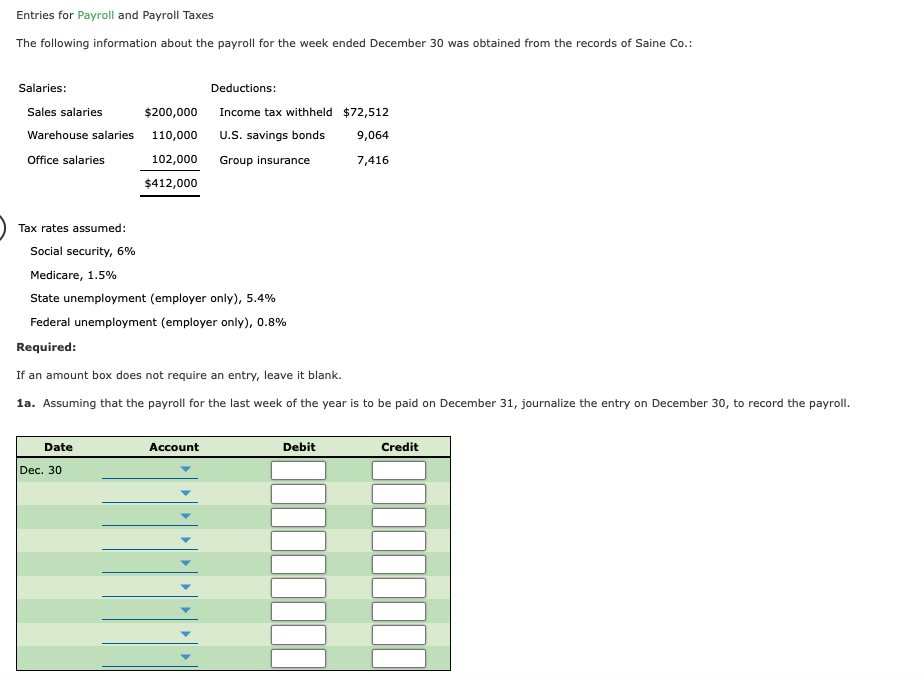

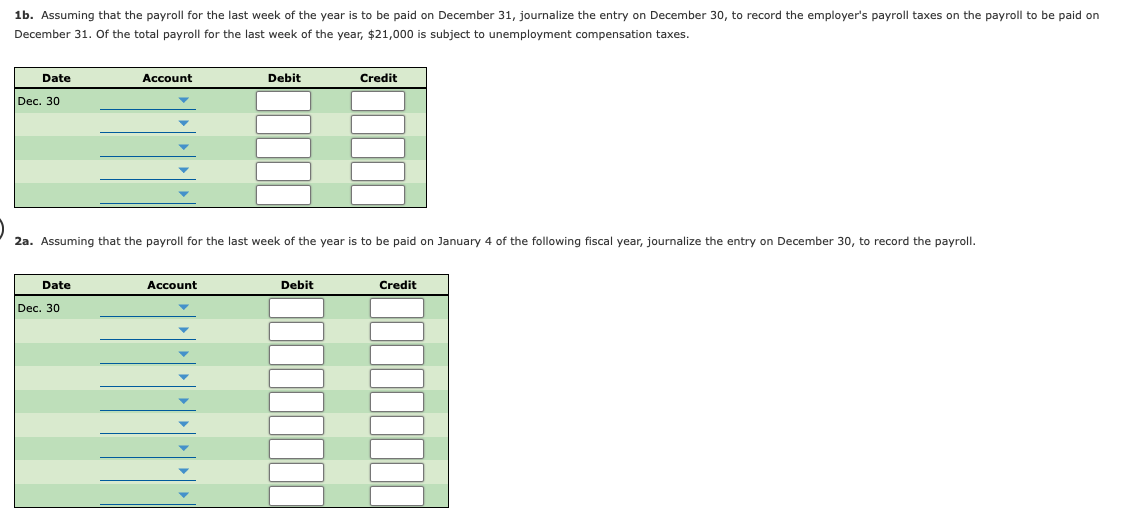

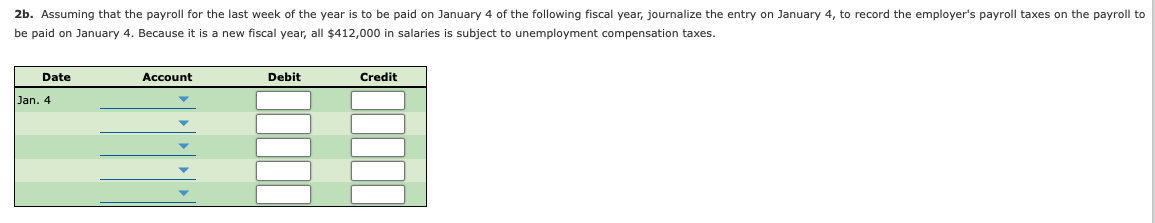

Entries for Payroll and Payroll Taxes The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Sales salaries $200,000 Warehouse salaries 110,000 Office salaries 102,000 $412,000 Deductions: Income tax withheld $72,512 U.S. savings bonds 9,064 Group insurance 7,416 Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment employer only), 5.4% Federal unemployment (employer only), 0.8% Required: If an amount box does not require an entry, leave it blank. 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30, to record the payroll. Date Account Debit Credit Dec. 30 1b. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $21,000 is subject to unemployment compensation taxes. Date Account Debit Credit Dec. 30 2a. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry on December 30, to record the payroll. Date Account Debit Credit Dec. 30 2b. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry on January 4, to record the employer's payroll taxes on the payroll to be paid on January 4. Because it is a new fiscal year, all $412,000 in salaries subject to unemployment compensation taxes. Date Account Debit Credit Jan. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts