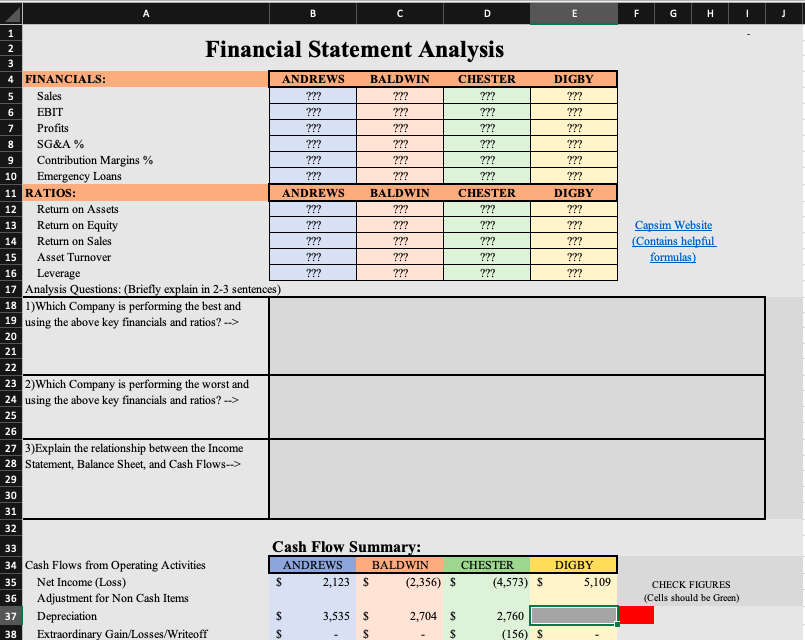

Question: Please help fill in empty boxes. No HARDCODING is allowed. Formulas only. I will rate positive ! F G H I Financial Statement Analysis BALDWINCHESTER

Please help fill in empty boxes. No HARDCODING is allowed. Formulas only. I will rate positive !

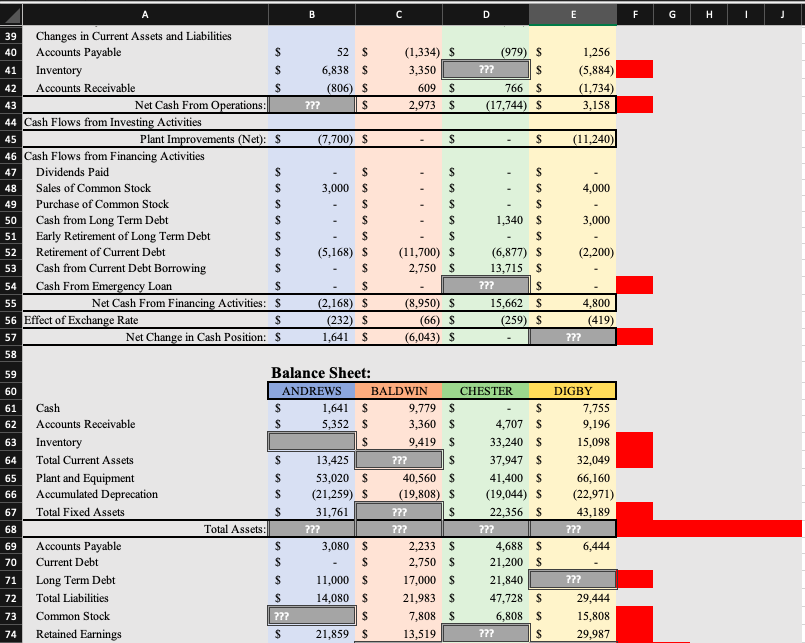

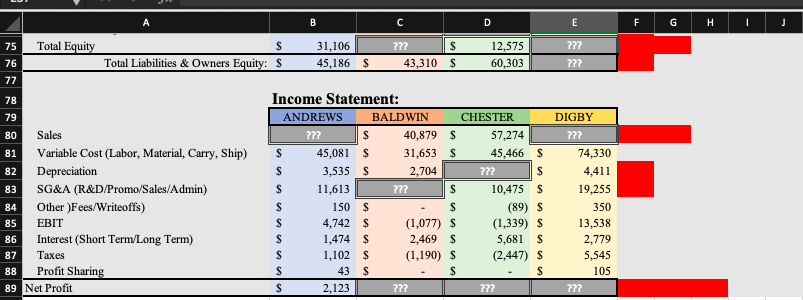

F G H I Financial Statement Analysis BALDWINCHESTER DIGBY 5 7 8 9 ??? ??? ??? ??? m? ??? ??? 77? BA LDWIN DIGBY 4 FINANCIALS: ANDREWS Sales EBIT Profits SG&A % Contribution Margins % 10 Emergency Loans 11 RATIOS: ANDREWS 12 Return on Assets 13 Return on Equity 14 Return on Sales ??? 15 Asset Turnover ??? Leverage 17 Analysis Questions: (Briefly explain in 2-3 sentences) 18 1)Which Company is performing the best and 19 using the above key financials and ratios? --> 20 777 CHESTER ??? ??? ??? ??? ??? ??? ??? 77? ??? Capsim Website (Contains helpful formulas) ??? 16 ??? 21 22 23 2)Which Company is performing the worst and 24 using the above key financials and ratios? --> 25 27 3)Explain the relationship between the Income 28 Statement, Balance Sheet, and Cash Flows --> 29 30 31 32 Cash Flow Summary: ANDREWS BALDWINCHESTER 2,123 $ (2,356) $ (4,573) $ DIGBY 5,109 34 Cash Flows from Operating Activities 35 Net Income (Loss) Adjustment for Non Cash Items 37 Depreciation Extraordinary Gain/Losses/Writeoff CHECK FIGURES (Cells should be Green) 36 $ 3,535 $ 2,704 - $ $ 2,760 (156) $ 38 Extr E 40 41 1,256 (5,884) (1,734) 3,158 45 (11,240) 4,000 3,000 (2,200) 55 39 Changes in Current Assets and Liabilities Accounts Payable 52 $ (1,334) S (979) $ Inventory 6,838 $ 3,350 ??? S 42 Accounts Receivable (806) S 609 $ 766 $ 43 Net Cash From Operations: ??? 2,973 S (17,744) S 44 Cash Flows from Investing Activities Plant Improvements (Net): S (7,700) $ - $ - $ 46 Cash Flows from Financing Activities 47 Dividends Paid 48 Sales of Common Stock 49 Purchase of Common Stock . $ Cash from Long Term Debt - $ 1.340 S 51 Early Retirement of Long Term Debt - $ Retirement of Current Debt (5,168) S (11,700) S (6,877) S 53 Cash from Current Debt Borrowing 2,750 $ 13,715 $ 54 Cash From Emergency Loan - ??? Net Cash From Financing Activities: S (2,168) S (8,950) S 15,662 $ 56 Effect of Exchange Rate S (232) S (66) S (259) S Net Change in Cash Position: $ 1,641 $ (6,043) $ - 58 Balance Sheet: ANDREWS BALDWINCHESTER 61 Cash 1,641 $ 9,779 $ - $ 62 Accounts Receivable 5,352 $ 3,360 $ 4,707 S Inventory $ 9,419 $ 33,240 $ 64 Total Current Assets 13,425 ??? 37,947 $ Plant and Equipment $ 53,020 $ 40,560 $ 41,400 $ Accumulated Deprecation $ (21,259) S (19,808) S (19,044) S 67 Total Fixed Assets $ 31,761 ??? S 22,356 $ Total Assets: ??? ??? ??? 69 Accounts Payable 3,080 S 2,233 $ 4,688 $ Current Debt S 2,750 $ 21,200 $ 71 Long Term Debt 11,000 $ 17,000 $ 21,840 72 Total Liabilities S 14.080 $ 21,983 S 47,728 $ 73 Common Stock 7,808 S 6,808 S 74 Retained Earnings $ 21,859 $ 13,519 ??? $ 4,800 (419) ??? 57 63 DIGBY 7,755 9,196 15,098 32,049 66,160 (22,971) 43,189 ??? 6,444 66 68 70 ??? 29.444 ??? 29,987 Total Equity 75 76 $ Total Liabilities & Owners Equity: $ 31,106 45,186 ??? 43,310 12,575 60,303 ??? ??? $ S 77 78 79 80 Sales 81 Variable Cost (Labor, Material, Carry, Ship) 82 Depreciation 83 SG&A (R&D/Promo/Sales/Admin) 84 Other Fees/Writeoffs) 85 EBIT Interest (Short Term/Long Term) Taxes Profit Sharing 89 Net Profit Income Statement: ANDREWS BALDWINCHESTERDIGBY 40,879 $ 57,274 ??? 45,081 $ 31,653 $ 45,466 $ 74,330 3,535 $ 2,704 ??? S 4,411 11,613 ??? S 10,475 $ 19,255 150 $ - S (89) $ 4,742 $ (1,077) $ (1,339) $ 13,538 1,474 $ 2,469 5,681 $ 2,779 1,102 $ (1,190) $ (2,447) $ - S $ 105 2.123 350 86 87 88 5,545 F G H I Financial Statement Analysis BALDWINCHESTER DIGBY 5 7 8 9 ??? ??? ??? ??? m? ??? ??? 77? BA LDWIN DIGBY 4 FINANCIALS: ANDREWS Sales EBIT Profits SG&A % Contribution Margins % 10 Emergency Loans 11 RATIOS: ANDREWS 12 Return on Assets 13 Return on Equity 14 Return on Sales ??? 15 Asset Turnover ??? Leverage 17 Analysis Questions: (Briefly explain in 2-3 sentences) 18 1)Which Company is performing the best and 19 using the above key financials and ratios? --> 20 777 CHESTER ??? ??? ??? ??? ??? ??? ??? 77? ??? Capsim Website (Contains helpful formulas) ??? 16 ??? 21 22 23 2)Which Company is performing the worst and 24 using the above key financials and ratios? --> 25 27 3)Explain the relationship between the Income 28 Statement, Balance Sheet, and Cash Flows --> 29 30 31 32 Cash Flow Summary: ANDREWS BALDWINCHESTER 2,123 $ (2,356) $ (4,573) $ DIGBY 5,109 34 Cash Flows from Operating Activities 35 Net Income (Loss) Adjustment for Non Cash Items 37 Depreciation Extraordinary Gain/Losses/Writeoff CHECK FIGURES (Cells should be Green) 36 $ 3,535 $ 2,704 - $ $ 2,760 (156) $ 38 Extr E 40 41 1,256 (5,884) (1,734) 3,158 45 (11,240) 4,000 3,000 (2,200) 55 39 Changes in Current Assets and Liabilities Accounts Payable 52 $ (1,334) S (979) $ Inventory 6,838 $ 3,350 ??? S 42 Accounts Receivable (806) S 609 $ 766 $ 43 Net Cash From Operations: ??? 2,973 S (17,744) S 44 Cash Flows from Investing Activities Plant Improvements (Net): S (7,700) $ - $ - $ 46 Cash Flows from Financing Activities 47 Dividends Paid 48 Sales of Common Stock 49 Purchase of Common Stock . $ Cash from Long Term Debt - $ 1.340 S 51 Early Retirement of Long Term Debt - $ Retirement of Current Debt (5,168) S (11,700) S (6,877) S 53 Cash from Current Debt Borrowing 2,750 $ 13,715 $ 54 Cash From Emergency Loan - ??? Net Cash From Financing Activities: S (2,168) S (8,950) S 15,662 $ 56 Effect of Exchange Rate S (232) S (66) S (259) S Net Change in Cash Position: $ 1,641 $ (6,043) $ - 58 Balance Sheet: ANDREWS BALDWINCHESTER 61 Cash 1,641 $ 9,779 $ - $ 62 Accounts Receivable 5,352 $ 3,360 $ 4,707 S Inventory $ 9,419 $ 33,240 $ 64 Total Current Assets 13,425 ??? 37,947 $ Plant and Equipment $ 53,020 $ 40,560 $ 41,400 $ Accumulated Deprecation $ (21,259) S (19,808) S (19,044) S 67 Total Fixed Assets $ 31,761 ??? S 22,356 $ Total Assets: ??? ??? ??? 69 Accounts Payable 3,080 S 2,233 $ 4,688 $ Current Debt S 2,750 $ 21,200 $ 71 Long Term Debt 11,000 $ 17,000 $ 21,840 72 Total Liabilities S 14.080 $ 21,983 S 47,728 $ 73 Common Stock 7,808 S 6,808 S 74 Retained Earnings $ 21,859 $ 13,519 ??? $ 4,800 (419) ??? 57 63 DIGBY 7,755 9,196 15,098 32,049 66,160 (22,971) 43,189 ??? 6,444 66 68 70 ??? 29.444 ??? 29,987 Total Equity 75 76 $ Total Liabilities & Owners Equity: $ 31,106 45,186 ??? 43,310 12,575 60,303 ??? ??? $ S 77 78 79 80 Sales 81 Variable Cost (Labor, Material, Carry, Ship) 82 Depreciation 83 SG&A (R&D/Promo/Sales/Admin) 84 Other Fees/Writeoffs) 85 EBIT Interest (Short Term/Long Term) Taxes Profit Sharing 89 Net Profit Income Statement: ANDREWS BALDWINCHESTERDIGBY 40,879 $ 57,274 ??? 45,081 $ 31,653 $ 45,466 $ 74,330 3,535 $ 2,704 ??? S 4,411 11,613 ??? S 10,475 $ 19,255 150 $ - S (89) $ 4,742 $ (1,077) $ (1,339) $ 13,538 1,474 $ 2,469 5,681 $ 2,779 1,102 $ (1,190) $ (2,447) $ - S $ 105 2.123 350 86 87 88 5,545

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts